Probably the most outstanding cryptocurrency exchanges located in the USA, Coinbase, has simply introduced a substantial enhance of its service choices. It’s also necessary to notice that this growth is geared in the direction of institutional traders positioned outdoors of the USA, since they now have entry to identify cryptocurrency buying and selling companies on the Coinbase Worldwide Alternate. At first, the service, which was launched on December 14, 2023, let customers to commerce Bitcoin (BTC) and Ether (ETH) towards USD Coin (USDC).

As a strategic response to the ever-changing and unclear regulatory surroundings in the USA, Coinbase has made the selection to create spot markets in nations aside from the USA. A variety of asset issuers and members of the cryptocurrency group have proven reluctance to work together with exchanges in the USA because of this uncertainty. The brand new service is meant to fulfill the particular necessities and expectations of Coinbase’s worldwide person base by offering a spot market that’s dependable and doesn’t violate any laws in the USA.

A number of phases can be concerned within the introduction of spot buying and selling on the Coinbase Worldwide Alternate, in addition to its additional progress. At first, the service is completely accessible to institutional clients positioned outdoors of the USA through API entry. Earlier than starting to develop the enterprise, Coinbase intends to fastidiously assemble a strong foundation and step by step enhance the quantity of liquidity. The platform can be expanded within the subsequent months to incorporate retail clients, different belongings, and options that permit new buying and selling methods and increase capital effectivity. These enhancements can be made doable by the product’s growth.

The truth that Coinbase was in a position to get registration to function in Spain and Singapore earlier within the 12 months is proof of the corporate’s dedication to increasing itself all over the world. There was a complete of $10 billion price of perpetual futures quantity exchanged in the newest quarter, indicating that the worldwide derivatives trade that the enterprise operates out of Bermuda has already proven super progress. Alternatively, the agency is now engaged in a authorized dispute with the Securities and Alternate Fee (SEC) about costs that it operates as an unregistered trade and broker-dealer for sure crypto belongings.

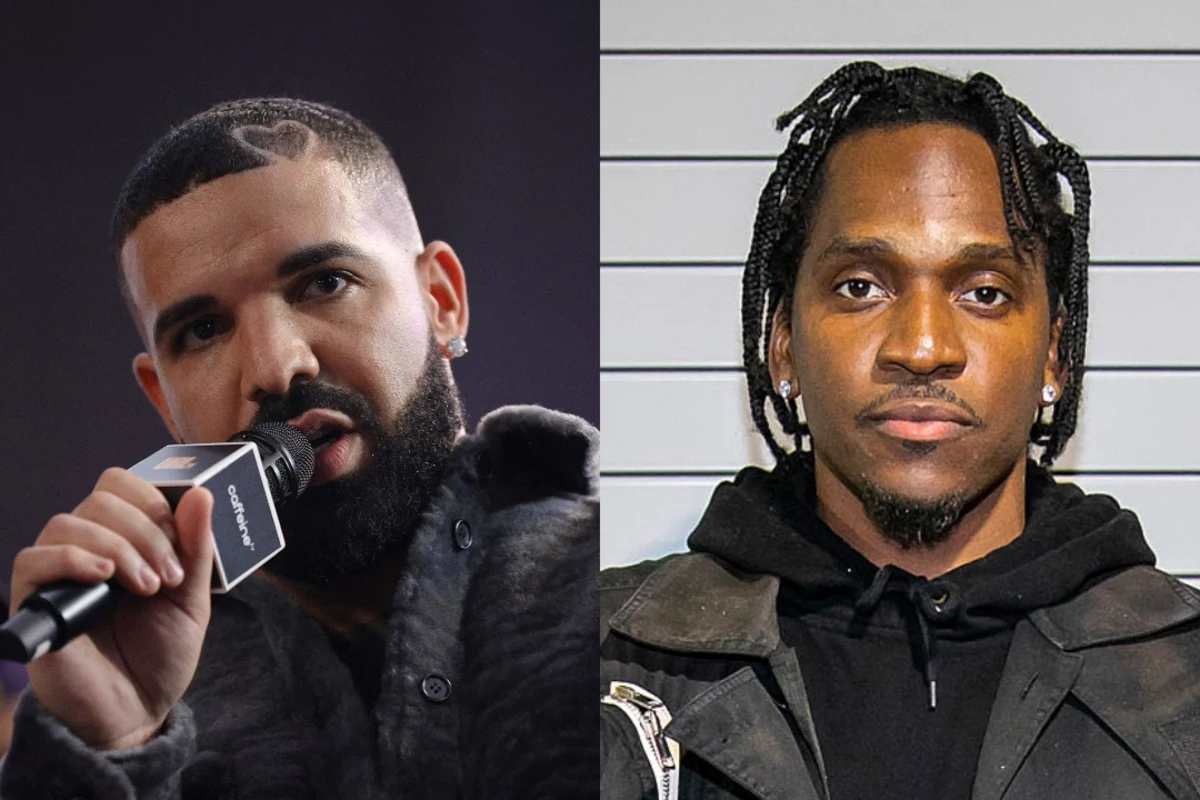

Picture supply: Shutterstock