Commodity strategists from Bloomberg say that two altcoins are outshining Ethereum (ETH) when one explicit metric.

Within the newest Bloomberg Intelligence: Crypto Outlook report, analysts Mike McGlone and Jamie Douglas Coutts say that by way of its price construction and issuance system, Ethereum enjoys a robust dominance over a lot of the market.

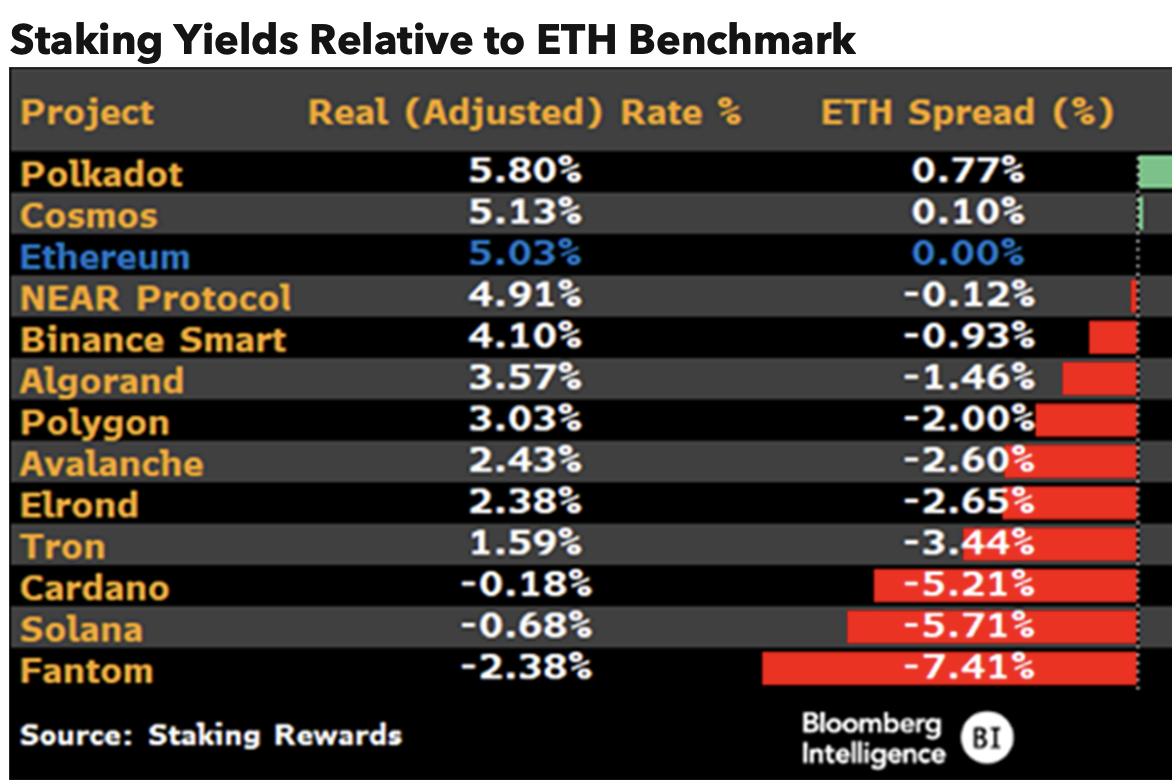

Nevertheless, the analysts say there are two blockchains that outperform Ethereum so far as staking yield. These altcoins embrace interoperable blockchain Polkadot (DOT) and Cosmos (ATOM), an ecosystem of blockchains designed to scale and talk with one another.

“Because of Ethereum’s dominant market share in price earnings and sound financial (issuance) coverage, capital deployment within the crypto financial system is more likely to begin pricing threat relative to Ethereum’s actual/adjusted charge (yield). On Bloomberg’s record of layer-1 crypto belongings, solely two networks have actual yields that commerce with a constructive unfold to Ethereum’s benchmark charge of 5.03%. Polkadot trades at a 0.77% premium whereas Cosmos is at a 0.10% premium. The belongings which commerce at adverse spreads could also be victims of mispricing. Inflation/issuance for these belongings might have to bear a radical discount, much like Ethereum, so as to appeal to extra capital.”

The Bloomberg analysts say that staking has introduced a brand new dimension to investing in crypto, they usually evaluate it to investing in company bonds.

“The emergence of crypto as an asset class along with a yield part presents a brand new set of concerns for buyers when assessing the chance/reward alternatives on this area. Given the volatility and newness of the demand for good contract use, staking belongings might be thought of as equal to junk bonds. Yields for proof-of-stake are much like company bonds in that they’re tied to the charges/money flows

of the community/firm.”

Based on the analysts, an increase in staking yields is to be anticipated probably as early as the primary half of 2023, after they speculate that central financial institution liquidity may enhance.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia