Fast Take

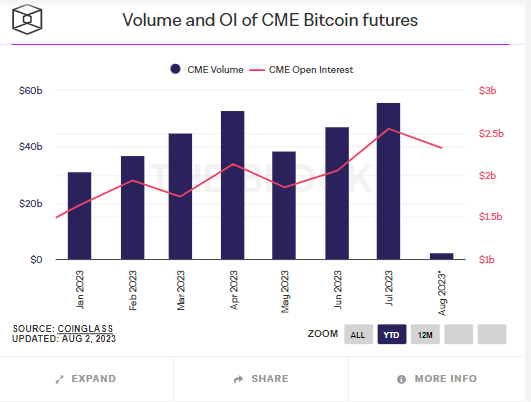

Knowledge from The Block reveals that the Bitcoin futures buying and selling quantity and open curiosity on the Chicago Mercantile Trade (CME) have reached their highest ranges for the 12 months. The buying and selling quantity for July 2023 reached a exceptional $56 billion, and open curiosity hit a peak of $2.55 billion. This implies a major rise in market participation and traders’ robust curiosity in Bitcoin futures.

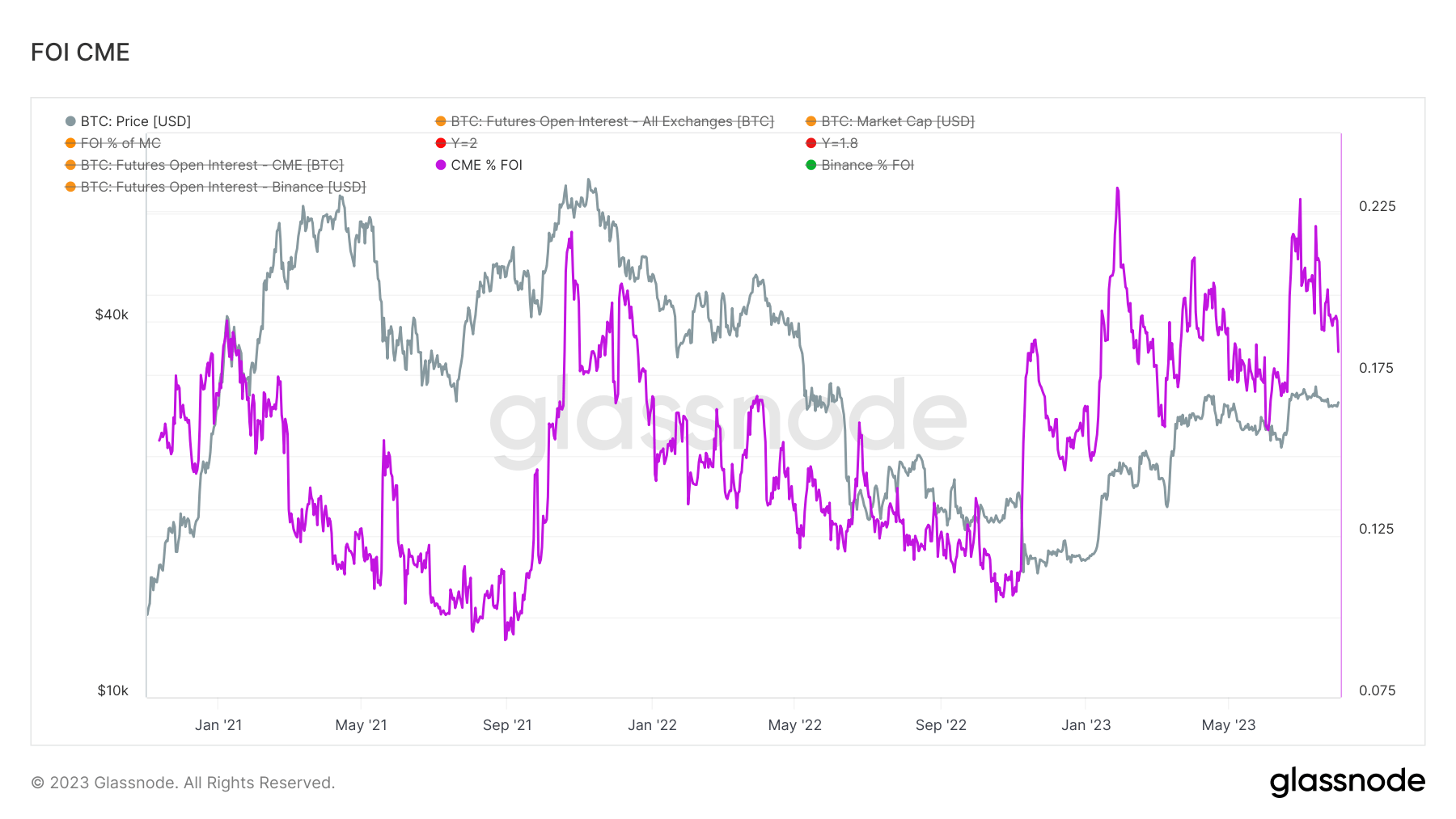

Extra information from Glassnode reveals that the CME’s share of the whole futures open curiosity is at the moment 18%, slightly below its highest-recorded share of 23%. This means that the CME continues to carry a considerable portion of the general market share, regardless of fierce competitors within the futures market.

These outcomes spotlight the rising acceptance and use of Bitcoin futures as an funding instrument. This might doubtlessly point out a wider pattern towards the adoption of cryptocurrencies and their derivatives within the monetary market.

.

The put up CME Bitcoin futures hit new highs as investor curiosity surges appeared first on CryptoSlate.