On Nov. 10, 2021, (BTC) established an all-time excessive of over $68,600, in response to CryptoSlate information. On the identical day, Ethereum (ETH) reached an all-time excessive worth of $4,864.11, CryptoSlate information exhibits.

The height within the worth of the 2 largest cryptocurrencies by market cap would lead traders to consider that the market was nonetheless experiencing a bull run. Nevertheless, an in depth have a look at information on energetic addresses suggests the bear market might have began in mid-2021, months earlier than BTC and ETH attained all-time highs.

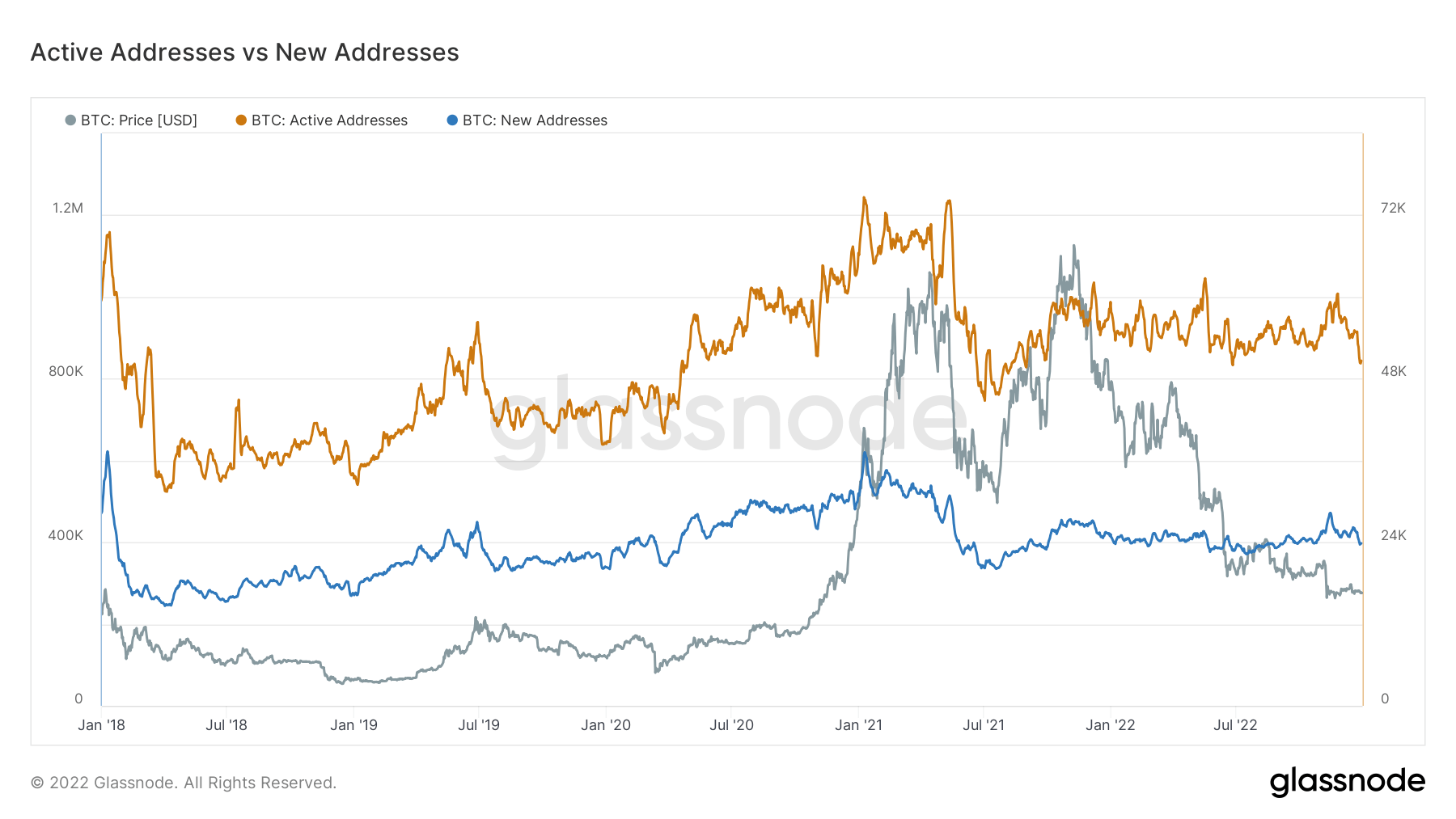

Analyzing addresses is a superb option to gauge the exercise within the ecosystem or how effectively the ecosystem is getting used. For example, through the bull run of 2017, energetic BTC addresses surpassed 1 million, in response to Glassnode information. Nevertheless, because the bull run resulted in 2018, energetic BTC addresses declined by practically 50% to round 500,000, Glassnode information signifies.

Energetic BTC addresses had a sluggish grind upward between 2018 and 2021. Between January and Might 2021, energetic BTC addresses hovered across the 1.2 million mark, breaching it twice within the 5 months and reaching as excessive as over 1.3 million, in response to Glassnode information.

