In an analysis shared by way of X, crypto analyst Ali Martinez elaborated on the continuing value correction of Dogecoin (DOGE), positing that it’s a constant precursor to main bull runs, drawing on historic patterns to forecast future value actions.

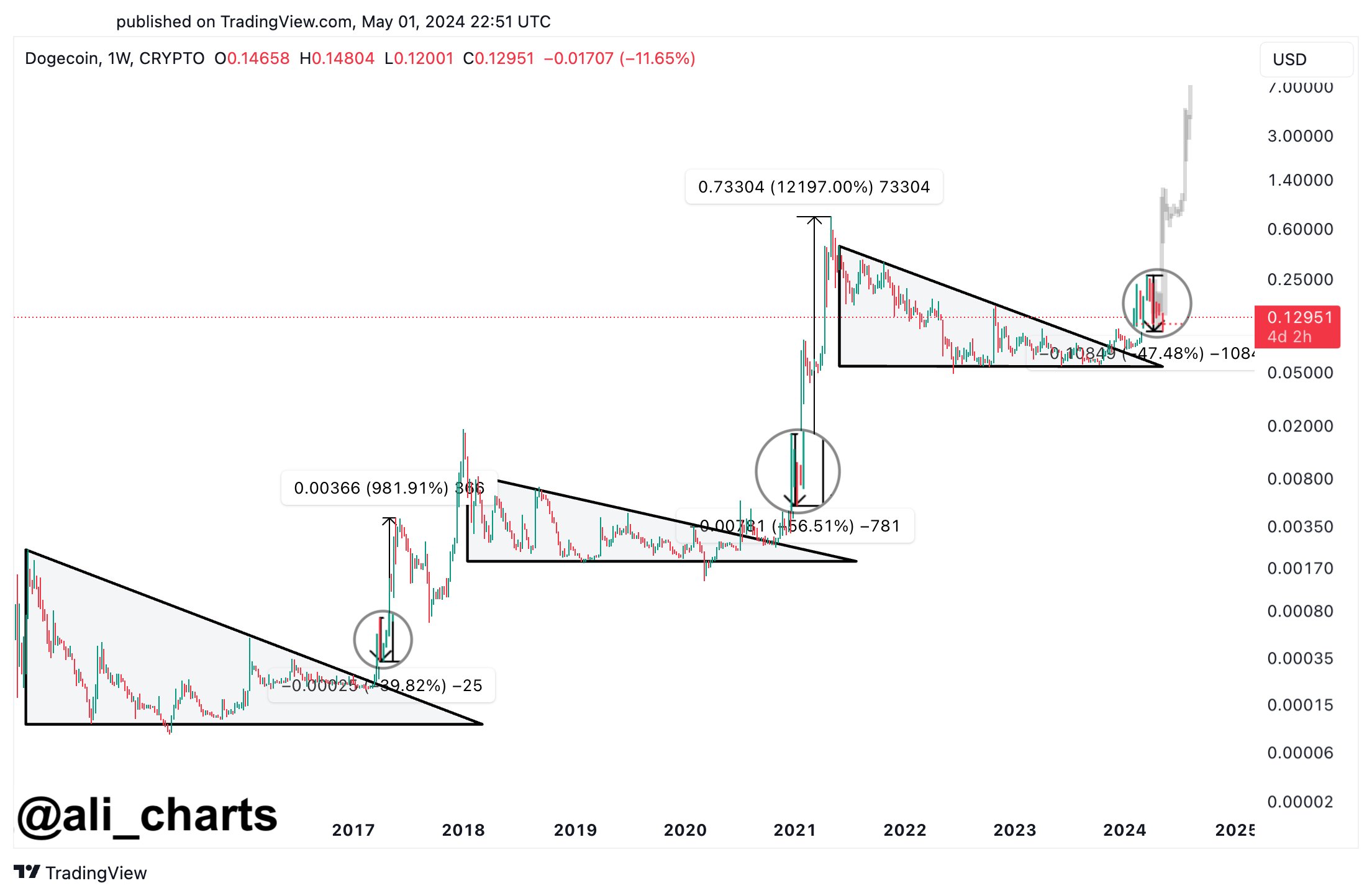

Martinez’s commentary facilities on the chart sample referred to as the “descending triangle.” This can be a bearish formation that happens when the worth follows a downward trendline intersecting a flat assist line. Sometimes, this sample signifies a continuation of a downward pattern, however within the context of Dogecoin, Martinez suggests it precedes important bullish breakouts.

“The continuing Dogecoin value correction is a part of its traditional conduct earlier than huge bull runs! Let’s dive in,” Martinez shared. He defined the historic significance of this sample in Dogecoin’s buying and selling historical past: “In 2017, DOGE broke out of a descending triangle. Then, DOGE retraced by 40% earlier than getting into a 982% bull run!”

Martinez additional analyzed newer cycles to bolster his observations, “In 2021, DOGE broke out of a descending triangle once more. Then, DOGE retraced by 56% earlier than skyrocketing by 12,197%!” In response to Martinez, these retracements usually are not random however are attribute of how Dogecoin has behaved in earlier cycles, setting the stage for explosive good points.

The analyst drew parallels to the present market circumstances: “Now, in 2024, DOGE has but once more damaged out of a descending triangle! It’s at present present process a 47% value correction, similar to earlier cycles, which might ignite the subsequent DOGE bull run!” This assertion means that the present market downturn could be an opportune shopping for second forward of potential good points.

Martinez’s evaluation underscores the cyclical nature of Dogecoin’s value actions, suggesting a sample of sharp declines adopted by dramatic recoveries. “Over time, Dogecoin seems to reflect its earlier bull cycles! All you want is slightly little bit of endurance,” he concluded.

Brief-Time period Dogecoin Worth Evaluation

Amidst this optimistic prediction, the Dogecoin value is in a precarious state of affairs within the short-term. Since mid-April, DOGE has skilled important technical resistance. Notably, the DOGE value was constantly rejected on the 50-day EMA over a number of cases, indicating sturdy promoting stress at increased value ranges.

Amid a broader market downturn, the trajectory was accentuated when Dogecoin’s value broke beneath the essential 100-day EMA. This stage, usually watched by merchants for indicators of medium-term market route, had beforehand supplied assist. The breach underscores a weakening market sentiment and will sign prolonged losses.

As of press time, Dogecoin’s value hovered close to $0.1259 after narrowly holding above the 200-day EMA yesterday, a key psychological and technical barrier. This transferring common is now a pivotal level for Dogecoin; its sustained breach on the every day chart might considerably alter the market construction, probably triggering a slide in the direction of the $0.1005 assist stage.

The Relative Energy Index (RSI) is at 31.63, edging near the oversold territory however not conclusively signaling an imminent reversal. This means that whereas the market is nearing oversold circumstances, the promoting stress has not totally abated. One final leg down could be essential to get DOGE into “oversold” territory to be able to mark an area backside.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site fully at your individual danger.