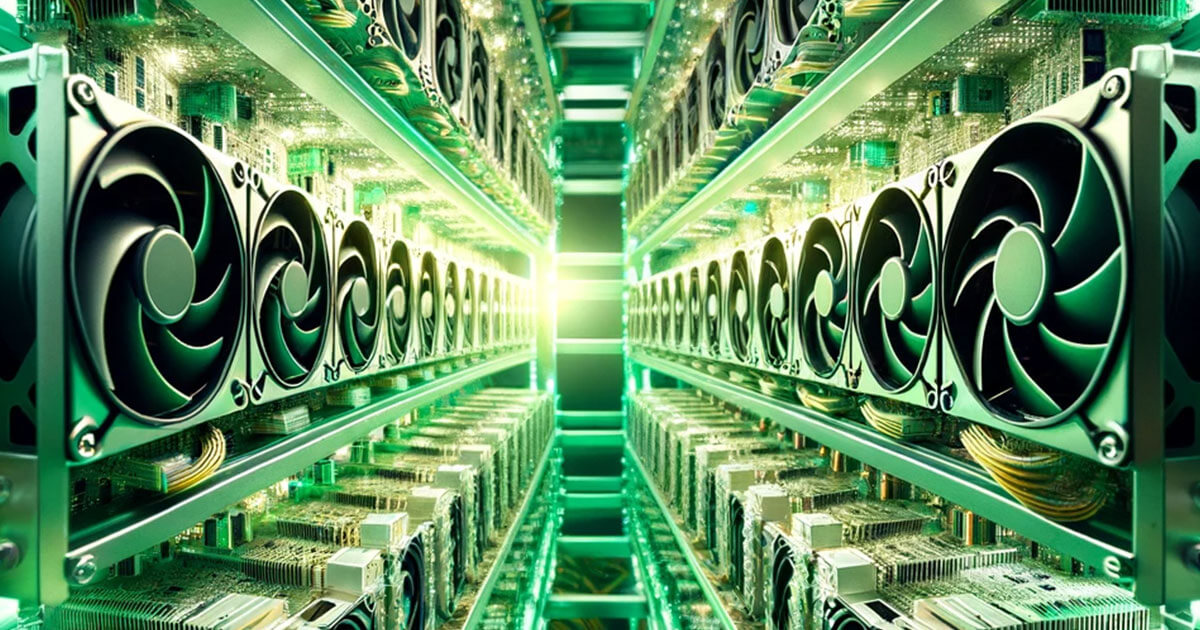

Celsius Community and its debtors intend to show the defunct lender right into a Bitcoin miner as a part of its restructuring, in response to a Nov. 20 press launch.

Celsius clients will personal the brand new entity, tentatively acknowledged as ‘Mining NewCo.’

Mining NewCo

Celsius had proposed the formation of Fahrenheit NewCo as a part of its restructuring and restoration plan, which the court docket accepted on Nov. 9.

Nevertheless, after receiving regulatory suggestions on the plan from the SEC and conducting consultations with the Official Committee of Unsecured Collectors, the corporate and its debtors have determined to change the preliminary plan, which might have entailed numerous regulatory issues.

The pivot is predicted to see Celsius retain some belongings designated initially for switch to Fahrenheit NewCo, which the agency’s estates will now handle for collectors’ profit.

The choice to pay attention solely on Bitcoin mining signifies a shift from earlier plans involving cryptocurrency staking. Celsius’ transfer in the direction of mining displays a rising pattern within the crypto business towards extra conventional enterprise practices compliant with the present rules.

Celsius outlined plans to use for registration of shares within the new publicly traded Bitcoin mining firm. The transfer is a strategic step in the direction of making a extra sustainable and clear enterprise mannequin post-bankruptcy.

Mining NewCo is predicted to begin operations with decrease administration charges and elevated liquid cryptocurrency distributions, probably offering larger returns to collectors.

This growth signifies a vital juncture for Celsius because it navigates its approach out of chapter. With a brand new concentrate on Bitcoin mining, the corporate goals to realign its enterprise targets whereas adhering to regulatory necessities.

Chapter

Celsius filed for Chapter 11 chapter safety in July 2022 amidst a pause in withdrawals on its platform.

Compounding the agency’s challenges, the SEC filed a lawsuit towards Celsius and its former CEO, Alex Mashinsky, over allegations associated to the agency’s Earn Curiosity Program. Mashinsky was arrested on securities fraud, commodities fraud, and wire fraud prices and is at the moment out on bail. His trial is slated to start in September 2024.

The lender collapsed attributable to issues arising from former Mashinsky’s buying and selling selections, mismanagement of $2 billion in belongings, and insufficient methods for monitoring these belongings.

On the time, Mashinsky had attributed the collapse to the fast progress of Celsius’ belongings, which he claimed outpaced the corporate’s skill to make prudent funding selections, leading to some poorly judged asset deployments.

The cryptocurrency neighborhood and buyers will intently monitor Celsius’ progress because it embarks on this new chapter, hoping for a profitable turnaround and elevated stability within the risky crypto market.