Este artículo también está disponible en español.

The Bitcoin value has already been up by 10% prior to now seven days, breaking above the $67,000 mark once more in the previous couple of hours. The Coinmarketcap Concern And Greed Index has now switched to greed in gentle of current shopping for momentum and is exhibiting no indicators of slowing down.

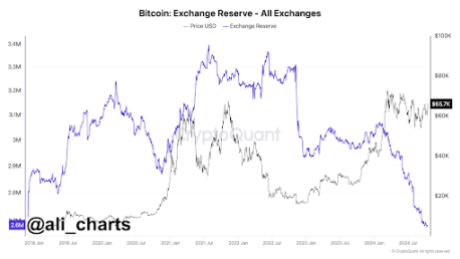

The shopping for strain on Bitcoin has been so nice prior to now few days, resulting in an enormous decline within the variety of BTC out there on crypto exchanges. Based on on-chain knowledge, this has brought on the Bitcoin trade reserve to drop to its lowest level in 5 years.

BTC Trade Reserve Drop to 5-12 months Low

Over the previous few days, the demand for Bitcoin has outweighed its provide, resulting in a pointy decline within the trade reserves. Based on CryptoQuant knowledge reposted on social media platform X by crypto analyst Ali Martinez, the variety of BTC held on exchanges is now at a five-year low of two.6 million BTC.

Associated Studying

Martinez’s chart reveals an intriguing development in Bitcoin’s trade reserves that has unfolded all year long. Initially of 2024, the reserves stood at roughly 3.05 million BTC. Nevertheless, this quantity has declined massively since that point.

The dwindling provide of Bitcoin on exchanges could be attributed to a number of key elements. First, there’s the surging curiosity from institutional gamers, particularly following the approval and rising momentum of Spot Bitcoin ETFs. These ETFs have triggered important shopping for exercise, with US-based Spot Bitcoin ETFs finally changing into the second-largest holders of BTC behind Satoshi Nakamoto.

Many long-term holders additionally contributed to the shopping for strain, as many continued shopping for in droves. Even intervals of value corrections and selloffs from short-term holders have been highlighted by the motion of extra BTC into steady long-term fingers who’re much less more likely to promote.

In consequence, the overall quantity of Bitcoin held on crypto exchanges has dropped by about 450,000 BTC since January, bringing the present reserve to simply 2.6 million BTC. That is the bottom stage seen since January 2019, and such a pointy decline sometimes indicators a bullish outlook for Bitcoin. “Everyone knows what this implies,” Martinez stated.

What Does This Imply For Bitcoin Worth?

The present state of Bitcoin’s trade reserves means that market members are more and more holding onto their BTC in anticipation of future positive factors, as many individuals proceed to take a position about the place the Bitcoin value might be heading within the coming months.

Associated Studying

When fewer cash can be found on exchanges, it usually signifies diminished promoting strain, which drives the worth greater as demand continues to rise.

Uptober is now absolutely in play, and Bitcoin is already up by 6.3% within the month. On the time of writing, Bitcoin is buying and selling at $67,200. This notable value level places Bitcoin on the trail to breaking above its all-time excessive of $73,737 earlier than the tip of October.

Featured picture created with Dall.E, chart from Tradingview.com