The general cryptocurrency market seems to be bleeding. Within the midst of this market downturn,, ADA, the native token of the Cardano blockchain, is poised for a notable value decline. This bearish hypothesis for ADA is predicated on latest value motion, general market sentiment, and merchants’ robust bearish outlook.

Cardano (ADA) Technical Evaluation and Key Ranges

In accordance with CoinPedia’s technical evaluation, ADA has confirmed its bearish pattern by retesting the breakdown of its ascending trendline. Nevertheless, the altcoin is presently discovering minor help on the $0.90 stage. Based mostly on latest value motion and historic momentum, if ADA closes a each day candle beneath $0.90, there’s a robust chance it might decline by 15% to achieve $0.70 sooner or later.

Regardless of this bearish outlook, the altcoin remains to be buying and selling above the 200 Exponential Transferring Common (EMA) on the each day timeframe, indicating that the asset stays in an uptrend.

Rising Bets on Quick Positions

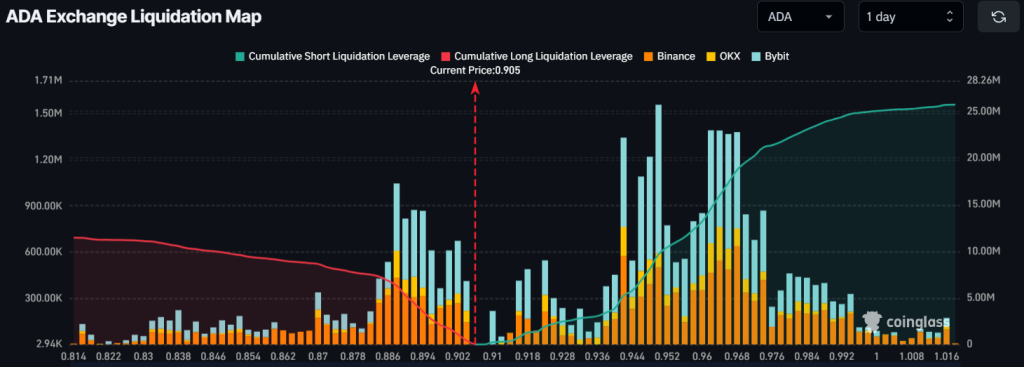

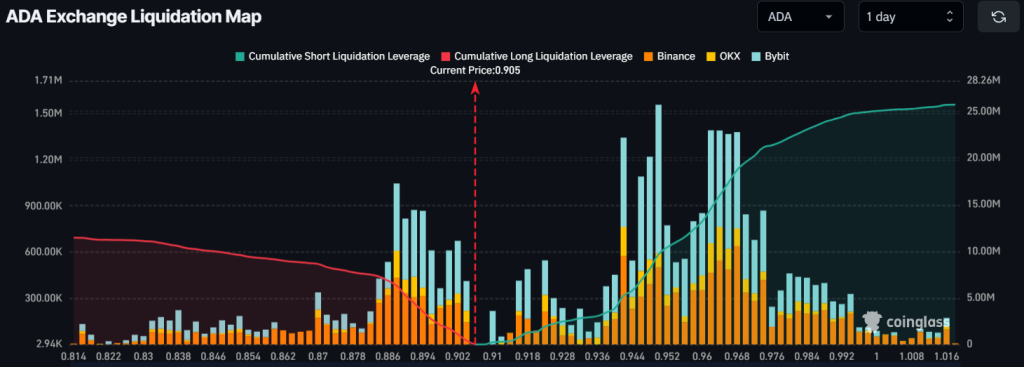

Following this bearish value motion, merchants are strongly betting on the draw back, as revealed by the on-chain analytics agency CoinGlass.

In accordance with on-chain information, short-sellers are presently dominating the asset and will liquidate bullish lengthy positions.

The info exhibits that the $0.95 stage acts as robust resistance, with short-sellers being over-leveraged at this stage, holding $9.65 million price of brief positions. In the meantime, the $0.88 stage serves as robust help, the place bulls are over-leveraged, holding $6.30 million price of lengthy positions.

These statistics present that short-sellers are presently controlling the asset and have the potential to drive ADA’s value.

When combining merchants’ curiosity with technical evaluation and value motion, it seems that ADA might decline to the $0.70 stage within the coming days.

Present Worth Momentum

ADA is presently buying and selling close to $0.913 and has skilled a value drop of over 3.50% up to now 24 hours. Nevertheless, throughout the identical interval, as a result of bearish market sentiment, merchants’ and buyers’ participation has declined by 22% in comparison with the day gone by.