CoinEx Analysis has launched its complete report on the cryptocurrency marketplace for August, highlighting vital volatility, restoration, and key developments all through the month. This report is important because it presents insights into the evolving dynamics of the crypto area, serving to buyers and stakeholders navigate the complexities of a market in flux.

Financial institution of Japan Price Hike

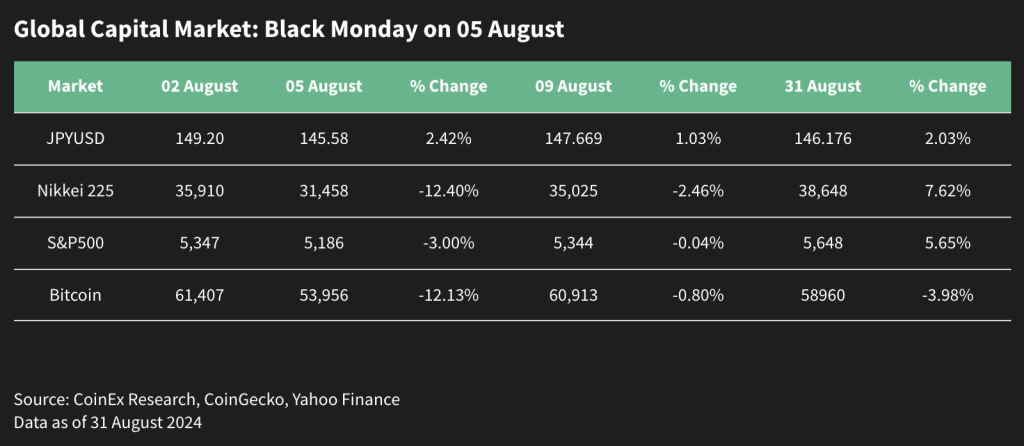

The choice by the Financial institution of Japan to extend rates of interest led to vital market turmoil, triggering a worldwide sell-off in the course of the week of 04 August. Whereas the U.S. fairness markets swiftly rebounded from their losses, the crypto market did not mirror this restoration. Bitcoin initially confirmed a gradual restoration, reaching its August opening ranges, however subsequently tumbled additional, closing the month close to the $58,000 mark. Bitcoin balances on exchanges dropped to a 2024 low of two.39 million BTC, indicating a rising tendency amongst buyers to carry Bitcoin relatively than liquidate positions.

Market Situation

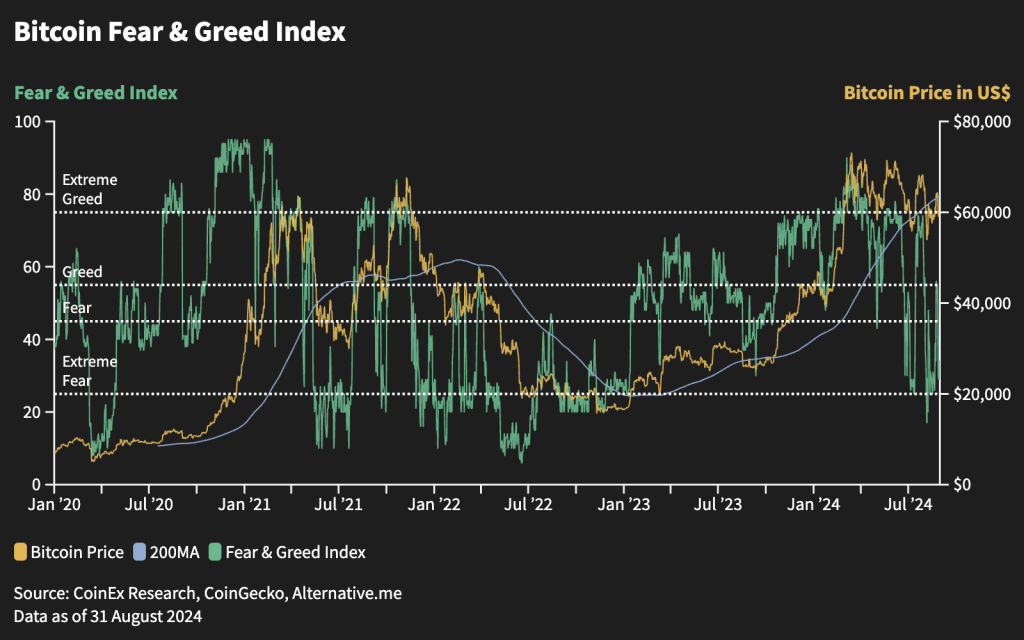

The market is in limbo, missing clear path, with the Worry & Greed Index slipping into “Excessive Worry” territory. The speed minimize by the Federal Reserve in September is broadly seen as market consensus and seems to be largely priced in. This might current a shopping for alternative for long-term buyers prepared to climate the volatility.

