The European inventory market has been on a powerful run, at the same time as latest tariff talks have led to elevated volatility. On this evaluation, we discover why European equities stay a compelling diversification alternative, analyzing earnings progress, valuations, key macroeconomic drivers, and potential dangers forward.

Why European Shares Matter for Diversification

With valuations nonetheless enticing and a shifting macroeconomic panorama, European shares present a powerful case for diversification. Profitable investing isn’t nearly figuring out the highest performer in a bull market. It’s additionally about discovering resilient property that may maintain up throughout downturns. As coverage uncertainty will increase, essentially the most speculative elements of the market (costly momentum property) are typically the primary to appropriate, underscoring the significance of geographic diversification past the US.

Whereas European shares have already seen sturdy positive factors, sustaining this momentum would require continued earnings progress, steady margins, and a good macro backdrop. Traders ought to monitor company efficiency, geopolitical dangers, and coverage developments as key elements driving European equities within the coming 12 months.

Europe vs. the US: Divergence

12 months-to- date as of March seventeenth, the Euro Stoxx 50 has gained 11%, considerably outperforming the S&P 500, which has misplaced -3.8%. Regardless of making new highs, the rally seems extra measured than previous peaks. At present, 74% of shares within the index are buying and selling above their 200-day shifting average- properly under the 96% seen in earlier market tops, suggesting that momentum, whereas constructive, is just not excessive.

European earnings have performed a key position in sustaining market momentum. The This autumn earnings season exceeded expectations, reviving EPS progress after a interval of stagnation.

Whereas European corporates nonetheless lag behind their US friends, particularly resulting from weaker performances within the vitality and auto sectors, constructive earnings surprises have supplied a powerful tailwind. Banks have led the best way, with names like Santander, Intesa, and BBVA accounting for the majority of the upside surprises. The tech sector (ASML, Infineon) has additionally carried out properly, although luxurious large LVMH and pharmaceutical chief Sanofi have been notable underperformers. Ahead EPS estimates have risen modestly for each indices, with the US sustaining a slight edge. Ahead EPS estimates must advance additional to help the momentum behind Europe.

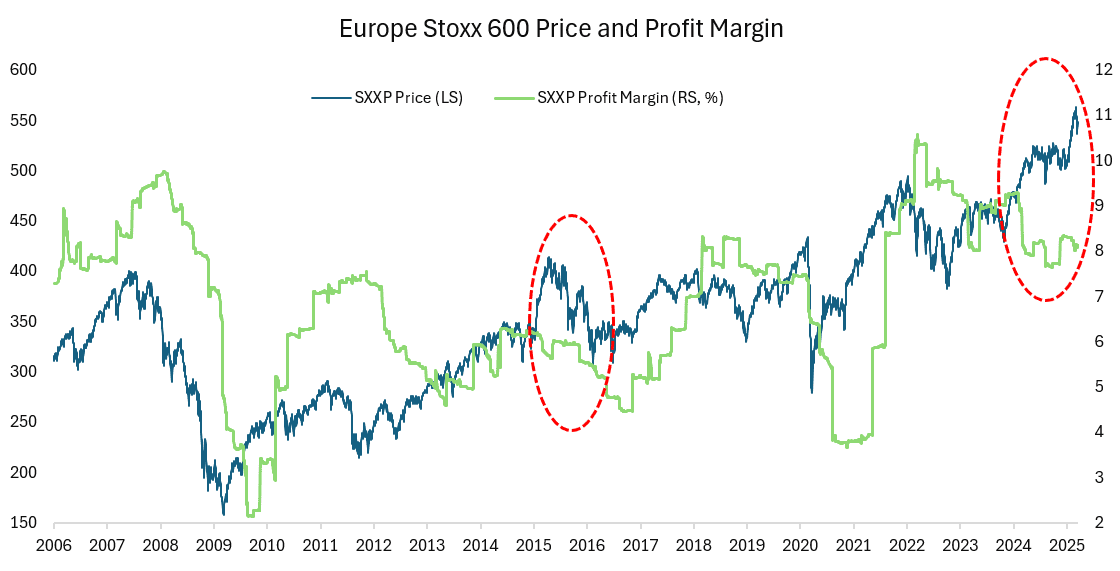

Whereas Europe’s bettering earnings outlook is a web constructive, valuations have re-rated considerably for the reason that begin of the 12 months, elevating the bar for additional outperformance. Revenue margins, particularly, shall be vital going ahead. The latest inventory surge has occurred alongside stagnant margins, echoing patterns final seen in 2015 (Graph 1). If corporations fail to develop margins in 2025, the rally might lose steam and that’s the reason we at present take a look at the regional allocation extra as a diversification publicity and never an “all-in” play on Europe.

Chart 1. Euro Stoxx 600 Worth and Revenue Margins

Knowledge as of March 17, 2025. Supply: Bloomberg

Sure sectors stay particularly weak to exterior dangers. Automakers and luxurious items corporations face the largest threats from tariffs, whereas industries like mining and drinks might additionally see headwinds if commerce relations worsen.

Political Panorama and Fiscal Help

Germany’s latest election outcomes have been one other catalyst for European equities. The formation of a centrist coalition has helped keep away from excessive fiscal austerity, paving the best way for extra balanced, and market-friendly, insurance policies. Moreover, Germany has embraced the necessity for stronger protection spending, recognizing that Europe should take larger accountability for its personal safety. This shift has structural financial implications, with CDU chief Friedrich Merz has proposed a €500 billion particular fund to strengthen Germany’s infrastructure and protection, advocating for a reform of the nation’s debt brake for traders this can be a pure large stimulus package deal. That alone triggered a pointy enhance within the DAX40 (+3.54%) on the day of the announcement.

Contemplating all of the above, European shares seem to current an fascinating alternative, supported by the next valuation elements; ahead price-to-earnings (P/E) ratio for the Euro Stoxx 50 stands at 15.2x, considerably decrease than the S&P 500’s 21x, although nonetheless above its long-term common of 12.4x (2006–2024). One other valuation metric, the fairness threat premium, means that European equities current a compelling risk-reward tradeoff, extra so in comparison with the US.

Dangers

Nonetheless, dangers stay. Commerce tensions with the US are a serious concern, with potential tariffs on European autos and different items threatening to disrupt momentum. President Trump has beforehand proposed 25% levies on European automakers, and tariff talks might weigh on investor sentiment. Moreover, skeptics argue that whereas the rally has been sturdy, it should translate into sustained earnings progress to stay sturdy.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.