Main Developments for the Week

- BTC soars previous $89K, weekend super-surge paves option to new all-time highs

- ETH surges previous $3.2K, overtakes Financial institution of America in market cap

- ADA jumps 30% on Cardano founder-Trump collaboration buzz

- Solana passes $210, breaks $100B milestone, highest in almost three years

- Analyst PlanB predicts Bitcoin to high $250K in coming years

- Bitcoin flips silver, now the eighth largest asset by market cap

- Raoul Pal: SUI set to outperform ETH & SOL this cycle

- DOGE surges 100% with Musk’s robust ties to President-Elect Trump

- ImmutableX unveils in-game signing for Web3 gaming

- Lawyer says SEC’s Mark Uyeda doubtless subsequent chair

- Ethereum pumps almost $500M into ecosystem tasks in 2022–23

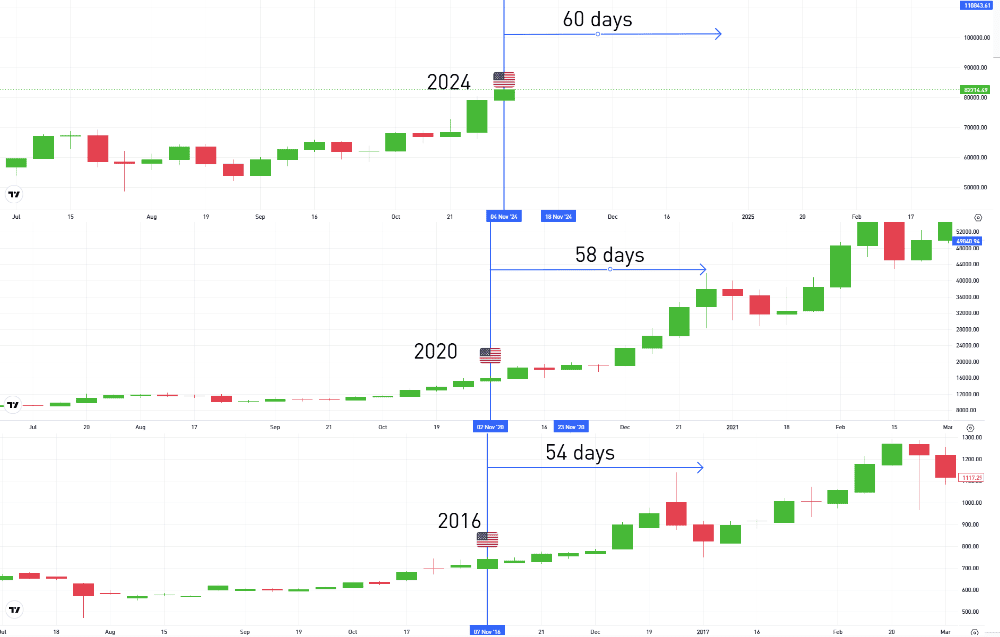

A comparative take a look at the behaviour of Bitcoin at this stage post-Halving.

Will this bull run proceed with the identical sample as earlier than?

Previous efficiency is just not a sign of future outcomes

Crypto Market Roars: Trump Win and Fed Price Lower Spark Large Rally

The post-election rally has injected contemporary optimism into the crypto sector, with Trump’s pro-crypto market stance and the Fed’s supportive situations creating fertile floor for additional development.

Traders are speculating on doable regulatory reduction, invigorating the market and driving spectacular positive factors throughout main altcoins, with Ethereum, Cardano, and Solana being pushed into the highlight. Analysts are eyeing what they name the “banana zone,” a part of fast positive factors throughout main tokens, with a possible path towards a $10 trillion crypto market cap by 2026.

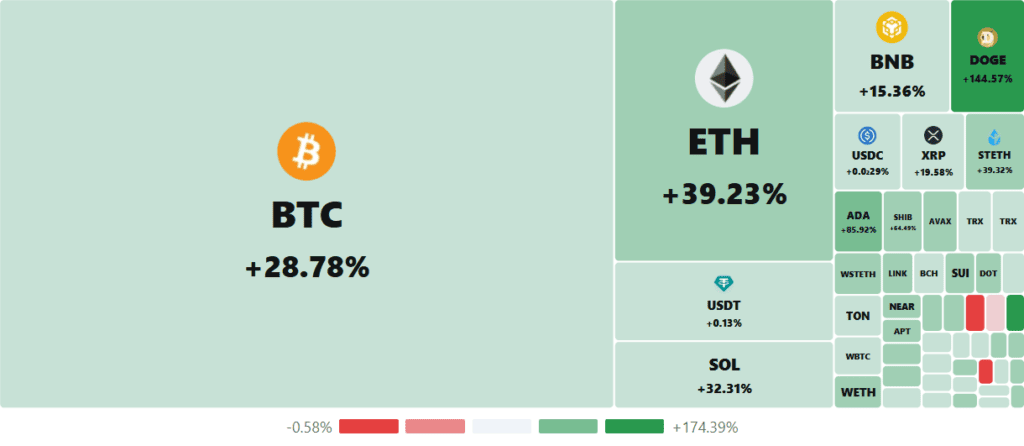

A warmth map indicating the crypto market surges over the previous week

Previous efficiency is just not a sign of future outcomes

From Disaster to Comeback: Bitcoin Soars

Two years to the day after the collapse of FTX, Bitcoin has soared previous $89,000 (at time of writing) — a dramatic rise few might have predicted. From fears of collapse to an industry-wide resurgence, Bitcoin’s restoration underscores the resilience of crypto since that fateful November in 2022.