Bitcoin Staking

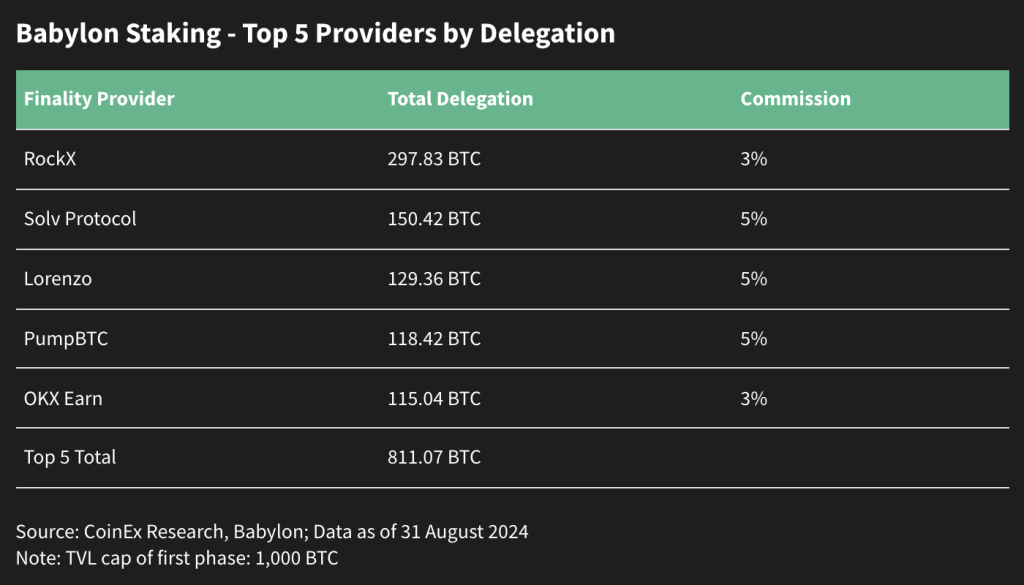

On August 22, Babylon’s launch of Bitcoin staking was met with enthusiasm, rapidly reaching full subscription of 1,000 BTC, which was absolutely subscribed inside simply three hours by roughly 12,700 customers. This initiative briefly spiked Bitcoin fuel charges, to as excessive as 800 sat/vB, reflecting robust demand for staking alternatives.

Ethereum’s Struggles

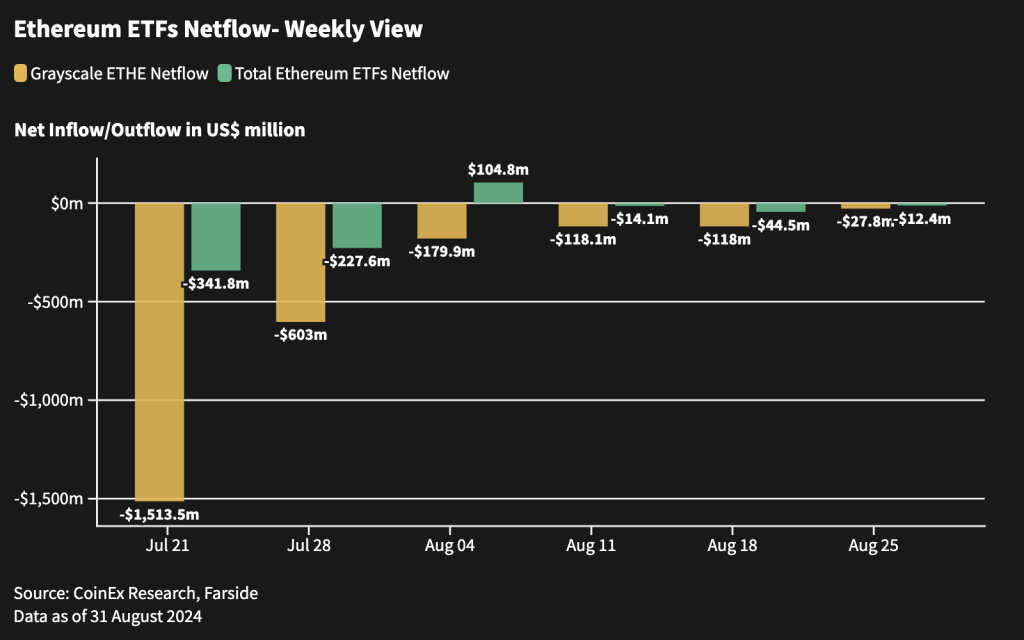

Ethereum ETFs noticed a constructive web stream in August, recording a web influx of $6.2 million, in comparison with a major web outflow of $541.8 million in July. Regardless of a small web influx into Ethereum ETFs, the worth of Ethereum continues to face downward strain. That is occurring at the same time as Grayscale’s ETHE outflows have slowed, indicating ongoing challenges for Ethereum in sustaining value stability. However Ethereum’s core worth propositions, significantly within the DeFi sector, stay sturdy and sustainable.

