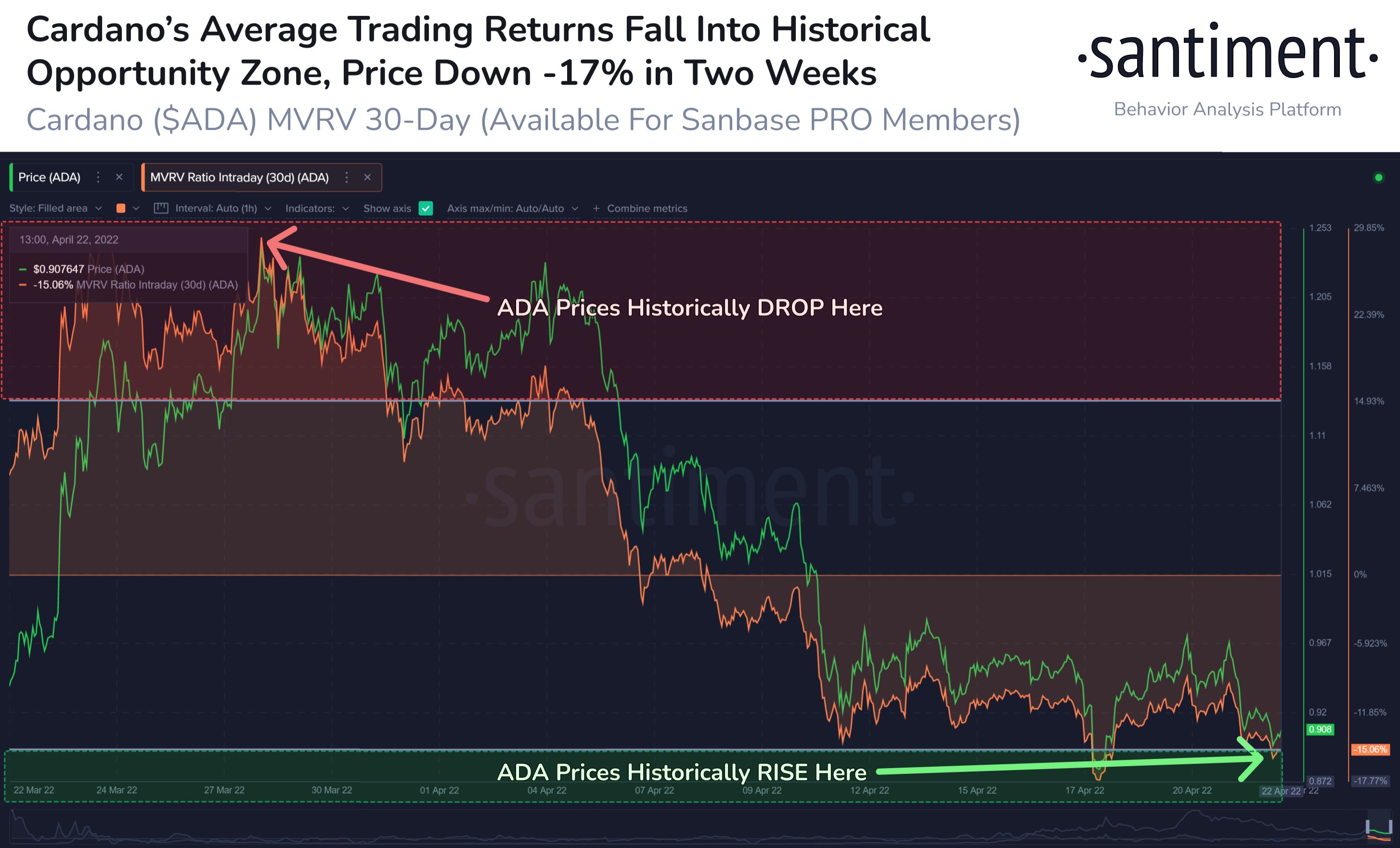

Main analytics agency Santiment says that one on-chain metric is hinting that Cardano has reached an opportune worth degree for ADA bulls.

The agency locks its radar on Cardano’s market worth to realized worth (MVRV), which exhibits the common revenue or lack of all cash in circulation at a given worth and can be utilized to recommend worth reversals.

In accordance with Santiment, Cardano’s MVRV is at a degree that has traditionally been a bullish turning level for ADA.

“Cardano’s common buying and selling returns on the 30-day mid-term interval has fallen under -15%. That is traditionally an MVRV degree when ADA and plenty of different altcoins see a minimum of a brief turnaround in costs to alleviate the losses mounting on networks.”

