A category motion lawsuit has been filed in opposition to big-three client credit score bureau Experian over studies that the corporate did little to stop identification thieves from hijacking client accounts. The authorized submitting cites liberally from an investigation KrebsOnSecurity revealed in July, which discovered that identification thieves have been capable of assume management over current Experian accounts just by signing up for brand new accounts utilizing the sufferer’s private data and a distinct e mail tackle.

The lawsuit, filed July 28, 2022 in California Central District Courtroom, argues that Experian’s documented apply of permitting the re-registration of current Experian accounts with out first verifying that the prevailing account holder licensed the adjustments violates the Truthful Credit score Reporting Act.

In July’s Experian, You Have Some Explaining to Do, we heard from two totally different readers who had safety freezes on their credit score information with Experian and who additionally lately acquired notifications from Experian that the e-mail tackle on their account had been modified. So had their passwords and account PIN and secret questions. Each had used password managers to select and retailer complicated, distinctive passwords for his or her accounts.

Each have been capable of get better entry to their Experian account just by recreating it — sharing their title, tackle, telephone quantity, social safety quantity, date of delivery, and efficiently gleaning or guessing the solutions to 4 a number of selection questions which are virtually fully based mostly on public data (or else data that isn’t terribly troublesome to search out).

Right here’s the bit from that story that obtained excerpted within the class motion lawsuit:

KrebsOnSecurity sought to copy Turner and Rishi’s expertise — to see if Experian would enable me to re-create my account utilizing my private data however a distinct e mail tackle. The experiment was executed from a distinct laptop and Web tackle than the one which created the unique account years in the past.

After offering my Social Safety Quantity (SSN), date of delivery, and answering a number of a number of selection questions whose solutions are derived virtually fully from public data, Experian promptly modified the e-mail tackle related to my credit score file. It did so with out first confirming that new e mail tackle might reply to messages, or that the earlier e mail tackle authorized the change.

Experian’s system then despatched an automatic message to the unique e mail tackle on file, saying the account’s e mail tackle had been modified. The one recourse Experian provided within the alert was to register, or ship an e mail to an Experian inbox that replies with the message, “this e mail tackle is not monitored.”

After that, Experian prompted me to pick new secret questions and solutions, in addition to a brand new account PIN — successfully erasing the account’s beforehand chosen PIN and restoration questions. As soon as I’d modified the PIN and safety questions, Experian’s web site helpfully jogged my memory that I’ve a safety freeze on file, and would I wish to take away or briefly elevate the safety freeze?

To be clear, Experian does have a enterprise unit that sells one-time password providers to companies. Whereas Experian’s system did ask for a cell quantity after I signed up a second time, at no time did that quantity obtain a notification from Experian. Additionally, I might see no possibility in my account to allow multi-factor authentication for all logins.

In response to my story, Experian steered the studies from readers have been remoted incidents, and that the corporate does all types of issues it may possibly’t discuss publicly to stop dangerous individuals from abusing its techniques.

“We imagine these are remoted incidents of fraud utilizing stolen client data,” Experian’s assertion reads. “Particular to your query, as soon as an Experian account is created, if somebody makes an attempt to create a second Experian account, our techniques will notify the unique e mail on file.”

“We transcend reliance on personally identifiable data (PII) or a client’s capacity to reply knowledge-based authentication inquiries to entry our techniques,” the assertion continues. “We don’t disclose extra processes for apparent safety causes; nevertheless, our knowledge and analytical capabilities confirm identification components throughout a number of knowledge sources and will not be seen to the patron. That is designed to create a extra constructive expertise for our shoppers and to supply extra layers of safety. We take client privateness and safety significantly, and we frequently evaluation our safety processes to protect in opposition to fixed and evolving threats posed by fraudsters.”

That sounds nice, however since that story ran I’ve heard from a number of extra readers who have been doing every thing proper and nonetheless had their Experian accounts hijacked, with little left to indicate for it besides an e mail alert from Experian saying they’d modified the tackle on file for the account.

I’d wish to imagine this class motion lawsuit will change issues, however I don’t. Probably, the one factor that can come from this lawsuit — if it’s not dismissed outright — is a fats payout for the plaintiffs’ attorneys and “free” credit score monitoring for just a few years compliments of Experian.

Credit score bureaus don’t view shoppers as clients, who’re as an alternative the product that’s being offered to 3rd get together corporations. Usually that knowledge is offered based mostly on the pursuits of the entity buying the info, whereby client data will be packaged into classes like “canine proprietor,” “expectant mum or dad,” or “diabetes affected person.”

