ADA, the native token of the Cardano blockchain, seems to be struggling to take care of its essential assist stage amidst market uncertainty. At the moment, December 27, 2024, the general cryptocurrency market sentiment seems to be experiencing a value decline, encompassing main belongings akin to Bitcoin (BTC), Ethereum (ETH), and XRP.

This value decline in main belongings has utterly shifted market sentiment in direction of a downtrend.

Cardano (ADA) Present Momentum

At press time, ADA is buying and selling close to $0.864, having skilled a value decline of over 6.9% previously 24 hours. Amid this value decline, the altcoin has reached a vital stage. If this stage fails to carry, the asset might tank by 15%, falling beneath the $0.75 mark.

This bearish value motion has infused worry amongst merchants and buyers, resulting in a decline in buying and selling quantity. In response to CoinMarketCap information, ADA’s buying and selling quantity has dropped by 16% previously 24 hours.

Cardano (ADA) Technical Evaluation and Upcoming Degree

In response to knowledgeable technical evaluation, ADA has lately damaged down from a bearish head and shoulders value motion sample. Over the previous seven days, it has been consolidating beneath the sample’s neckline. Amid the latest value decline, ADA’s value has reached the decrease boundary of the consolidation zone and is on the verge of a breakdown.

Based mostly on the latest value motion, if the altcoin breaches this stage and closes a every day candle beneath the decrease boundary of the zone, there’s a sturdy chance it might decline by 15%, reaching the $0.77 mark sooner or later.

ADA’s bearish thesis will solely maintain true if it closes a every day candle beneath the $0.85 stage, which constitutes the decrease boundary of the consolidation zone. In any other case, the bearish state of affairs could fail to materialize.

On-Chain Metrics Reveals Blended Sentiment

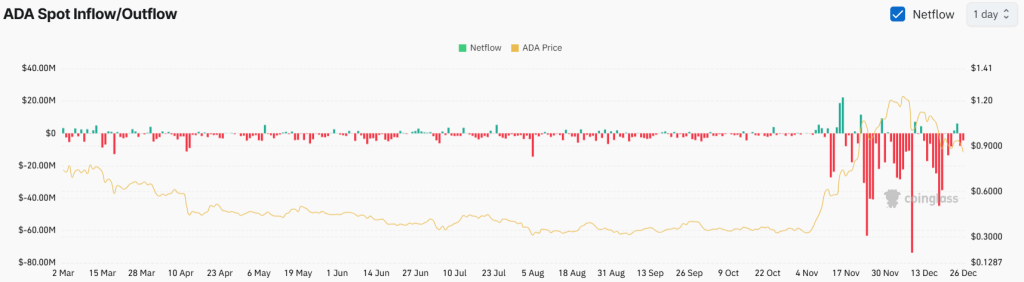

Regardless of this bearish outlook, long-term holders seem optimistic, whereas merchants appear hesitant to determine new positions, as reported by the on-chain analytics agency Coinglass. Information from ADA spot influx/outflow reveals that exchanges have witnessed a major outflow of $4.7 million price of ADA, suggesting potential accumulation and shopping for stress.

Conversely, merchants seem like liquidating their positions, as evidenced by an 8.2% drop in ADA’s open curiosity inside the final 24 hours.