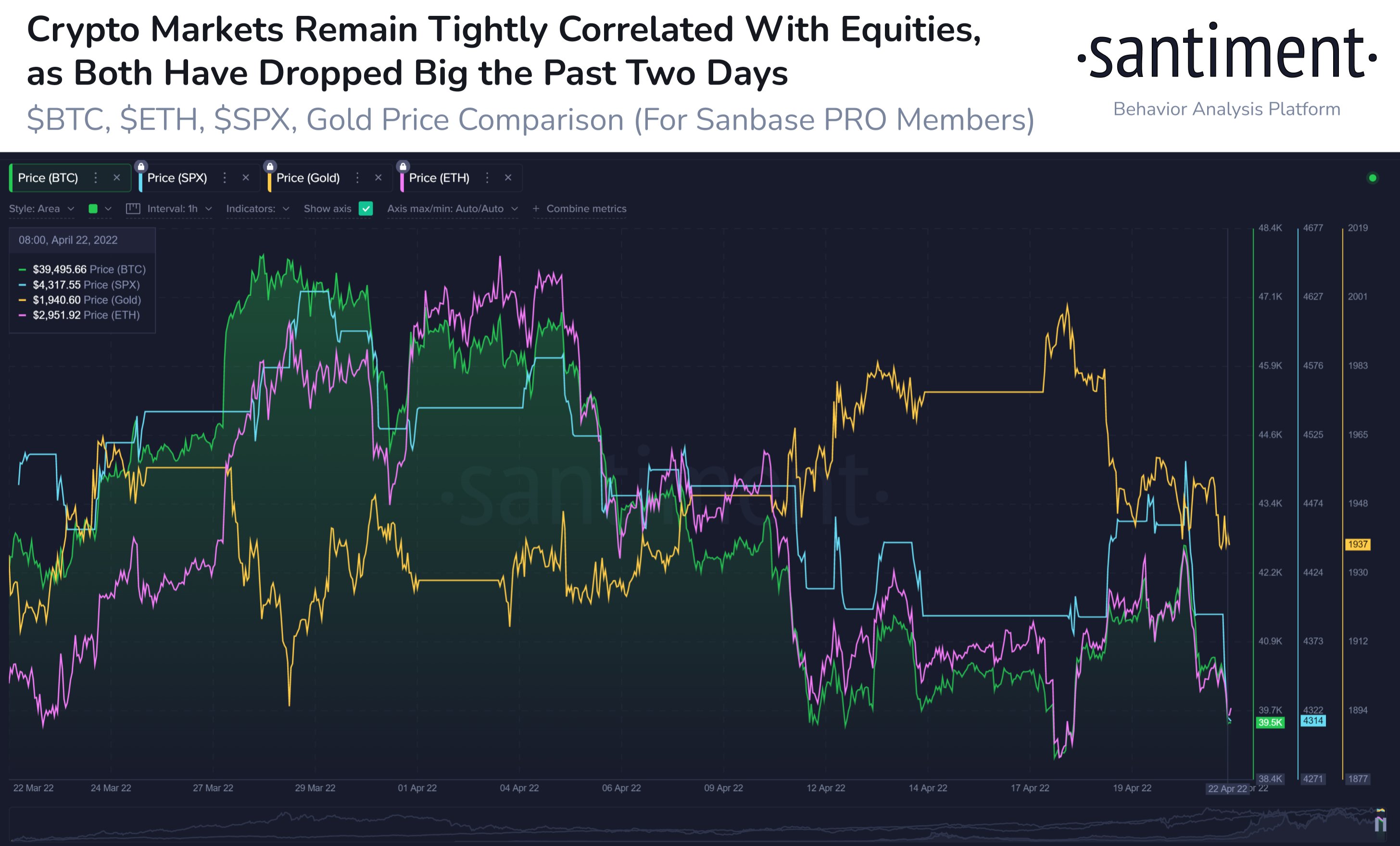

Whereas Cardano could also be able to rally, the analytics agency says that crypto, on the whole, stays on the mercy of the inventory marketplace for now.

Santiment says that crypto markets could need to climate the correlation till the Federal Open Market Committee (FOMC) assembly subsequent month.

“A pattern which will proceed till the following FOMC assembly in Might, crypto markets stay firmly entrenched in the identical worth patterns because the SP500 and equities markets. The Fed lately introduced {that a} half-point rate of interest hike is probably going.”