However in June 2021, energetic Bitcoin addresses reached a low of round 500,000, which might have been doubtlessly the beginning of the bear market. After that, energetic BTC addresses elevated barely as BTC reached a brand new all-time excessive in November 2021. However even with the BTC worth peaking, energetic addresses hovered round 1 million.

All through 2022, energetic BTC addresses primarily remained beneath 1 million, in response to Glassnode information. New BTC addresses remained comparatively flat by 2022, across the 400,000 mark. New BTC addresses have hovered across the 400,000 mark over the previous 5 years. Nevertheless, in early 2021, new BTC addresses peaked barely to exceed 600,000, Glassnode information signifies.

Subsequently, though the worth of Bitcoin touched new heights in November 2021, fundamentals recommend that the bear market set in months prior.

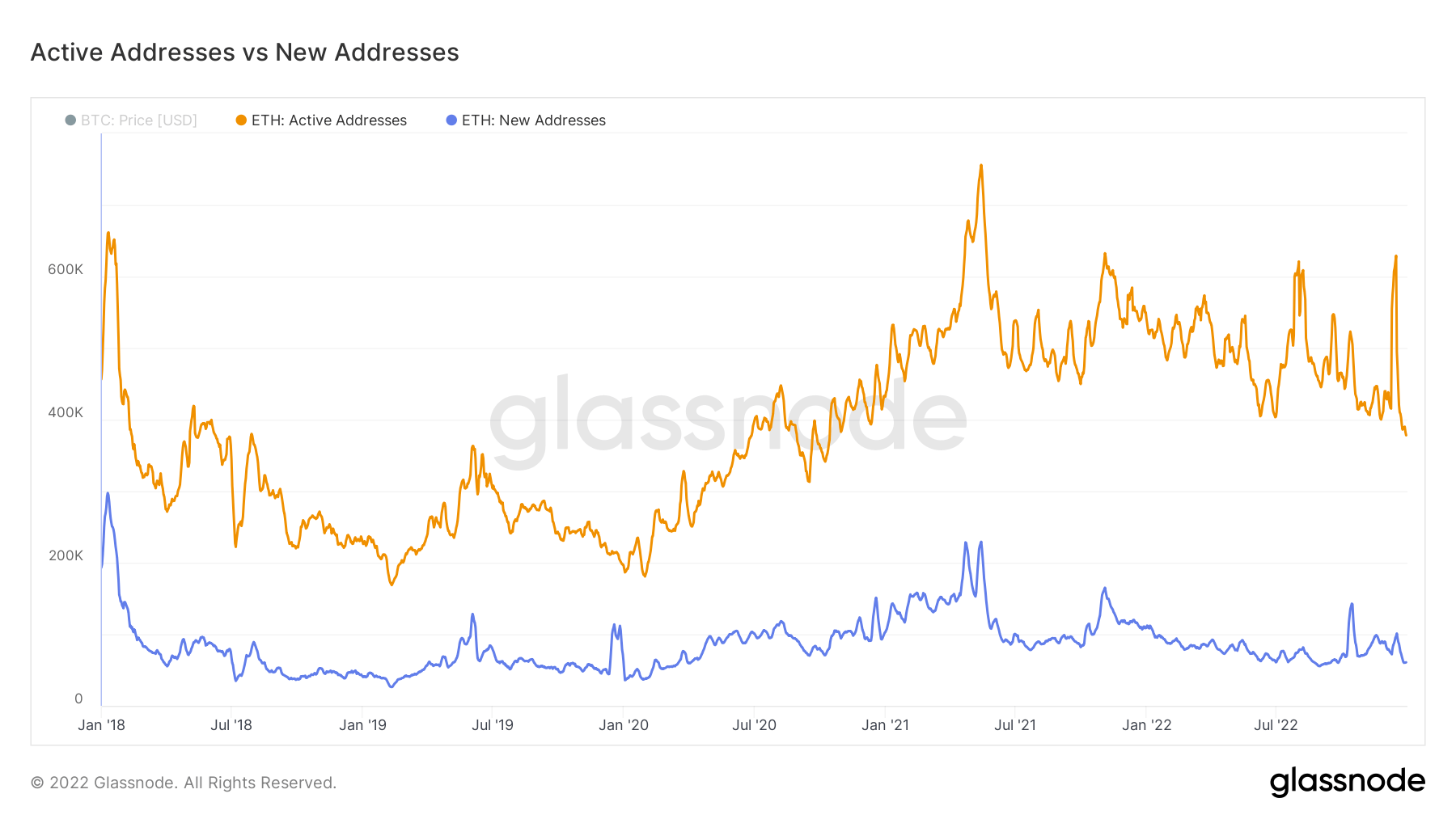

ETH energetic addresses observe an analogous story to Bitcoin — peaking throughout bull runs and falling and stagnating burning bear markets.

It’s price noting that ETH energetic addresses noticed essentially the most vital 2022 spikes throughout market capitulations, such because the Terra-Luna fiasco and the chapter of FTX and Alameda Analysis. This might point out a number of issues, equivalent to opportunistic traders shopping for the dip or new traders panic promoting, and even merely interacting with the ecosystem.

New ETH addresses, like BTC, remained practically flat beneath 200,000 over the previous 5 years, solely breaching the mark twice — as soon as in early 2018 and once more round Might 2021.