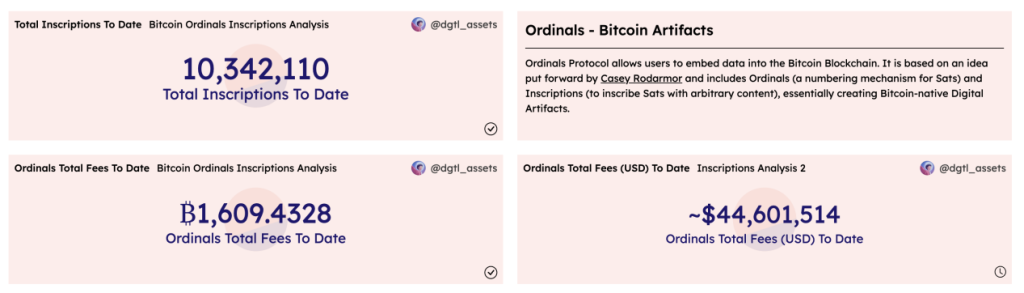

For a very long time after its start, Bitcoin progressed slowly. Nonetheless, Ordinals, a brand new growth inside the Bitcoin ecosystem, emerged in early 2023. It permits customers to inscribe distinctive, verifiable crypto belongings onto particular Satoshis within the Bitcoin community, which has sparked a small craze surrounding native Bitcoin NFTs and tokens. Moreover, Ordinals additionally helped Bitcoin enhance the influx of funds, making a vibrant ecosystem. As Ordinals entice new customers and transactions to the Bitcoin community, miners have additionally benefited from the elevated utilization. As of Could 31, over 10 million inscriptions have been created, costing over 1,600 BTC with transaction charges exceeding $40 million. Regardless of that, this growth has additionally sparked some controversy within the Bitcoin group. Critics say that it deviates from Bitcoin’s authentic objective as a peer-to-peer digital foreign money and creates litter within the treasured block house.

Basis of Ordinals

Segregated Witness (SegWit)

In August 2017, Bitcoin SegWit (Segregated Witness) was formally activated. The Bitcoin Core builders opposed instantly rising the block dimension restrict with out technical enhancements and consideration for balanced useful resource expenditure. But SegWit permits every block to accommodate extra transactions with out instantly rising the unique 1MB restrict. This improve launched the idea of witness information by shifting sure info (akin to transaction signatures) to the witness information, decreasing the block house occupied by every transaction and not directly enhancing the community’s processing capability. For nodes supporting SegWit, nevertheless, the precise information obtained is usually bigger than 1MB (block + witness information) as a result of witness information is saved individually.

Right here’s an instance of the unique script with out utilizing SegWit:

[…]

“Vin” : [

“txid”: “0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2”,

“vout”: 0,

“scriptSig”: “<Bob’s scriptSig>”,

] […]

A script utilizing SegWit:

[…]

“Vin” : [

“txid”: “0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2”,

“vout”: 0,

“scriptSig”: “”,

] […]

“witness”: “<Bob’s witness information>”

[…]

Supply

Taproot

In 2021, Taproot, essentially the most vital technical improve of the Bitcoin community after SegWit, formally went stay and launched new script options akin to Schnorr signatures and Pay-to-Taproot (P2TR) outputs. Schnorr signatures make multi-signature scripts indistinguishable from single-signature ones, offering enhanced privateness for all Taproot customers. Most significantly, Taproot removes the dimensions restrict on a transaction’s witness information, enabling storage of information as much as 4MB on BTC.

The Start of Ordinals

The activation of SegWit and Taproot laid the muse for the emergence of the Bitcoin Ordinals protocol. Proposed in January 2023, Ordinals is a protocol that assigns off-chain numbers to Satoshis, the smallest unit of Bitcoin, and steadily gained consensus out there. Leveraging the technical options of SegWit and Taproot on the Bitcoin community, the protocol permits the direct minting, switch, and destruction of NFTs on the Bitcoin blockchain.

Ordinals launched two main ideas: ordinal numbers and inscriptions.

Ordinal numbers: As Bitcoin relies on the UTXO mannequin, every transaction might be traced again to all of the associated transactions. Ordinals make use of a first-in-first-out (FIFO) algorithm to assign particular Satoshis inside every transaction’s inputs to the outputs. What this implies is that underneath the FIFO rule, every Satoshi in each transaction might be recognized with a singular ordinal quantity. It’s much like assigning a serial quantity to every banknote, which offers every Satoshi with a singular identifier, permitting us to hint its circulation and establish people who beforehand held and used the Satoshi. From a technical perspective, Ordinals offers a device (https://github.com/casey/ord) to speak with Bitcoin Core nodes and monitor the indexes of all Satoshis off-chain.

Inscriptions: Inscriptions contain storing arbitrary content material in Taproot scripts (P2TR). Since Taproot scripts have nearly no content material restrictions and witness information comes with low-cost prices, texts, photographs, audio, and movies can probably be created as digital artworks or NFTs on particular person Satoshis, so long as their dimension doesn’t exceed 4MB. The content material of inscriptions is included inside the script directions of OP_FALSE OP_IF…OP_ENDIF and isn’t executed by miners. The content material begins with the “ord” string to point that it’s an inscription, which is adopted by OP_PUSH 1 to state the following push accommodates the content material sort, after which OP_PUSH 0 to specify that the following information push contains the content material itself.

Right here’s an instance:

OP_FALSE

OP_IF

OP_PUSH “ord”

OP_PUSH 1

OP_PUSH “textual content/plain;charset=utf-8”

OP_PUSH 0

OP_PUSH “Good day, world!”

