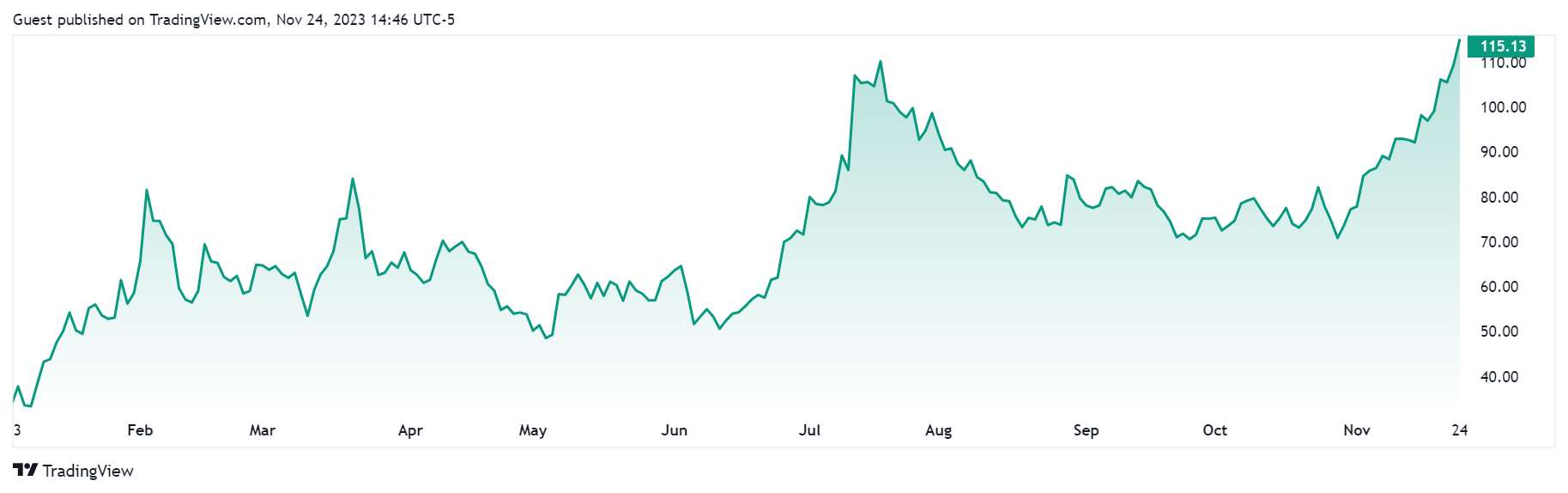

Coinbase’s COIN inventory has rallied to its highest level since late April 2022 at $115, representing a 216% progress on the year-to-date metric, based on Tradingview information.

Observers have linked COIN’s worth efficiency to the commonly optimistic pattern noticed within the crypto house, the place flagship digital belongings like Bitcoin, Ethereum, and Solana have recorded greater than 100% features through the previous 12 months.

Why Coinbase inventory is rising

Over the previous 12 months, Coinbase has emerged as one of many largest trade gamers following the collapse of a number of crypto corporations.

The trade’s robust fame has performed an enormous position in its enterprise because it has not too long ago touted its robust compliance-first method following the problems of rivals like Binance.

Coinbase CEO Brian Armstrong acknowledged this method has been confirmed proper, highlighting how the agency embraced “compliance to turn out to be a generational firm” that may stand the take a look at of time.

In addition to that, the corporate additionally performs an lively position in a number of spot Bitcoin exchange-traded fund (ETF) functions with the U.S. Securities and Change Fee (SEC).

A number of candidates, together with Constancy, Invesco, WisdomTree, VanEck, and Ark 21 Shares, have surveillance-sharing agreements (SSAs) with the trade. Moreover, the agency could be serving to asset managers like Franklin Templeton custody of their fund’s BTC.

In the meantime, the trade has grown considerably, securing Bermuda’s licensing to launch a world trade and providing perpetual futures buying and selling to non-U.S. retail clients.

Moreover, it has secured licenses in a number of European nations, together with the Netherlands, Spain, Eire, Singapore, and Italy, as a part of its enlargement outdoors the U.S.

It has additionally launched a number of merchandise, together with creating an institutional lending service, including new belongings, and unifying its USD and USDC order books.