Candlesticks are arguably the preferred chart kind amongst merchants. They mix the information from numerous timeframes and current it in a handy manner. Compared to the usual line chart, the candlestick chart provides merchants the chance to trace similarities in value formation and see repetitions. Chart sample buying and selling is predicated on recognizing related patterns of candlesticks, which can present the path wherein the pattern may transfer subsequent.

There are dozens of candlestick patterns that merchants recurrently use. Right this moment we are going to take a look at 4 standard ones: the Harami cross candlestick sample, Head and Shoulders, Doji and the Hanging Man. These patterns can doubtlessly assist merchants catch pattern reversals and enter new positions in a well timed method.

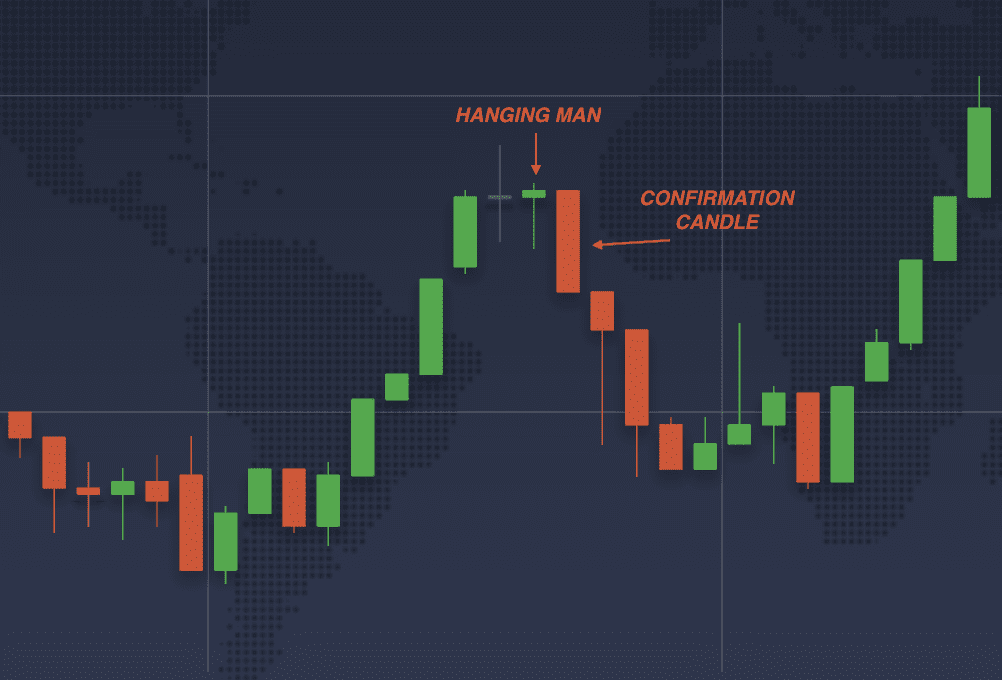

Hanging Man

The Hanging Man is a well-liked buying and selling sample in technical evaluation, sometimes used to determine potential pattern reversals in monetary markets. The sample varieties when a candlestick exhibits an extended decrease shadow with a small physique on the high, resembling a dangling man. It’s typically in comparison with the Hammer sample, however the distinction is within the context wherein the patterns happen.

The Hanging Man sample can sometimes be noticed after an uptrend, indicating {that a} bearish pattern could begin quickly. The Hammer sample varieties after a downtrend and signifies a bullish reversal.

How one can spot the Hanging Man sample:

- The sample normally happens after an uptrend.

- A candlestick with a quick physique and an extended decrease shadow (and typically a brief higher shadow) is shaped, indicating that the bullish pattern is dropping momentum.

- The next candle signifies that the worth is declining, confirming the reversal.

