The market sentiment throughout the cryptocurrency panorama is kind of bearish. Amid this, Chainlink (LINK) turns bearish and is poised for a notable worth decline however is at present at a powerful help stage.

This unfavourable outlook could also be on account of LINK’s current worth motion and merchants’ bets during the last 24 hours.

Chainlink (LINK) Technical Evaluation and Upcoming Ranges

Based on professional technical evaluation, LINK seems bearish and is on the verge of breaking down the inclined trendline of its ascending triangle worth motion sample on a every day timeframe. For the reason that starting of August 2024, LINK has been supported by this inclined trendline, experiencing shopping for stress and upward rallies every time.

Nonetheless, because of the unfavourable outlook and merchants’ bearish sentiment, the asset now seems susceptible to breaking down from this help stage.

Based mostly on the historic worth motion, if LINK breaks out and closes a every day candle beneath this important help stage of $10.65, there’s a sturdy chance that the asset might decline by 20% to achieve the $9 stage within the coming days.

Presently, LINK is buying and selling beneath the 200 Exponential Transferring Common (EMA) on the every day timeframe, indicating a downtrend. In buying and selling and investing, merchants usually use the 200 EMA on the every day chart to find out whether or not an asset is appropriate for the brief facet or the purchase facet.

LINK’s Bearish On-Chain Metrics

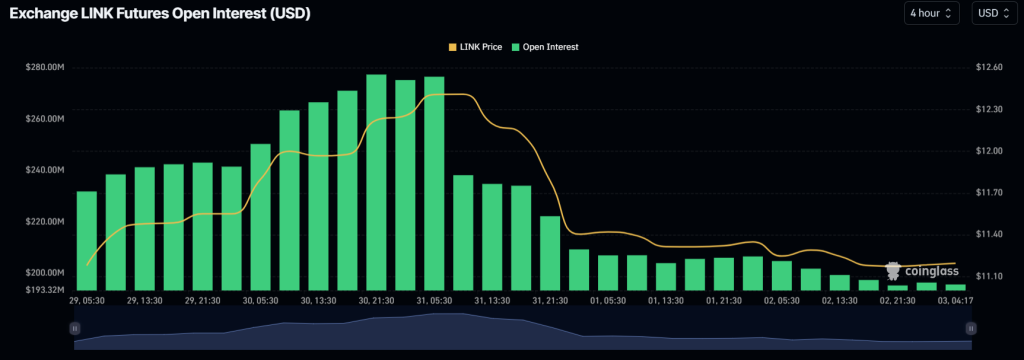

LINK’s unfavourable outlook is additional supported by on-chain metrics. Based on the on-chain analytics agency Coinglass, LINK’s Lengthy/Brief ratio at present stands at 0.94, indicating bearish sentiment amongst merchants. Moreover, its open curiosity has dropped by 4.5% over the previous 24 hours and jumped by 1.5% over the previous 4 hours.

This drop in open curiosity for LINK suggests declining curiosity amongst buyers and merchants.

Present Worth Momentum

At press time, LINK is buying and selling close to $11.20 and has skilled a 1.1% worth decline prior to now 24 hours. Throughout the identical interval, its buying and selling quantity dropped by 34%, indicating diminished participation from merchants amid a broader worth decline throughout the crypto market.