BNB Chain (BNB) has launched a $100 million program designed to bootstrap liquidity for its native tasks on centralized exchanges (CEXs).

The community is allocating $100 million in incentives, primarily within the type of its native BNB tokens, to tasks that efficiently record on any of 11 main CEXs specified by BNB Chain, in response to a March 24 announcement.

This system goals to “additional improve BNB Chain’s ecosystem liquidity and foster mission progress by incentivizing exchanges to record native BNB Chain tokens,” the chain stated within the assertion.

BNB Chain beforehand launched two smaller liquidity incentive packages, allocating two tranches of $4.4 million in February and March to incentivize CEX listings for memecoins and different ecosystem tasks.

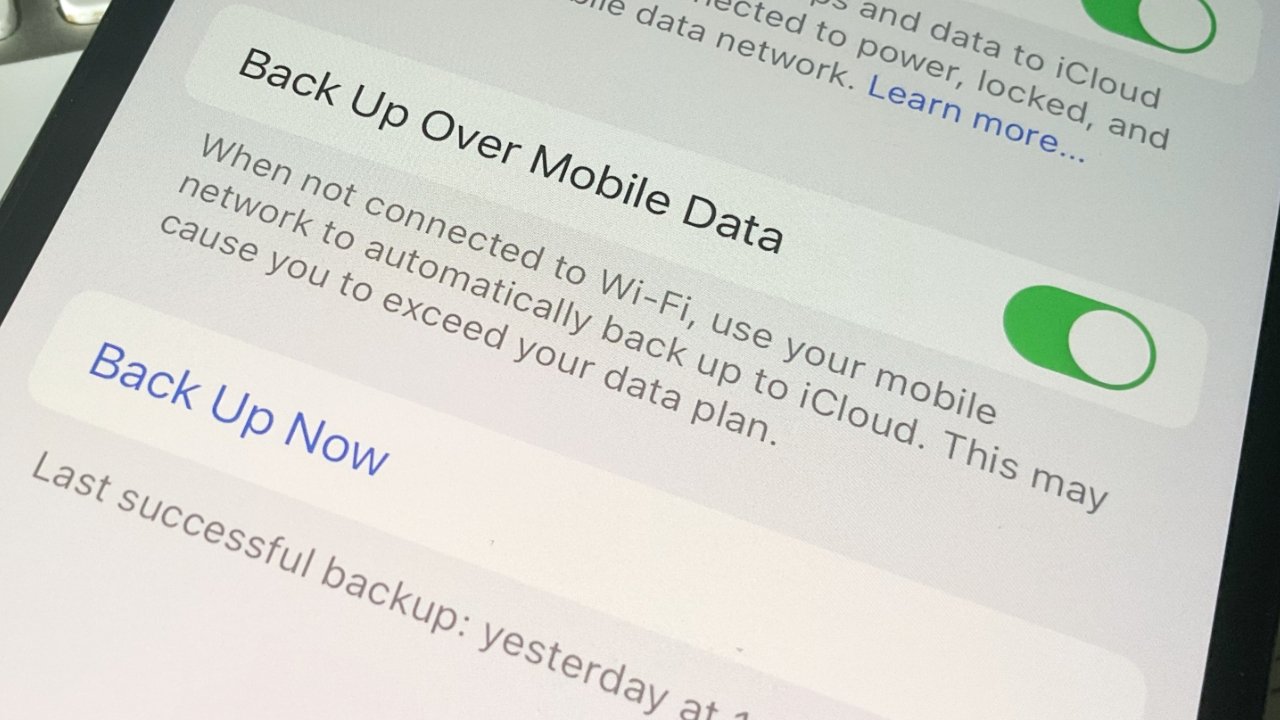

Rewards differ primarily based on the prominence of the trade itemizing. Supply: BNB Chain

The community’s newest liquidity incentive program can be executed on a first-come, first-served foundation and can initially run for a three-month trial interval, it stated.

Solely tasks with a minimum of a $5 million market capitalization and $1 million in day by day buying and selling quantity are eligible, amongst different standards, BNB Chain stated.

The biggest rewards — $500,000 in everlasting liquidity — are reserved for tasks that record on main CEXs similar to Binance and Coinbase, it stated.

In some circumstances, rewards can be restricted to non-withdrawable BNB token liquidity and in others, they can even embody purchases of mission tokens to create two-sided liquidity, in response to BNB Chain.

Chains by TVL. Supply: DeFILlama

Associated: Binance CEO reiterates denial of Trump household deal talks

Lagging opponents

BNB Chain has a complete worth locked (TVL) of roughly $5.4 billion, in response to information from DefiLlama.

It ranks fourth amongst blockchain networks in TVL, lagging behind main sensible contract platforms Ethereum and Solana, with TVLs of about $46 billion and $7 billion, respectively, in response to DefiLlama.

BNB Chain is affiliated with Binance, the world’s largest cryptocurrency trade.

In March, The Wall Avenue Journal reported that entities affiliated with US President Donald Trump have been in talks to purchase Binance.US, an independently-operated US crypto trade.

Former Binance CEO Changpeng “CZ” Zhao has denied most of the studies’ claims, together with any suggestion {that a} deal was contingent on Trump pardoning Zhao following his conviction on fees of violating the Financial institution Secrecy Act.

In 2023, Binance agreed to pay a $4.3 billion penalty and for Zhao to plead responsible to at least one rely of violating the Financial institution Secrecy Act for shortcomings in Binance’s Anti-Cash Laundering program.

Journal: Trump’s crypto ventures elevate battle of curiosity, insider buying and selling questions

Leave a Reply

![[SaveUs] Tilt your phone… [SaveUs] Tilt your phone…](https://external-preview.redd.it/NzlvYjZ1eHJlMXNlMfjlwkFWX-3Da_vscECei0u7rvsEn3F1e0iq_6Dl7ruH.png?width=640&crop=smart&auto=webp&s=a978d14dcc4627eaf40423d0e9e9595ec1dc4b16)