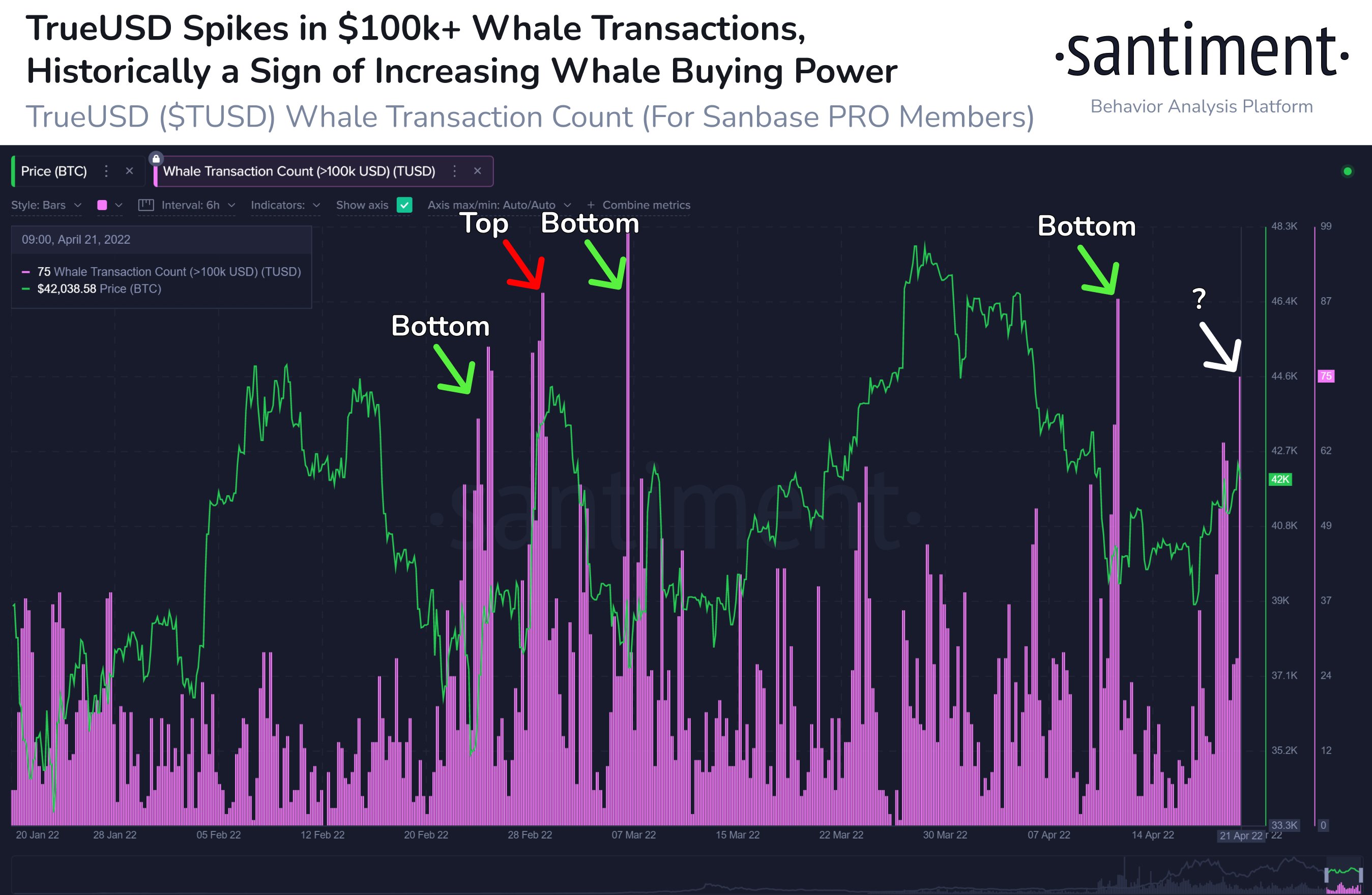

Taking a look at Bitcoin, the agency notes that surges in whale stablecoin transactions, or transfers value over $100,000, have preceded native tops and bottoms for BTC.

Santiment says it’s protecting an in depth watch on the rise of whale exercise in stablecoin TrueUSD (TUSD), indicating that deep-pocketed traders are accumulating BTC.

“TrueUSD, crypto’s sixth largest stablecoin, is seeing a spike in whale transactions right now. The previous six hours has been one of many 10 largest stretches in $100k+ transactions this yr. Traditionally, whale transaction spikes are an indication of accumulation.”

Test Worth Motion

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Natchapol18/KHIUS