Sui’s Rise

Sui is gaining traction as a powerful performer, significantly within the GameFi sector. Backed by Grayscale’s launch of recent belief merchandise and robust endorsements from key opinion leaders (KOLs) and buyers. Its distinctive worth proposition units it aside, even because it attracts comparisons to Solana, highlighting the aggressive nature of blockchain platforms.

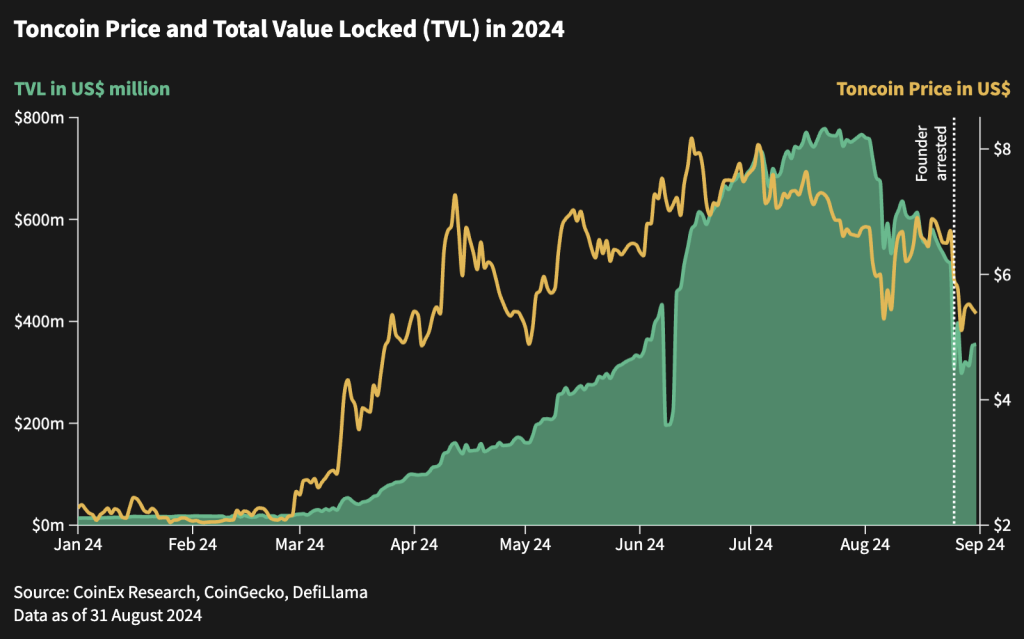

Ton Ecosystem

The arrest of Telegram founder Pavel Durov resulted in a decline in Toncoin’s value and whole worth locked (TVL), leading to a 20% drop in Toncoin’s value and a 30% decline in Complete Worth Locked (TVL). Nonetheless, the neighborhood has rallied, adopting the “Resistance Canine” meme coin avatar as an emblem of assist and resilience.

