ADA, the native token of the Cardano blockchain, is gaining vital consideration from crypto lovers following an asset supervisor’s transfer to file for a Cardano Alternate-Traded Fund (ETF) in america. This growth has sparked notable curiosity amongst merchants and buyers, leading to spectacular upside momentum.

Cardano (ADA) Shedding its Achieve

Because the market surge pushes ADA close to an important resistance degree, the asset has begun experiencing large sell-offs, inflicting its worth to fall—one other disappointment for merchants and buyers right now.

Regardless of the current fall within the ADA token worth, the asset has reclaimed its uptrend because it strikes above the 200 Exponential Shifting Common (EMA) on the day by day timeframe. Moreover, right now’s notable promoting strain has not had any vital influence on investor sentiment, as long-term holders seem like accumulating the token.

Present Worth Momentum

ADA is at present buying and selling close to $0.77 and has skilled a worth surge of over 11% prior to now 24 hours. Nonetheless, the asset reached an intraday excessive of $0.815 with a 16% achieve, however the market misplaced a good portion of these beneficial properties, probably attributable to ongoing revenue reserving and the present market sentiment.

Nonetheless, participation from merchants and buyers has surged to the following degree, growing by greater than 120% throughout the identical interval.

ADA Worth Motion

Based on knowledgeable technical evaluation, ADA is at an important resistance degree of $0.85, the place it confronted resistance right now.

Based mostly on the current worth motion, if ADA continues to rally and breaches the $0.85 degree, closing a day by day candle above it, there’s a robust chance it might soar by 32% to achieve the $1.13 degree sooner or later.

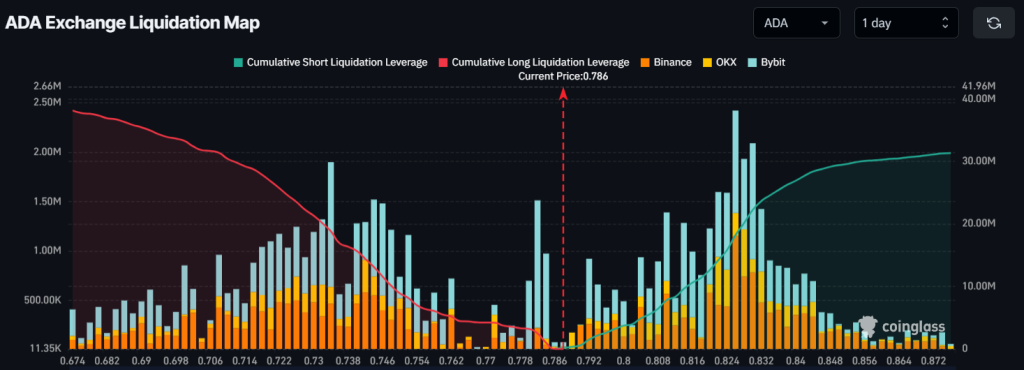

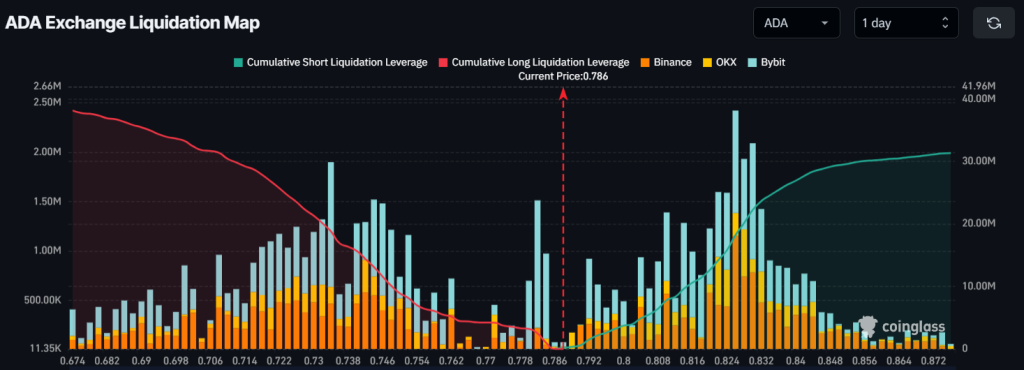

ADA’s Main Liquidation Areas

At the moment, merchants are taking a combined strategy. At current, the main liquidation areas are close to $0.734, the place merchants holding lengthy positions are over-leveraged, with $18.80 million price of lengthy positions. Conversely, $0.826 is one other liquidation degree, the place merchants holding brief positions are over-leveraged, with $18.20 million price of brief positions.

When combining these on-chain metrics with technical evaluation, it seems that long-term holders are accumulating tokens, whereas intraday merchants are taking benefit of the present market sentiment.