Main Developments for the Week

- BTC hits $106,489, reaching 142% year-to-date development

- ETH adoption and pockets exercise surge, analysts speculate $8,800 in Q1 2025

- XRP rebounds to $2.42 however stays beneath its seven-year peak

- DOGE features 2%, supported by sturdy group backing and cost integrations

- French Hill proposes crypto laws to make clear digital asset regulation

- Avalanche secures $250M to supercharge its blockchain ecosystem

- Altcoin market cap grows by 15%; Bitcoin dominance rises

- Fed anticipated to chop rates of interest by 0.25%, boosting Bitcoin’s momentum

- Market Construction and Stablecoin payments goal to foster innovation and funding.

- Solana overtakes Ethereum as the highest blockchain for brand spanking new builders

- Sui companions with Ant Digital to launch tokenized ESG belongings

- Microsoft shareholders present minimal curiosity in Bitcoin investments

- Italy might reduce its proposed tax hike on crypto features

Bitcoin Surges to $106.5K, Reaching 142% YTD Development

Bitcoin hit a brand new all-time excessive of $106,489 on December 16, marking a 142% year-to-date enhance from its beginning worth of @ $44K originally of 2024.

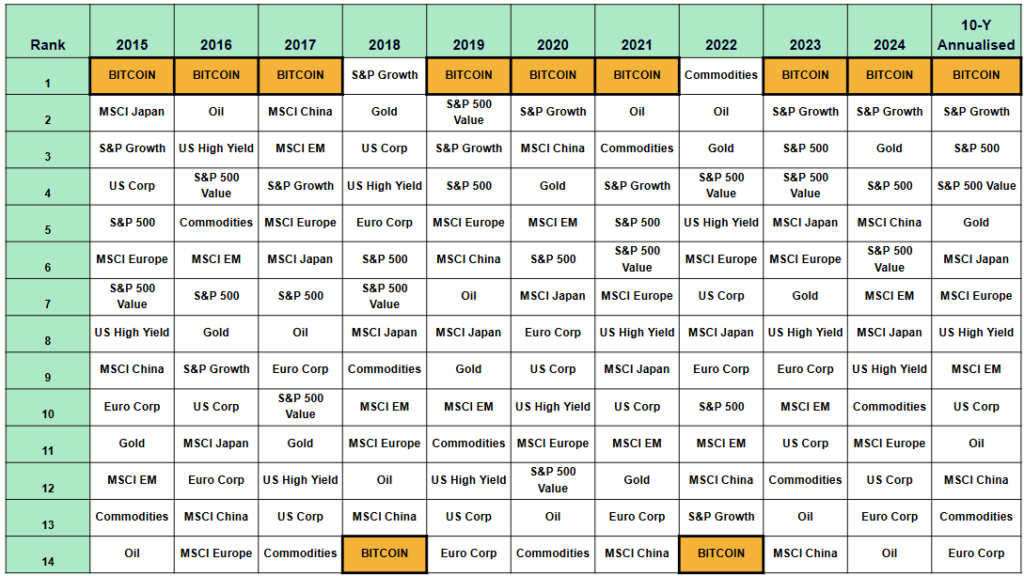

Picture by Sam North, eToro analyst

Previous efficiency will not be a sign of future outcomes.

As proven above, over the previous 10 years Bitcoin has been the highest-ranked annual asset eight occasions out of ten.

Federal Reserve Fee Cuts on the Horizon

A 0.25% rate of interest reduce is anticipated this week, which might mark the second consecutive discount. Traditionally, Bitcoin has thrived in low-rate environments as traders search alternate options to conventional monetary belongings.

Institutional Help

New accounting guidelines by the Monetary Accounting Requirements Board permit establishments to file crypto holdings extra realistically. Mixed with spot ETF inflows, this has bolstered institutional confidence in Bitcoin. Bitcoin’s market sentiment stays extremely bullish, with the Crypto Worry and Greed Index reaching 83/100 (Excessive Greed)—its highest degree since Bitcoin broke by means of $100,000 earlier this month.

Analysts predict Bitcoin may attain $125,000 in early 2025. Nonetheless, a possible 30% correction to round $87,500 is anticipated because the market digests present bullish information.

Ethereum: Poised for Development

Ethereum’s worth stays slightly below the $4,000 mark, however a number of components counsel it might be getting ready for a major breakout. Analysts forecast Ethereum may attain $8,800 by Q1 2025, pushed by lowered market leverage and rising investor adoption. The day by day common new pockets creation for ETH reached 130,000 in December, the very best since April, reflecting sturdy curiosity. Conservative estimates counsel Ethereum might peak nearer to $6,000 in 2025, however the present trajectory alerts sturdy development potential.

Avalanche raises $250M to spice up blockchain development

Avalanche secured $250 million this week in a token sale led by main traders, together with Galaxy Digital and Dragonfly, signaling sturdy institutional confidence. The funding helps the Avalanche9000 improve, which cuts deployment prices by 99% and enhances developer accessibility. Following the announcement, AVAX surged 9.6% and now ranks because the Tenth-largest blockchain by complete worth locked (TVL) at $1.6 billion, in line with DeFiLlama.

XRP: Regular restoration amid market volatility

XRP continues to indicate resilience regardless of a unstable month. After briefly dropping beneath $2, it has rebounded to $2.42, marking a notable restoration. Whereas it stays beneath its seven-year excessive of $2.82, ongoing developments, together with its increasing use in cross-border cost techniques and rising institutional curiosity, may drive future efficiency. Analysts word that XRP’s place as a liquidity-focused cryptoasset places it in a robust place ought to broader regulatory readability emerge in 2025.

Dogecoin: Modest features, sturdy potential

Dogecoin gained 2% this week, climbing to $0.403, although it stays 13% beneath its three-year excessive of $0.48. DOGE’s enduring enchantment lies in its sturdy community-driven help and rising integration into cost techniques. As a meme coin turned utility asset, Dogecoin continues to spark curiosity for its potential function in mainstream monetary ecosystems, particularly because it stays a favourite amongst high-profile advocates and modern fintech experiments.

French Hill Pushes for Clear Crypto Rules

French Hill, the incoming Chair of the U.S. Home Monetary Companies Committee, plans to introduce two main payments throughout the first 100 days of the Trump administration. The primary, a Market Construction Invoice for Digital Belongings, goals to determine clear guidelines for a way digital belongings are categorized, traded, and controlled, shifting away from the SEC’s criticized “regulation by enforcement” strategy. The second, a Stablecoin Invoice, seeks to outline the function of stablecoins within the monetary system, balancing innovation with correct integration into conventional markets.