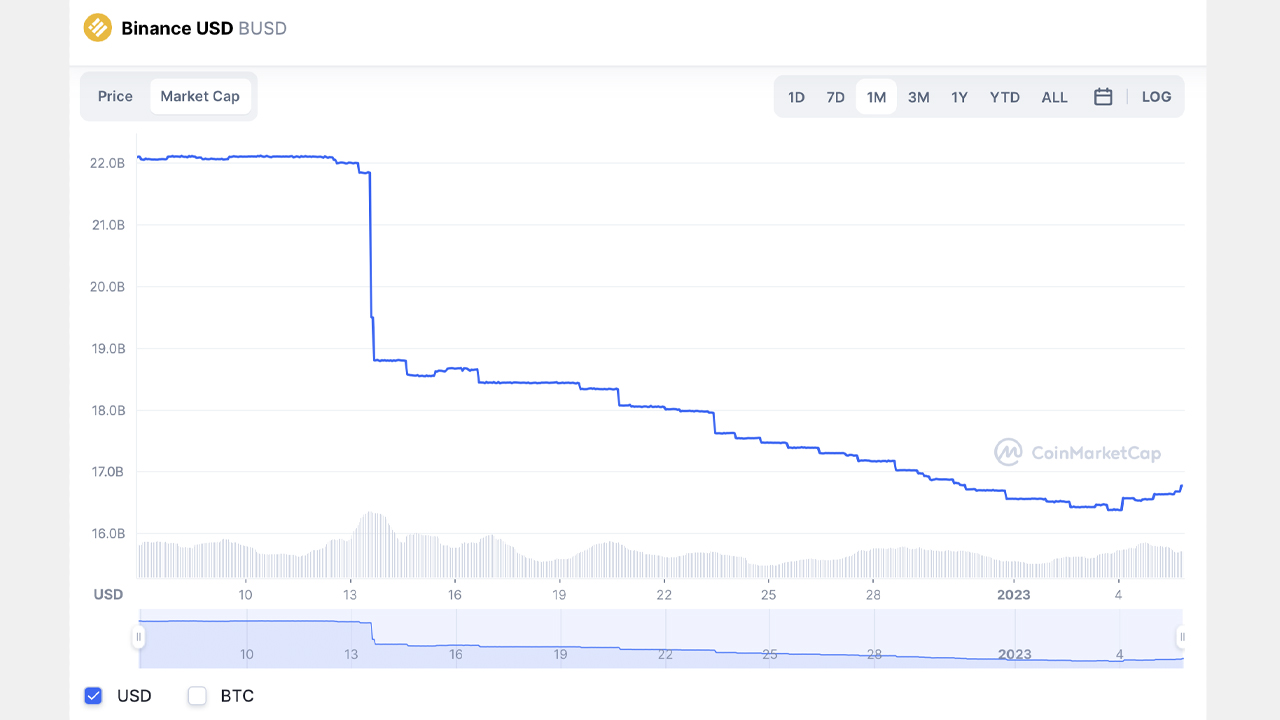

In line with statistics, the stablecoin BUSD noticed a big drop in its provide over the previous 30 days, shedding roughly 23.8% from Dec. 5, 2022, to Jan. 6, 2023. Since Dec. 13, 2022, BUSD’s provide has been decreased by greater than $5 billion, going from $21.84 billion to its present stage of $16.77 billion.

Stablecoin Market Sees Fluctuations With BUSD Dropping Important Provide, Ties to Turkish Lira

BUSD, the stablecoin based by Paxos and Binance, has skilled a big discount in its circulating provide. Information reveals that among the many high ten stablecoins by market capitalization, BUSD has misplaced probably the most between Dec. 5, 2022, and Jan. 6, 2023. Tether managed to extend by 1.1% over the previous month, and USDC jumped by 1.8% within the final 30 days. Nevertheless, BUSD shed 23.8% over the past month and now has a market cap of round $16.77 billion. Since Dec. 13, 2022, BUSD has seen roughly 5,066,884,674 web redemptions.

The discount in stablecoin provide coincides with a time of serious hypothesis surrounding the world’s largest cryptocurrency alternate, Binance. Final month, Binance introduced that Binance US would try to accumulate Voyager Digital’s property, however the U.S. Securities and Trade Fee (SEC) intervened within the buy. The SEC said that it was “formally investigating” the debtors within the matter. Along with the SEC, Alameda Analysis, a defunct buying and selling unit of FTX, has additionally objected to Binance US’ buy of Voyager’s property.

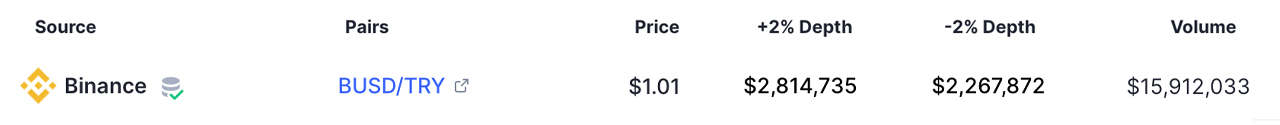

Of the greater than $5 billion in BUSD redemptions, BUSD’s provide shrank by 3.24 billion in three days from Dec. 13 to Dec. 16, 2022. International commerce quantity was considerably greater at the moment, as Dec. 13 statistics present that BUSD had round $9.38 billion in 24-hour quantity in comparison with right this moment’s $4.41 billion. BUSD’s high buying and selling pair is tether (USDT), however statistics from cryptocompare.com point out that BUSD has a robust relationship with the Turkish lira. As of Jan. 6, 2023, metrics present that the lira represents 2.45% of all BUSD trades.

Turkey has been experiencing a sovereign debt and forex disaster since 2018. In early 2022, Bitcoin.com reported on the rising recognition of stablecoins in Turkey, when the lira represented 7.20% of the $3.51 billion in 24-hour BUSD trades on Jan. 3. On Jan. 5, 2023, the Turkish lira accounted for $15,912,033 of Binance’s 24-hour trades. Along with the lira, different high BUSD buying and selling pairs on Binance embrace BTC, ETH, and BNB. Along with BUSD, the stablecoin DAI issued by Makerdao shed 2.9% final month, and GUSD, issued by Gemini, dropped by 3.8%.

What do you consider BUSD’s $5 billion in web redemptions since Dec. 13, 2022? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.