Cardano (ADA), the good contracts platform aiming to dethrone Ethereum, is dealing with a balancing act. Whereas the token has seen a latest value improve, a possible exodus by main traders casts a shadow of doubt.

Associated Studying

Will Whales Drag ADA Down?

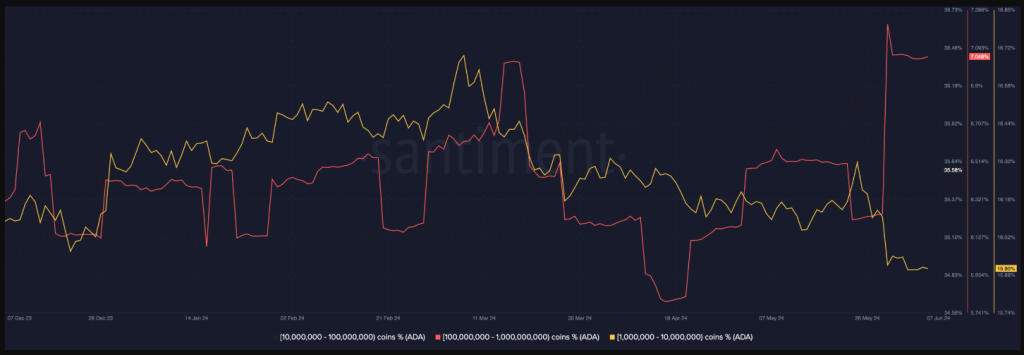

On-chain knowledge reveals a trigger for concern for Cardano bulls. Addresses holding a major quantity of ADA (between 1 million and 1 billion tokens) have been promoting their holdings. This conduct by “whales,” as these massive traders are recognized, generally is a bearish indicator, suggesting a lack of confidence within the venture’s future. Traditionally, such selloffs have usually preceded value dips.

Whereas some would possibly view low volatility as an indication of stability, in ADA’s case, it may be hindering progress. The token’s present low volatility acts like a pressure subject, preserving value swings in verify. This may be constructive, stopping sharp drops. Nevertheless, it additionally restricts upward momentum and makes vital value will increase much less probably.

Consolidation Or Correction?

Two potential eventualities for ADA’s value have been noticed. If promoting stress by whales intensifies, ADA may fall again to its earlier help stage between $0.42 and $0.44. This consolidation section would signify a pause within the token’s upward trajectory.

Nevertheless, a extra regarding chance exists. A big improve in promoting may set off a correction, pushing the worth all the way down to $0.42 and even decrease. This situation could be a setback for ADA bulls, probably erasing latest features.

Cardano Bulls Look For A Lifeline

Regardless of the bearish undercurrents, there are causes for cautious optimism. First, ADA has defied the promoting stress from whales with an almost 5% value improve within the final week. This resilience suggests there would possibly nonetheless be sufficient shopping for stress to offset the promoting.

Second, some Cardano value predictions stay bullish. Sources anticipate an increase to $0.46 by July eighth. Whether or not this prediction materializes is dependent upon market forces, however it provides a possible silver lining for traders.

Associated Studying

The Worry & Greed Index

Including one other layer to the complicated state of affairs is the present market sentiment. The Worry & Greed Index, a measure of investor sentiment throughout the cryptocurrency market, at the moment sits at 72, indicating “Greed.”

This total bullish sentiment may probably present some help for ADA, however it’s essential to keep in mind that the index displays the broader market, not simply Cardano particularly.

Featured picture from Pngtree, chart from TradingView