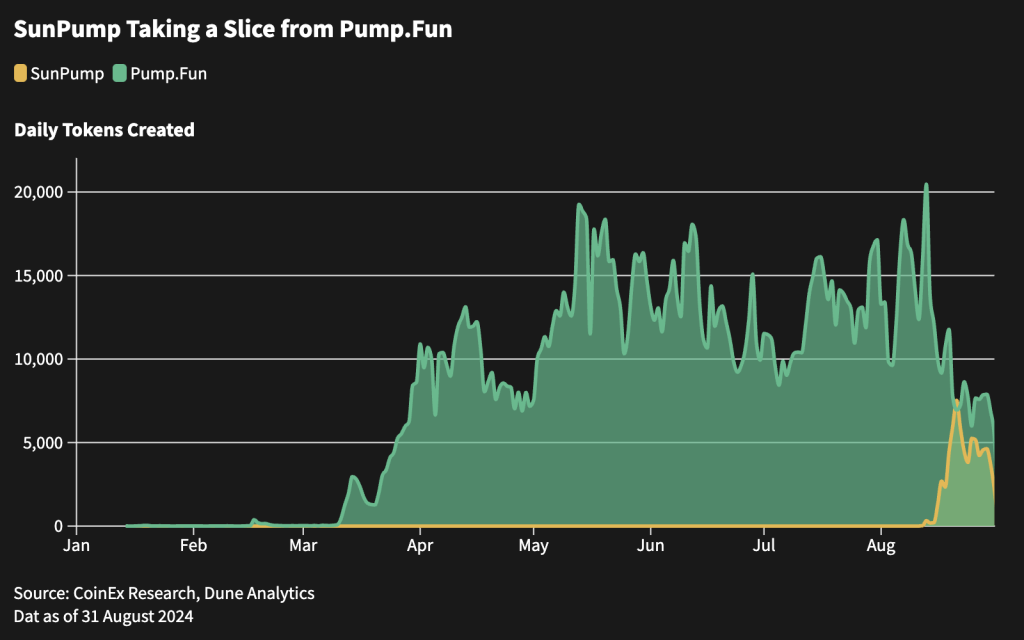

SunPump on Tron

SunPump is rising as a preferred selection amongst meme coin merchants on the Tron platform, has facilitated the creation of over 63,000 meme tokens and generated over 25 million TRX in income, difficult the dominance of Pump.Enjoyable and showcasing the dynamic nature of meme coin markets.

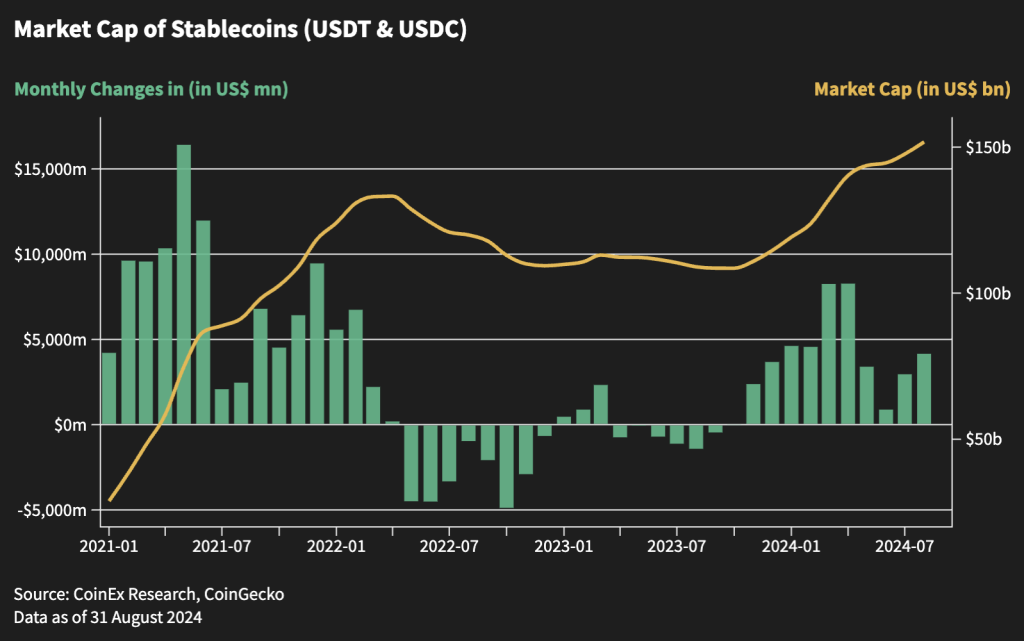

Stablecoins Issuance

In August, an extra $4 billion in USDT and USDC was issued, bringing ranges again to these seen in November of final 12 months. Presently, the market is in a interval of stagnation attributable to a scarcity of liquidity and market narratives. The robust influx of stablecoins means that the market has not entered an absolute bear market part akin to early 2022 when stablecoins began flowing out.

Conclusion

The CoinEx Analysis report paints an image of a cryptocurrency market at a crossroads, influenced by macroeconomic elements and inner dynamics. The findings recommend that whereas the market faces challenges, there are additionally alternatives for progress and innovation. Because the business awaits new catalysts, the main target will possible stay on regulatory developments and macroeconomic shifts. Trying forward, the potential for rate of interest cuts and different financial occasions may present the required impetus for a market rally. As stakeholders digest these insights, the emphasis might be on strategic positioning and readiness to capitalize on rising developments and alternatives.

About CoinEx

Established in 2017, CoinEx is a worldwide cryptocurrency trade dedicated to creating crypto buying and selling simpler. The platform offers a variety of companies, together with spot and futures buying and selling, margin buying and selling, swaps, automated market makers (AMM), and monetary administration companies for over 10 million customers throughout 200+ international locations and areas. Since its institution, CoinEx has steadfastly adhered to a “user-first” service precept. With the honest intention of nurturing an equitable, respectful, and safe crypto buying and selling atmosphere, CoinEx allows people with various ranges of expertise to effortlessly entry the world of cryptocurrency by providing easy-to-use merchandise.

CoinEx Analysis stays dedicated to offering in-depth analyses and insights into the evolving cryptocurrency market, serving to buyers navigate by way of the complexities and alternatives that lie forward.

To study extra about CoinEx, go to: Web site | Twitter | Telegram | LinkedIn | Fb | Instagram | YouTube