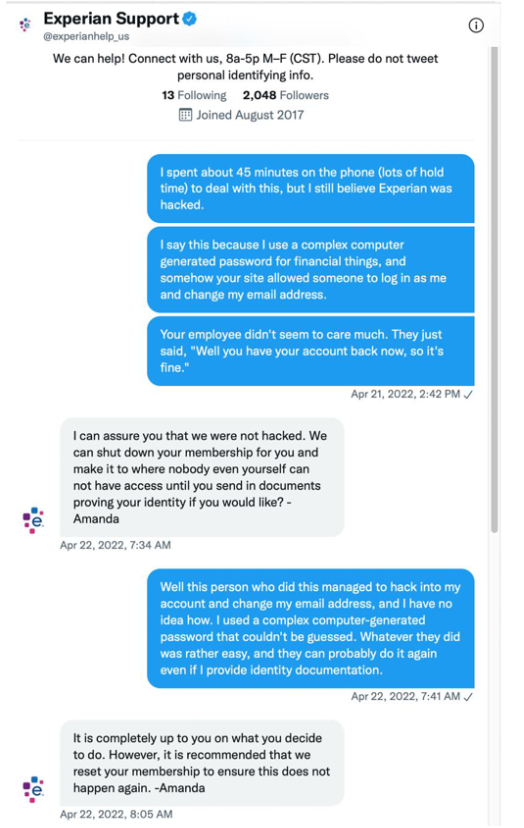

A chat dialog between the plaintiff and Experian’s help employees exhibits he skilled the identical account hijack as described by our readers, regardless of his use of a computer-generated, distinctive password for his Experian account.

Nonetheless, most lenders depend on the big-three client credit score reporting bureaus, together with Equifax, Experian and Trans Union — to find out everybody’s credit score rating, fluctuations by which could make or break one’s utility for a mortgage or job.

On Tuesday, The Wall Road Journal broke a narrative saying Equifax despatched lenders incorrect credit score scores for tens of millions of shoppers this spring.

In the meantime, the credit score bureaus hold having fun with file earnings. For its half, Equifax reported a file fourth quarter 2021 income of 1.3 billion. A lot of that income got here from its Workforce Options enterprise, which sells details about client wage histories to a wide range of clients.

The Biden administration reportedly needs to create a public entity inside the Client Monetary Safety Bureau (CFPB) that may incorporate components like lease and utility funds into lending choices. Such a transfer would require congressional approval however CFPB officers are already discussing the way it may be arrange, Reuters reported.

“Credit score reporting companies oppose the transfer, saying they’re already working to supply honest and reasonably priced credit score to all shoppers,” Reuters wrote. “A public credit score bureau could be dangerous for shoppers as a result of it could broaden the federal government’s energy in an inappropriate approach and its objectives would shift with political winds, the Client Information Trade Affiliation (CDIA), which represents non-public ranking companies, stated in a press release.”

A public credit score bureau is more likely to meet fierce resistance from the Congress’s most beneficiant constituents — the banking trade — which detests speedy change and is closely reliant on the credit score bureaus.

And there’s a preview of that battle happening proper now over the bipartisan American Information Privateness and Safety Act, which The Hill described as some of the lobbied payments in Congress. The thought behind the invoice is that corporations can’t accumulate any extra data from you than they should offer you the service you’re in search of.

“The bipartisan invoice, which represents a breakthrough for lawmakers after years of negotiations, would limit the sort of knowledge corporations can accumulate from on-line customers and the methods they will use that knowledge,” The Hill reported Aug. 3. “Its provisions would affect corporations in each consumer-centric trade — together with retailers, e-commerce giants, telecoms, bank card corporations and tech companies — that compile large quantities of consumer knowledge and depend on focused advertisements to draw clients.”

In keeping with the Digital Frontier Basis, a nonprofit digital rights group, the invoice as drafted falls quick in defending shoppers in a number of areas. For starters, it could override or preempt many sorts of state privateness legal guidelines. The EFF argues the invoice additionally would block the Federal Communications Fee (FCC) from implementing federal privateness legal guidelines that now apply to cable and satellite tv for pc TV, and that customers ought to nonetheless be allowed to sue corporations that violate their privateness.

A replica of the category motion criticism in opposition to Experian is out there right here (PDF).