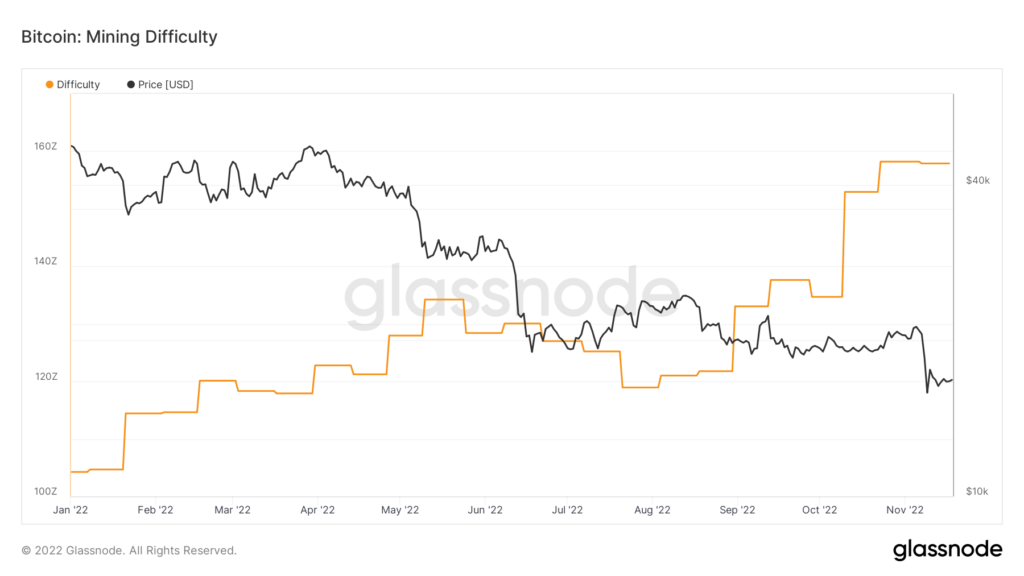

Bitcoin’s mining problem is anticipated to regulate Sunday night time/Monday morning (Nov. 20/21.) At the moment, over 100% of the mined Bitcoin provide is being spent on the fifth most important charge ever.

Following back-to-back problem unfavorable or impartial changes, it’s doable that Bitcoin hash charge and problem might have topped. Nevertheless, the issue is anticipated to regulate down once more over the weekend, bolstering expectations that the hashrate has peaked.

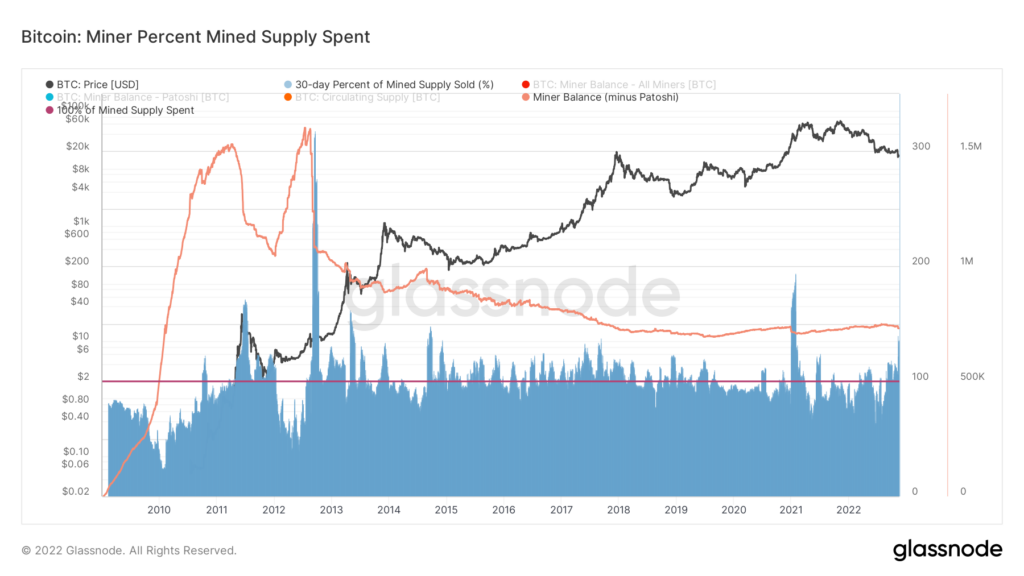

The next highlights the share of spent Bitcoins from miners over a 30-day window. The blue part, which has peaked at its highest degree since 2021, depicts the variety of cash bought by miners. The amount of Bitcoins bought by miners over the previous 30 days is the fifth-largest outflow in Bitcoin’s historical past.

Miners’ balances are additionally trending downward, nevertheless, not at present at a worrying velocity. The discrepancy between spent Bitcoins and Miner stability suggests mining corporations could also be promoting newly mined cash to cowl prices.

A drastic improve in international vitality prices in tandem with the drawdown within the worth of Bitcoin is creating an ideal storm for Bitcoin miners.

In a current earnings name, the highest Bitcoin mining agency. Marathon Digital revealed that it anticipated Bitcoin to commerce between $18,000 and $21,000 for a while. Additional, it acknowledged that it was “snug with” this vary and was ready to “climate the storm.”

Nevertheless, because the fallout from the FTX collapse continues to reverberate throughout the trade, Bitcoin continues to commerce under $17,000 for the eighth day straight.

Ought to Bitcoin’s worth stay under $18,00, it may proceed to trigger points for miners leading to additional promoting. A cycle of additional downward strain might subsequently be led by miners promoting to cowl the operation value.