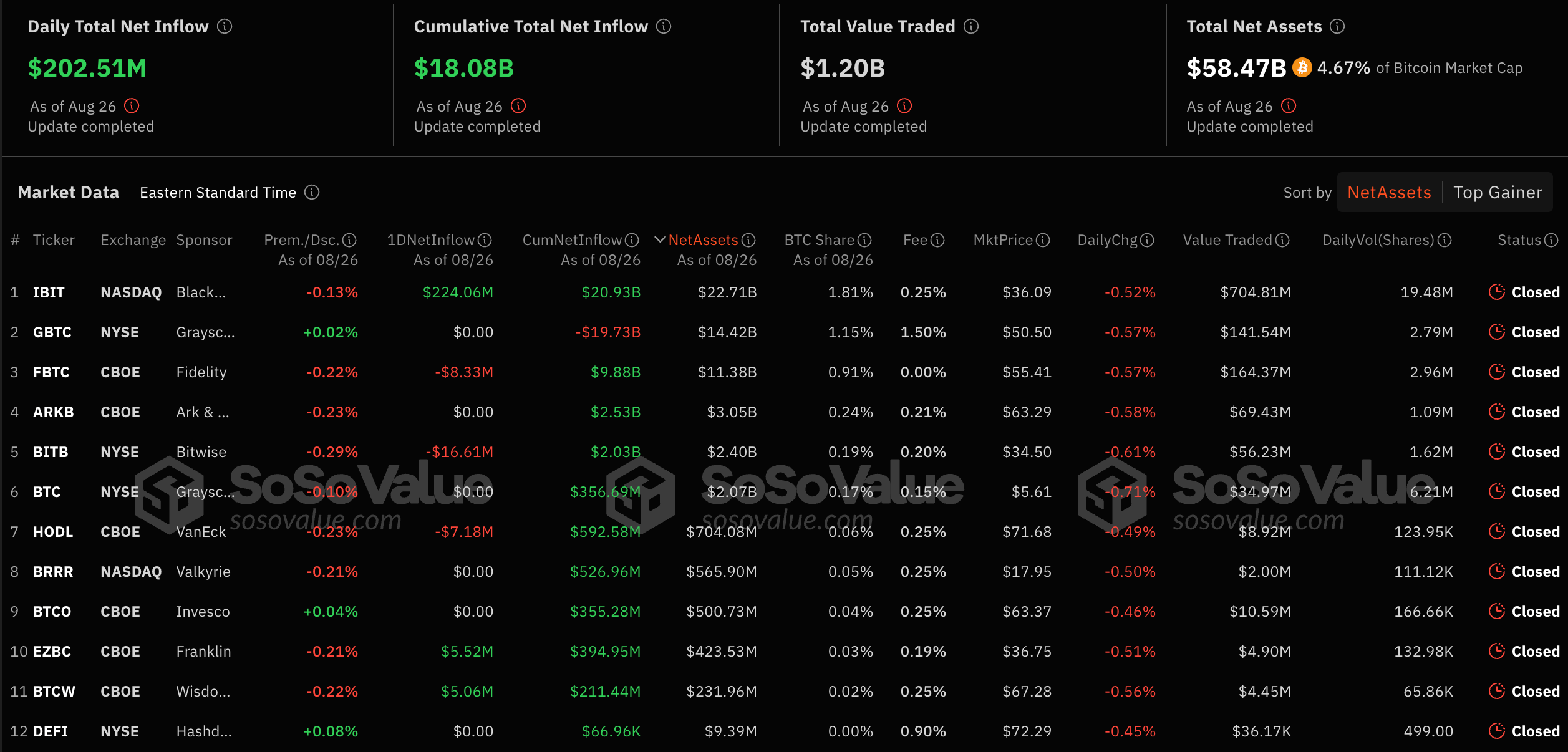

US-based Bitcoin ETFs noticed a web influx of $202.6 million on Aug. 26, based on SoSo Worth knowledge.

| Ticker | Sponsor | Prem./Dsc. | Aug. 26 Influx | Web Influx | BTC Share | Worth Traded |

|---|---|---|---|---|---|---|

| IBIT | BlackRock | -0.13% | $224.06M | $20.93B | 1.81% | $704.81M |

| GBTC | Grayscale | +0.02% | $0.00 | -$19.73B | 1.15% | $141.54M |

| FBTC | Constancy | -0.22% | -$8.33M | $9.88B | 0.91% | $164.37M |

| ARKB | Ark | -0.23% | $0.00 | $2.53B | 0.24% | $69.43M |

| BITB | Bitwise | -0.29% | -$16.61M | $2.03B | 0.19% | $56.23M |

| BTC | Grayscale | -0.10% | $0.00 | $356.69M | 0.17% | $34.97M |

| HODL | VanEck | -0.23% | -$7.18M | $592.58M | 0.06% | $8.92M |

| BRRR | Valkyrie | -0.21% | $0.00 | $526.96M | 0.05% | $2.00M |

| BTCO | Invesco | +0.04% | $0.00 | $355.28M | 0.04% | $10.59M |

| EZBC | Franklin | -0.21% | $5.52M | $394.95M | 0.03% | $4.90M |

| BTCW | WisdomTree | -0.22% | $5.06M | $211.44M | 0.02% | $4.45M |

Beginning with IBIT, managed by BlackRock, this ETF skilled a considerable web influx of $224.06 million on Aug. 26. This influx provides to its already spectacular cumulative web influx, which now stands at $20.93 billion. The fund trades at a slight low cost of 0.13% relative to its web asset worth (NAV), holding a 1.81% share of Bitcoin. With a buying and selling quantity of $704.81 million, IBIT continues demonstrating its dominance within the Bitcoin ETF market, reflecting robust investor confidence and important capital dedication.

Alternatively, GBTC, supplied by Grayscale, confirmed no change in its web influx on Aug. 26, sustaining a impartial stance. Nonetheless, the fund has skilled substantial outflows over time, evidenced by its cumulative web influx of -$19.73 billion. Regardless of this, GBTC trades at a slight premium of 0.02% and holds a 1.15% share of Bitcoin. Its buying and selling quantity on this present day was $141.54 million, indicating continued curiosity within the fund regardless of its extended outflows.

FBTC, Constancy’s Bitcoin ETF, noticed a web outflow of $8.33 million on Aug. 26, barely decreasing its cumulative web influx, now at $9.88 billion. The ETF trades at a 0.22% low cost to its NAV and holds a 0.91% share of Bitcoin. Regardless of the outflow, the fund stays lively out there with a buying and selling quantity of $164.37 million, showcasing its resilience and continued relevance amongst buyers.

The ARKB ETF, from Ark’s 21Shares, recorded no web influx or outflow on Aug. 26, preserving its cumulative web influx regular at $2.53 billion. The ETF trades at a 0.23% low cost relative to its NAV and holds a comparatively modest 0.24% share of Bitcoin. With a buying and selling quantity of $69.43 million, ARKB continues to take care of its place out there with secure, if not spectacular, exercise.

Lastly, BITB, managed by Bitwise, skilled a web outflow of $16.61 million on Aug. 26. However, its cumulative web influx stays constructive at $2.03 billion. The ETF trades at a 0.29% low cost to its NAV and holds a 0.19% share of Bitcoin. The buying and selling quantity for BITB was $56.23 million, reflecting a decrease degree of market exercise in comparison with a few of the different ETFs.

In abstract, IBIT (BlackRock) leads the pack with the best each day and cumulative web inflows, reflecting robust investor confidence. Notably, BlackRock and Grayscale personal a mixed 2.96% of the Bitcoin circulating provide.