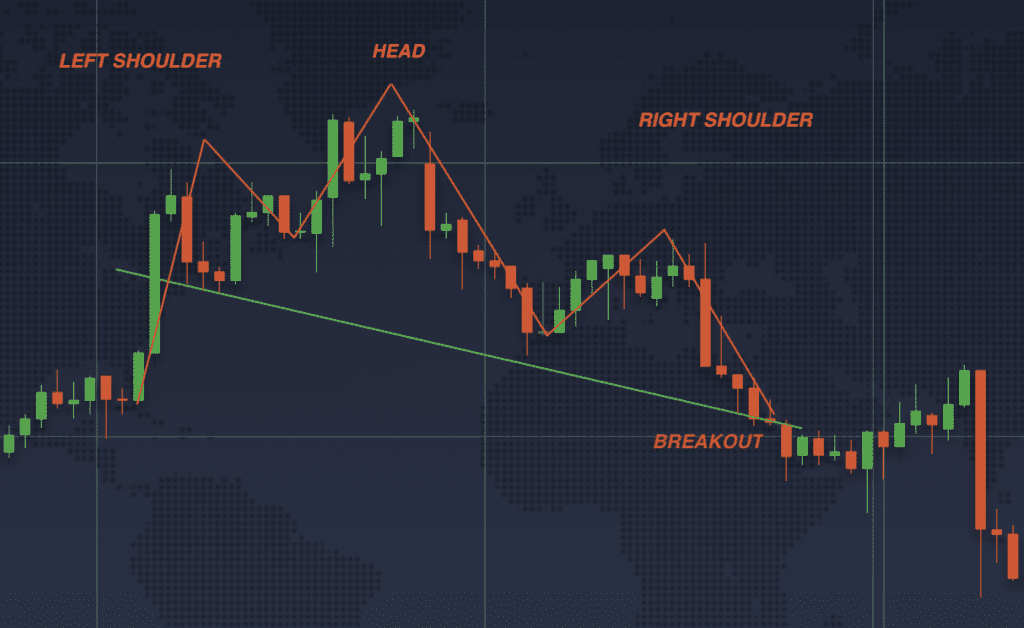

Head and Shoulders

Like many different candlestick patterns, the Head and Shoulders is called after the form that it resembles. This sample is a formation that may be seen when viewing the chart on longer timeframes. With two smaller peaks forming on all sides of a bigger peak, this form appears like a head between two shoulders.

This sample normally signifies that the present upward pattern is dropping momentum and a decline is to be anticipated within the close to future. The neckline of the sample is drawn by connecting the lows of the 2 shoulders. A breakout beneath the neckline is taken into account a affirmation of the sample and a sign of a promote level.

How one can spot the Head and Shoulders sample:

- You could search for an asset in a bullish pattern. After some time, the bullish pattern begins to lose momentum and the worth checks a brand new low. It bounces again, forming the left shoulder of the sample.

- The value begins to rise once more, forming the top.

- When the momentum proves to not be sufficient, the worth drops once more, after which makes one final try at bouncing upwards. This varieties the proper shoulder within the sample.

- A “neckline” might be drawn by connecting the low factors of the sample. As soon as the worth breaks by the neckline, the reversal of the pattern is confirmed.

The Head and Shoulders sample has its bullish model — the Head and Shoulders reversal. It appears the identical, however inverted. The breakout above the assist line could also be a sign that the bearish pattern is over and {that a} bullish indication is confirmed.

If you want to observe a recording of our dwell webinar about chart sample buying and selling, take a look at the video beneath.

Doji

Doji is usually utilized in chart sample buying and selling to identify indecision out there. This kind of a sample is shaped when the open and the shut value are very shut to one another, forming a really small and even nonexistent physique of the candle.

Whereas some merchants imagine that the Doji signifies a pattern reversal out there, it isn’t all the time the case. You will need to mix any single candlestick sample, together with the Doji, with different instruments of technical evaluation. Utilizing technical indicators will assist to verify the indications and make an knowledgeable determination.

How one can spot the Doji candlestick sample:

There are a number of forms of Doji to be careful for.

- Traditional Doji: Open and shut costs are the identical or very shut to one another.

- Lengthy-legged Doji: The higher and decrease shadows are lengthy in comparison with the physique.

- Headstone Doji: The opening and shutting costs are at or close to the low of the buying and selling interval, creating an extended higher shadow.

- Dragonfly Doji: The opening and shutting costs are at or close to the excessive of the buying and selling interval, creating an extended decrease shadow.

Harami Cross

The Harami Cross candlestick sample is a two-candlestick sample, consisting of a big candlestick adopted by a Doji that’s utterly engulfed throughout the physique of the earlier candle.

Usually, the primary candlestick is lengthy, and it signifies a powerful bullish or bearish pattern. The second candlestick is a Doji, which signifies indecision or a possible reversal. Collectively they kind a sample which may present a change within the dealer’s sentiment. A bullish sample signifies that the worth could quickly reverse to the upside, whereas a bearish sample signifies that the worth may begin falling quickly.

How one can spot the Harami Cross candlestick sample:

- The primary candlestick that you could be be in search of ought to be a lengthy candlestick that signifies a powerful pattern.

- The next candlestick is a basic Doji, which is absolutely positioned throughout the earlier candlestick’s physique.

- The following candlestick confirms the reversal. If it’s a bullish Harami Cross (pink candlestick adopted by Doji), the reversal will probably be to a bullish pattern. If the sample is bearish (inexperienced candlestick, adopted by Doji), the reversal will probably be to the draw back.

To sum up

Chart sample buying and selling is an strategy that makes use of repetitions in candlestick patterns so as to try and predict the longer term motion of the asset. Whereas patterns might be very helpful, there is no such thing as a single candlestick sample that would present utterly correct data each single time. Combining candlestick patterns with different evaluation instruments is a crucial step to make sure that you’re higher knowledgeable and have a number of sources of indications.

In the event you’d prefer to be taught extra about different candlestick patterns, verify this text subsequent: Buying and selling with Candlestick Patterns.

Publish Views: 1