OP_ENDIF

Supply: https://docs.ordinals.com/inscriptions.html

Inscriptions are like an envelope that comes with each banknote which has a singular serial quantity, and also you get to place treasured artworks or images into this envelope. Basically, the Ordinals protocol assigns a singular identifier to every Satoshi and hyperlinks it to the metadata within the witness information, thereby creating traceable NFTs. Furthermore, because of Bitcoin’s sturdy consensus, as soon as these digital artworks or NFTs are minted, they may completely exist as an integral a part of the community.

NFTs earlier than FTs

Ordinals protocol has introduced a brand new dimension to Bitcoin, increasing its purposes past the standard cost and retailer of worth to NFTs and FTs. In contrast to what occurred within the Ethereum ecosystem, the Ordinals protocol initially sparked an NFT craze on the Bitcoin community, adopted by the increase of FTs, particularly BRC-20 tokens. Outstanding NFT initiatives like BAYC started issuing NFTs on Bitcoin via the Ordinals protocol, whereas nameless Ordinals NFT initiatives additionally gained market reputation. Bitcoin inscriptions retailer all of the content material inside Taproot scripts, whereas Ethereum NFTs typically depend on URIs (Uniform Useful resource Identifiers) to find the related metadata, which permits the community to establish media assets (e.g., photographs) linked to the precise NFTs. These assets, nevertheless, are sometimes saved on centralized servers, which signifies that they might be misplaced or tampered with. On this regard, Bitcoin inscriptions provide a extra decentralized and tamper-resistant various.

The BRC-20 commonplace, proposed by Twitter person @domodata on March 8, 2023, was launched as an FT commonplace primarily based on the Ordinals protocol. Like Ethereum’s ERC20 commonplace, the BRC-20 commonplace permits for token issuance on the Bitcoin community. BRC-20 tokens are JSON information minted on Satoshis, which outline the fundamental info such because the title, provide, and most minting amount of a token, in addition to its Deploy, Mint, and Switch specs. ORDI, for instance, is the primary and most profitable BRC-20 token, with a complete provide of 21 million and a minting cap of 1,000 per time.

Instance of Deploy

{

“p”: “brc-20”,

“op”: “deploy”,

“tick”: “ordi”,

“max”: “21000000”,

“lim”: “1000”

}

Instance of Mint

{

“p”: “brc-20”,

“op”: “mint”,

“tick”: “ordi”,

“amt”: “1000”

}

Instance of Switch

{

“p”: “brc-20”,

“op”: “switch”,

“tick”: “ordi”,

“amt”: “100”

}

Supply

In early Could, as some CEXs began to listing BRC-20 tokens, some BRC-20 tokens within the MEME class grew to become the topic of market hypothesis, pushed by the FOMO sentiment surrounding such tokens. In consequence, the Bitcoin community grew to become congested resulting from large transactions and transaction charges even surpassed block rewards, which is extraordinarily uncommon. Regardless of the immense reputation, because of the community’s listed efficiency, the person expertise was removed from satisfying, and the market hype didn’t final lengthy. At this time, the minting quantity of Ordinals has dropped to round one tenth of its peak. Though the buying and selling quantity of BRC-20 tokens has declined, the amassed transaction charges related to them nonetheless occupy a big portion of the overall Bitcoin transaction charge.

After BRC-20

Though BRC-20 went viral, it confronted some limitations, akin to restrictions on the naming size (4 characters solely), easy functionalities, and vulnerability to potential double-spending assaults. In consequence, new token protocols have emerged on the Bitcoin blockchain. These new protocols, together with ORC-20, SRC-20, BRC-21, and BRC-30, intend to offer extra complete options for the Ordinals ecosystem.

The ORC-20 protocol, designed to be backward suitable with BRC-20, goals to enhance adaptability, scalability, and safety, eradicate the opportunity of double spending, and help the cancellation of transactions.

SRC-20 tokens include specs much like these of BRC-20 however are primarily based on the BTC Stamps protocol, which differs from the Ordinals-based BRC-20. The Stamps protocol embeds base64 photographs into BTC transaction outputs to completely retailer the corresponding information on the Bitcoin blockchain. That stated, the Stamps protocol suffers from a restricted information capability of solely 8 KB.

BRC-21 goals to introduce cross-chain belongings to the Bitcoin community. For example, it is going to allow the minting of BRC-20 variations of belongings from different networks (e.g., ETH and DAI) on Bitcoin. BRC-21’s deployment on the community is much like that of BRC-20, but it surely provides two new fields: one for the supply chain, and the opposite for the supply chain token contract.

BRC-30 is a staking mechanism for BTC and BRC-20 tokens. It expands on the performance of BRC-20 tokens and introduces an outline of the staking protocol. With BRC-30, customers can collateralize their BRC-20 tokens and BTC and obtain corresponding BRC-30 tokens as rewards, offering them with extra funding alternatives.

Trade Tendencies

The appearance of Ordinals has made Bitcoin’s Satoshis extra distinctive and scarcer, attracting extra funds from the market. A sequence of purposes and token protocols primarily based on Ordinals have emerged, making the Bitcoin ecosystem much more vibrant. As we all know, Bitcoin will expertise one other halving in 2024, which is able to, as soon as once more, minimize the block rewards by half. The emergence of Ordinals opens up potentialities for adjustments within the mining charge mannequin following Bitcoin’s future halvings.

About CoinEx

Established in 2017, CoinEx is a world cryptocurrency trade dedicated to creating buying and selling simpler. The platform offers a spread of providers, together with spot and margin buying and selling, futures, swaps, automated market maker (AMM), and monetary administration providers for over 5 million customers throughout 200+ international locations and areas. Based with the preliminary intention of making an equal and respectful cryptocurrency surroundings, CoinEx is devoted to dismantling conventional finance boundaries by providing easy-to-use services to make crypto buying and selling accessible for everybody.