Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

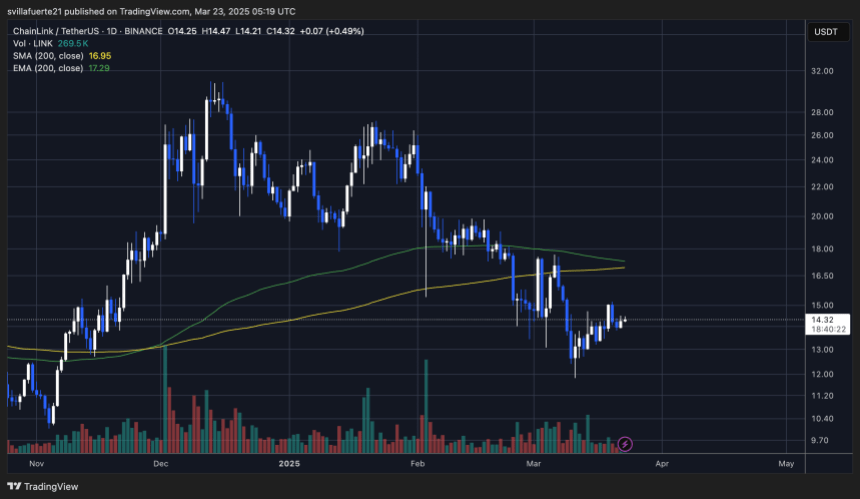

Chainlink (LINK) is displaying indicators of energy, buying and selling 27% above its March 11 low and hinting at a possible restoration if broader market circumstances enhance. Regardless of current volatility and ongoing macroeconomic uncertainty, LINK has managed to carry its floor higher than many altcoins, giving hope to traders who imagine the worst could also be over. Whereas some analysts stay cautious and warn of additional draw back, others see this consolidation as a wholesome reset earlier than the following leg up.

Associated Studying

Prime analyst Ali Martinez shared insights on X, noting that Chainlink is presently testing a vital assist stage round $13, which aligns with the decrease boundary of a long-standing value channel. In response to Martinez, if LINK holds this zone, historic patterns counsel a powerful rebound may comply with.

As market sentiment stays divided, all eyes are on LINK’s capability to take care of this assist. A profitable protection may place Chainlink as one of many altcoins main the following rally. For now, merchants are watching intently, ready to see if this value motion marks the start of a brand new upward development.

Chainlink Holds Essential Help As Bulls Eye A Breakout

After shedding the vital $17–$18 assist zone, bulls have struggled to regain management. Chainlink trades at a pivotal stage because it makes an attempt to reclaim larger costs amid ongoing market uncertainty and volatility. LINK has fallen over 61% since reaching its mid-December excessive of round $30, reflecting the broader market’s bearish sentiment fueled by macroeconomic instability and risk-off habits from traders.

Nevertheless, there’s rising optimism that LINK may very well be making ready for a restoration. Martinez’s insights spotlight that Chainlink is now sitting on a key assist stage at $13, which marks the decrease boundary of a well-defined buying and selling channel.

Martinez means that holding this zone may set the stage for a significant rally. If LINK confirms a stronghold above $13, historic value motion signifies {that a} transfer towards the mid-range goal of $25 is probably going, with a possible extension towards $50 if bullish momentum strengthens.

Associated Studying

The approaching days will probably be vital as bulls should defend the $13 stage to stop additional draw back. A bounce from this zone may set off renewed investor curiosity and speed up momentum, positioning Chainlink as one of many altcoins main a broader market restoration. For now, all eyes are on whether or not LINK can maintain the road and reignite its bullish construction.

LINK Value Battles Key Resistance

Chainlink is presently buying and selling at $14.30, sitting just under an important resistance zone that might decide its short-term path. The $15 stage has turn into a key battleground for bulls and bears. If LINK manages to interrupt above this resistance with energy, analysts anticipate a swift transfer towards the $17 area—one other vital stage that beforehand acted as sturdy assist earlier than the current downtrend.

The current value motion exhibits that bulls are regaining some momentum, particularly after bouncing from the $13 zone. Nevertheless, the market stays fragile amid broader macroeconomic uncertainty and cautious investor sentiment. A confirmed breakout above $15 would doubtless appeal to extra shopping for curiosity, setting the stage for a short-term rally.

On the flip facet, if LINK fails to reclaim $15 and faces rejection at this resistance, it may slide again towards decrease assist ranges. A drop beneath $13 would weaken the bullish case and expose the token to additional draw back, with the $12 mark appearing as a potential subsequent assist zone.

Associated Studying

The following few periods will probably be vital for LINK. Merchants are watching intently to see whether or not bulls can construct sufficient momentum to interrupt out—or if bears will regain management and push the worth decrease.

Featured picture from Dall-E, chart from TradingView