The journey in the direction of the approval of an Ethereum ETF in america has seen a brand new improvement yesterday because the US Securities and Trade Fee (SEC) has introduced a delay within the choice for Grayscale’s Ethereum belief conversion right into a spot Trade Traded Fund (ETF). The SEC has acknowledged the necessity for an prolonged interval to guage the proposed rule change, pushing the brand new deadline Grayscale to January 25, 2024.

In its reasoning, the SEC has reiterated, “The fee finds it applicable to designate an extended interval inside which to take motion on the proposed rule change in order that it has adequate time to contemplate the proposed rule change and the problems raised therein.” Notably, the delay comes at a time the place the US company is working with now 13 spot Bitcoin ETF candidates on presumably the ultimate amendments earlier than a January 10 approval.

Timeline For A Spot Ethereum ETF Approval

Regardless of the newest delay, the crypto neighborhood stays optimistic about the way forward for spot Ethereum ETFs. Bloomberg ETF analyst James Seyffart has steered that delays are par for the course, tweeting, “Replace: As anticipated Grayscale’s Ethereum belief submitting simply bought delayed. It was due by 12/6/23 so that is fully regular.”

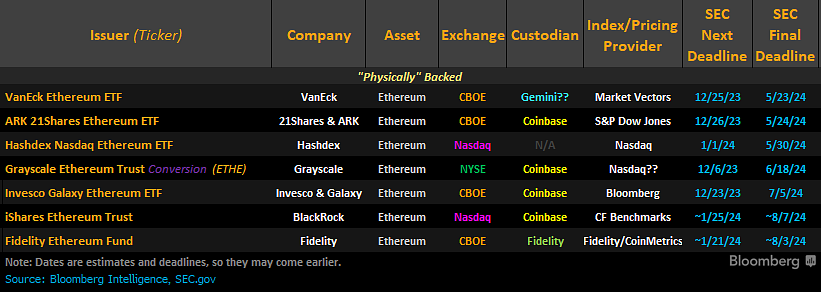

Seyffart additionally shared a desk of all seven spot Ethereum ETF candidates: VanEck, 21Shares & ARK, Hashdex, Grayscale, Invesco & Galaxy, BlackRock, Constancy and their deadlines. He additional hinted at potential approvals by mid-2024, responding to criticisms from Adam Again, CEO of Blockstream, with “Sadly I feel you’re gonna be actually upset by June of subsequent 12 months.”

In response to queries in regards to the likelihood of an Ethereum ETF approval following a Bitcoin ETF, Eric Balchunas of Bloomberg has indicated that the primary filers, Ark and VanEck, have robust odds of approval by their remaining deadline on Could 23, 2024, as they’re anticipated to make use of the identical mechanics as spot Bitcoin ETFs, and as a consequence of the truth that Ether futures have already obtained the inexperienced mild from the US SEC.

Queried about for the odd of a spot Ethereum ETF approval, he remarked, “Not formally but, however remaining deadline for the primary filers Ark and VanEck is Could twenty third so robust odds they authorized by then given they’d be utilizing similar design as btc etfs and ether futures have been Okay’d.”

The Subsequent Deadlines

The desk by Seyffart exhibits that the subsequent Ethereum ETF deadlines are from December 23 to 26 for VanEck, Ark Make investments and Invesco & Galaxy, adopted by Hashdex on January 1. Since a spot Bitcoin ETF could be very unlikely to be authorized by then, delays by the SEC are greater than doubtless for this batch of filings.

Each iShares by BlackRock and the Constancy Ethereum Fund have their subsequent deadlines on January 25 and January 21, 2024 respectively. These dates are essential as they may contain both an extension, a request for extra info, or a remaining choice.

However issues solely get actually tense in the direction of the ultimate deadlines for all Ethereum ETF filers, as outlined by each Bloomberg ETF specialists. With VanEck poised for Could 23, 2024, and ARK Make investments for Could 24, 2024 and different notable filers like Hashdex Nasdaq Ethereum ETF and Grayscale’s Ethereum Belief Conversion (ETHE) scheduled for choices by Could 30, 2024, and June 18, 2024, respectively, the timeline for potential approvals is taking form.

At press time, ETH traded at $2,271.

Featured picture from Shutterstock, chart from TradingView.com