Blur, a decentralized non-fungible token (NFT) market, and OpenSea competitor is below stress, tumbling by over 30% from its November peaks. Whereas BLUR retreats, on-chain information reveals that BLUR whales have been shifting their tokens to main crypto exchanges, probably to liquidate.

Whales On A Potential Promoting Spree

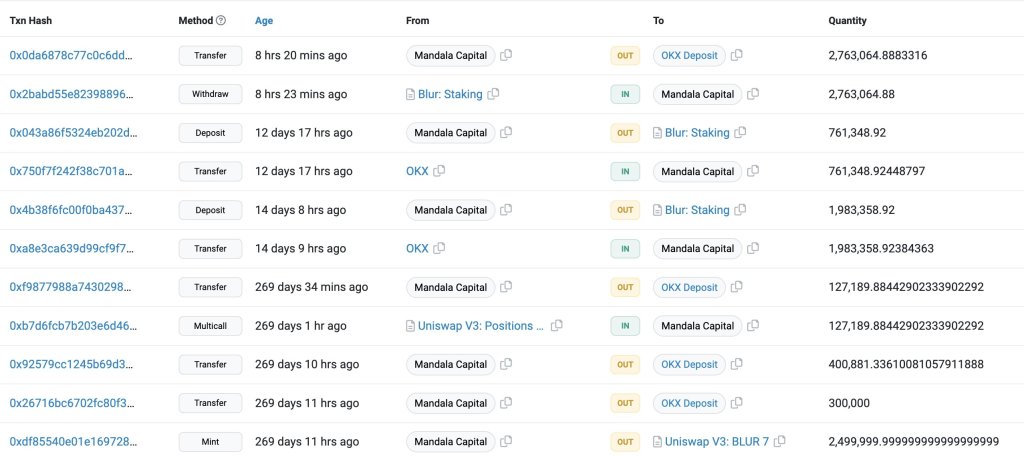

In line with Lookonchain data on December 7, a number of whales have been offloading massive quantities of BLUR. As an example, 16.85 million BLUR, price roughly $8.43 million, had been deposited to exchanges previously 24 hours.

Notably, one whale deposited 2.54 million BLUR, price $1.26 million, obtained from the airdrop to Binance. On the identical time, Mandala Capital transferred 2.76 million BLUR, price $1.4 million, to OKX.

The deluge continued as one other whale, solely marked by the related “0x68b5” tackle, withdrew 3.31 million BLUR price $1.79 million from Binance between November 25 and 29 earlier than shifting them to the identical change on December 1. The token had fallen, which means the whale was down by roughly $65,000.

It’s unclear whether or not the identical addresses are bought for USDT or different tokens. Nevertheless, what’s recognized is that any whale transfers to a centralized change is related to liquidation. Accordingly, sentiment is impacted when whales transfer cash in massive batches to exchanges, and retailers may interpret their transfers as incoming promoting stress.

BLUR Is Up 220% From October Lows

So far, taking a look at value motion, patrons have the lead from a top-down preview. The coin is already up 220% from October lows. Most significantly, patrons have the higher hand, wanting on the candlestick association within the each day chart.

Regardless that the token is down 30% from November peaks, the failure of bears to pressure the coin beneath the 20-day shifting common (MA) within the each day chart means that the uptrend remains to be legitimate. Losses beneath $0.46, or the bottom of the present bull flag, may set off a sell-off. Conversely, any upswing above $0.58 and even $0.69–or November highs, may drive extra demand, lifting BLUR to $0.84 or increased within the coming periods.

Associated Studying: Binance CEO Disputes JPMorgan Chief’s Critique Of Crypto

Whether or not the uptrend will resume additionally stays to be seen. What’s clear, although, is that the broader group is intently monitoring the NFT scene and Blur, {the marketplace}. The latest upswing was because of the activation of Season 2 Airdrop, which ended on November 20.

Forward of this, the token was already up 150%, solely to increase good points briefly earlier than cooling off within the first week of December.

Characteristic picture from Canva, chart from TradingView