Crypto change Coinbase is analyzing the influence that scaling options might have on the Ethereum (ETH) blockchain.

In a analysis report, Coinbase says that layer-2 scaling options (L2s) might cannibalize Ethereum’s income.

“The way forward for L2s might very nicely be a zero-sum recreation, as whichever L2 homes nearly all of decentralized purposes might at some point energy everything of the Ethereum ecosystem. That means that L2s might finally divert income away from Ethereum itself.”

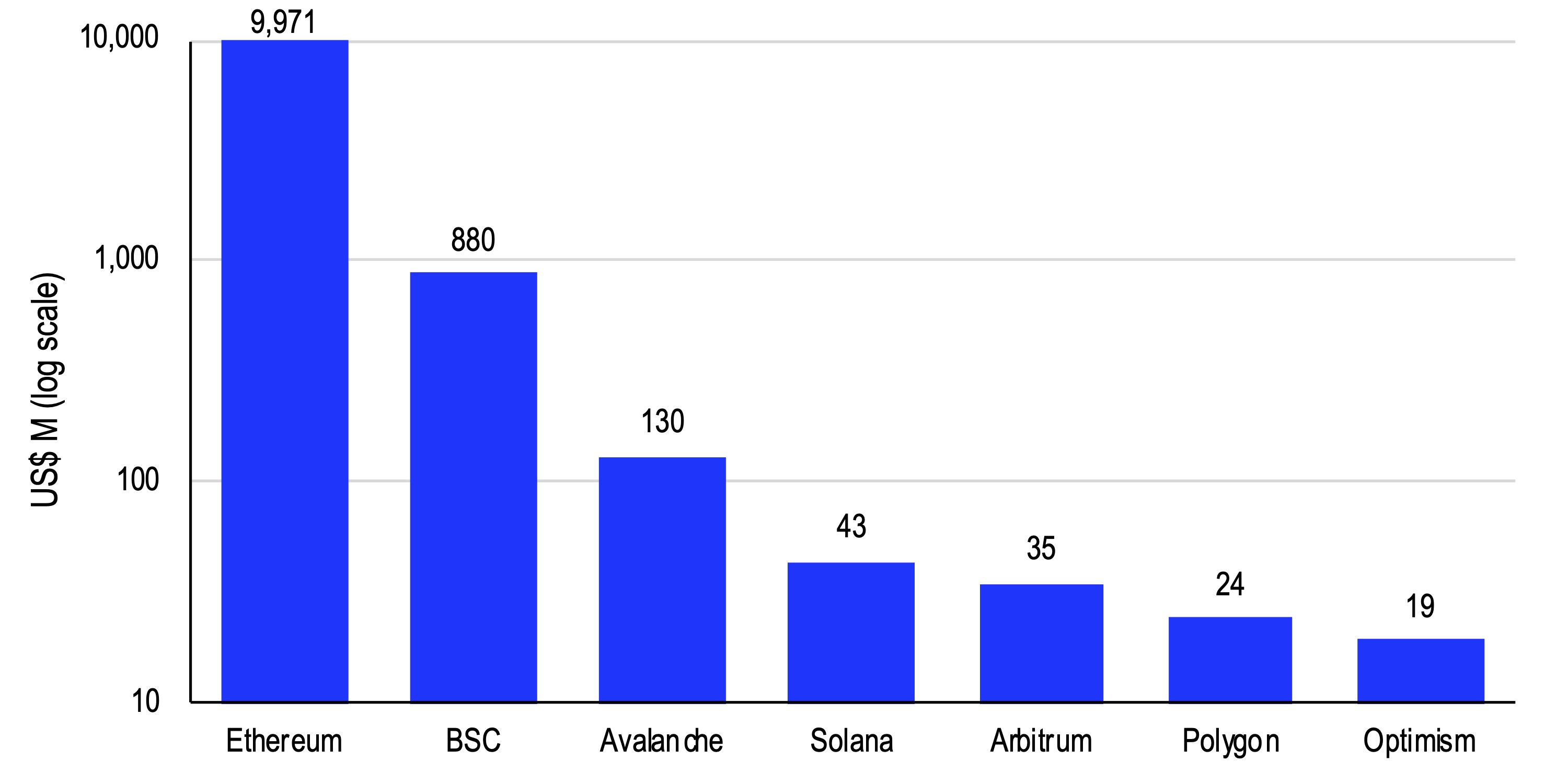

Coinbase says that over the previous 12 months, scaling options comparable to Polygon (MATIC), Optimism (OP) and Arbitrum have generated lower than one p.c of the income that Ethereum pulled in.

“During the last 12 months, Token Terminal has reported that Ethereum has earned $9.971 billion in complete income in comparison with an mixture of solely roughly $78 million on Arbitrum, Polygon and Optimism.”

The crypto change says that after Ethereum transitions to a proof-of-stake (PoS) consensus mechanism, the scaling options will probably trigger a decline within the staking yields and this might negatively influence the value of ETH.

“If extra person exercise migrates to L2s and people L2s require their very own tokens to facilitate transactions, that might probably scale back the staking yields to validators who will earn much less on these web transaction charges. If that daunts staking on the platform, that might improve the scale of the ETH liquid circulating provide, presumably hurting ETH costs.”

Coinbase, nevertheless, says that scaling options might in the long term profit Ethereum as they’ll improve community exercise.

“Additionally the influence of L2s consuming into Ethereum’s revenues might be a short-term phenomenon. Over the long term, revenues depend upon larger exercise within the general crypto ecosystem in addition to whether or not Ethereum turns into the dominant common (or basic use) blockchain.

If L2s facilitate extra transactions by making them cheaper, quicker and simpler, the preliminary income influence might be mitigated by the elevated exercise that finally takes place on the community.”

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: StableDiffusion