Ethereum’s Rally and the “Digital Bond” Enchantment

Ethereum has surged over 23%, surpassing $3,000—the very best since August. Traders are drawn to Ethereum’s yield potential, particularly with the Fed’s price minimize narrowing the hole between conventional and crypto returns, making ETH a gorgeous “digital bond” by means of staking. This spike displays the market’s pleasure across the potential for crypto-friendly insurance policies from the Trump administration, which might assist the decentralized finance (DeFi) sector the place Ethereum has established itself as a dominant participant.

Solana Joins the Elite $100B Membership, Alleged to Problem Ethereum

Solana has made headlines by crossing the $100 billion valuation mark, becoming a member of Bitcoin and Ethereum among the many Most worthy cryptocurrencies. Following a 34% rally, SOL reached $214, not removed from its all-time excessive of $260 from the 2021 crypto bull run. Recognized for its energetic DeFi and memecoin ecosystem, Solana’s comeback post-FTX has gained traction amongst retail traders, who see it as a robust contender within the crypto panorama. As Solana’s ecosystem expands, some consider it might problem Ethereum’s dominance, signalling a possible shake-up within the DeFi market.

Cardano’s Surge on Hypothesis of a Trump Connection

Cardano noticed a exceptional 30% spike, fueled by rumours of founder Charles Hoskinson probably collaborating with the Trump administration on crypto coverage. Though Hoskinson clarified that no formal position has been mentioned, the market’s response highlights its speculative nature. Cardano’s resurgence comes after a difficult interval, and if present assist ranges maintain, analysts predict ADA might double in worth by early 2025. This momentum has positioned ADA as one of many extra unstable however probably rewarding property within the present rally.

Crypto Knowledgeable Raoul Pal: SUI to Lead This Cycle

Raoul Pal, CEO of Actual Imaginative and prescient, predicts SUI might outperform each Ethereum and Solana on this crypto cycle. Whereas he expects Ethereum to outpace Bitcoin because the market enters a “risk-taking part,” Pal believes Solana’s development will surpass Ethereum’s—but Sui could effectively outperform all of them on account of its robust early-stage adoption.

Bitcoin’s $250K Potential: Key Drivers to Watch

Latest market developments and political shifts are aligning in a method that might propel Bitcoin (BTC) to new heights, with some analysts projecting a future value of over $250,000. Right here’s a take a look at the principle components fueling the optimism round Bitcoin’s subsequent potential bull run.

Bitcoin’s Management and the Path to $100,000

Bitcoin has as soon as once more surpassed its all-time excessive, buying and selling at round $81K at time of writing. Analysts undertaking it might attain $100,000 by the top of 2024. Commonplace Chartered’s Geoff Kendrick even forecasts BTC to hit $125,000 by Trump’s inauguration in January, signaling robust confidence in Bitcoin’s continued ascent. As Bitcoin rises, it could drive up different main property, comparable to Ethereum, Solana, and Cardano, by means of a “rising tide” impact that might raise your complete crypto market.

PlanB’s Daring Prediction

Quant analyst PlanB, recognized for his Inventory-to-Circulate (S2F) mannequin, predicts Bitcoin might surpass $250,000 throughout the subsequent few years. The S2F mannequin hyperlinks shortage to cost, and Bitcoin’s upcoming “halving” occasions – when mining rewards are lowered, making the asset scarcer – traditionally set off bull runs. PlanB additionally factors to institutional strikes, comparable to Michael Saylor’s deliberate $42 billion Bitcoin acquisition, as main value boosters.

Retail Traders Driving Weekend Positive factors

Bitcoin latest all-time excessive of $79,000 over the weekend (since surpassed), a historically quieter interval within the crypto market suggests smaller, retail traders are shopping for in, a optimistic indicator because it reveals widespread curiosity. Alongside this, $280 million in bearish bets have been liquidated, marking a excessive degree of exercise and a robust shift in market sentiment towards bullish.

Professional-Crypto and Bitcoin Potential presidential Coverage Prospects

The election consequence might effectively imply friendlier crypto laws. Ought to the Bitcoin Act be handed, it will place Bitcoin as a strategic reserve asset just like gold, by paving the best way for institutional acceptance, and driving extra capital into Bitcoin. If the brand new administration reconfigures the SEC, together with the doable substitute of SEC Chair Gary Gensler, it might additionally result in extra versatile laws. If the marketing campaign promise of a U.S. Bitcoin reserve involves fruition, it will consolidate 200,000 confiscated bitcoins, signalling authorities confidence in Bitcoin and probably boosting its market worth. Different guarantees embrace positioning the U.S. as a hub for Bitcoin mining, with a concentrate on utilizing home vitality sources, and offering regulatory readability inside 100 days. Such strikes might foster innovation and provides the market the soundness it wants.