Cardano (ADA) is at present competing with Ethereum when it comes to giant transaction quantity. That is undoubtedly a constructive growth for the ADA ecosystem, particularly because it signifies a wave of accumulation among the many token’s giant holders.

Cardano Matches Ethereum In Giant Transaction Quantity

Knowledge from the market intelligence platform IntoTheBlock exhibits that Cardano is witnessing an analogous giant transaction quantity as Ethereum. Within the final 24 hours, Cardano recorded a big transaction quantity of $6.7 billion, whereas Ethereum witnessed a big transaction quantity of $6.71 billion.

Associated Studying

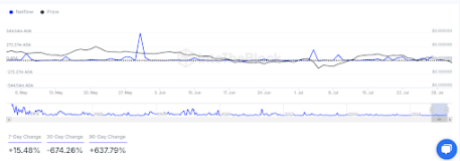

This growth means that Cardano whales have been energetic these previous few days as they appear so as to add extra tokens to their positions, particularly with the market at present on a dip and as these buyers anticipate the much-awaited value rally from ADA. Additional knowledge from IntoTheBlock confirms this, as there was an over 15% improve in giant holders’ internet circulation over the past seven days.

Knowledge from the on-chain analytics platform Santiment additionally exhibits that Cardano whales have added to their positions. These buyers, wallets holding between 100,000 and 10 million ADA tokens, collectively purchased 120 million ADA tokens between July 17 and August 1. These wallets now maintain over 5.69 billion ADA tokens.

A rise in whale exercise presents a bullish outlook for the Cardano ecosystem. These buyers might affect market costs, and these purchases might spark a big surge in ADA’s value. This can present a much-needed increase for Cardano, seeing how the crypto token has underperformed for the reason that begin of the 12 months.

Cardano has a year-to-date (YTD) lack of over 35% and is among the most shorted altcoins, because of this unimpressive value motion. Nevertheless, Santiment has urged {that a} huge turnaround for the crypto token can’t be dominated out since Cardano being closely shorted will increase the “possibilities of liquidations resulting in pumps.” The on-chain analytics platform claimed these liquidations might act as “rocket gas” for a value rally for Cardano.

What Will Ultimately Spark That ADA Rally?

Cardano has didn’t get pleasure from any important rally regardless of a number of bullish developments in its ecosystem this 12 months. The newest bullish basic was the information that the US Securities and Trade Fee (SEC) now not considers ADA a safety following the modification of its criticism in opposition to Binance.

Associated Studying

In the meantime, the Chang Onerous Fork is underway as Cardano transitions to the Voltaire period and ushers in its most superior governance system. It’s price mentioning that ADA’s value maintained a tepid value motion following the discharge of node validator software program, model 9.1.0, which includes the Chang Onerous Fork.

As such, Cardano’s value motion begs the query of what must occur for the crypto token to lastly witness that much-anticipated value rally and meet up with the remainder of the key cap tokens when it comes to YTD positive aspects.

On the time of writing, Cardano is buying and selling at round $0.38, down within the final 24 hours, based on knowledge from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com