Ethereum, the world’s second-largest cryptocurrency, is poised for a meteoric rise, in accordance with a brand new evaluation by VanEck, a number one asset administration agency. The report predicts that Ethereum may attain a valuation of $2.2 trillion by 2030, translating to a worth of round $22,000 per coin. This formidable prediction hinges on Ethereum’s dominance within the sensible contracts enviornment and its potential to generate a staggering $66 billion in free money circulation by the tip of the last decade.

Associated Studying

Conventional Finance Embraces Ethereum With ETF Approval

A key driver behind VanEck’s bullish outlook is the current approval of spot Ether ETFs on US inventory exchanges. These ETFs enable conventional monetary establishments and buyers to realize publicity to Ethereum with out the complexities of immediately holding the cryptocurrency.

This elevated accessibility has broadened Ethereum’s enchantment, attracting monetary advisors, institutional buyers, and even Huge Tech corporations. The inflow of those new gamers has bolstered Ethereum’s legitimacy and instilled confidence in its long-term potential.

A Community Powerhouse With Room For Progress

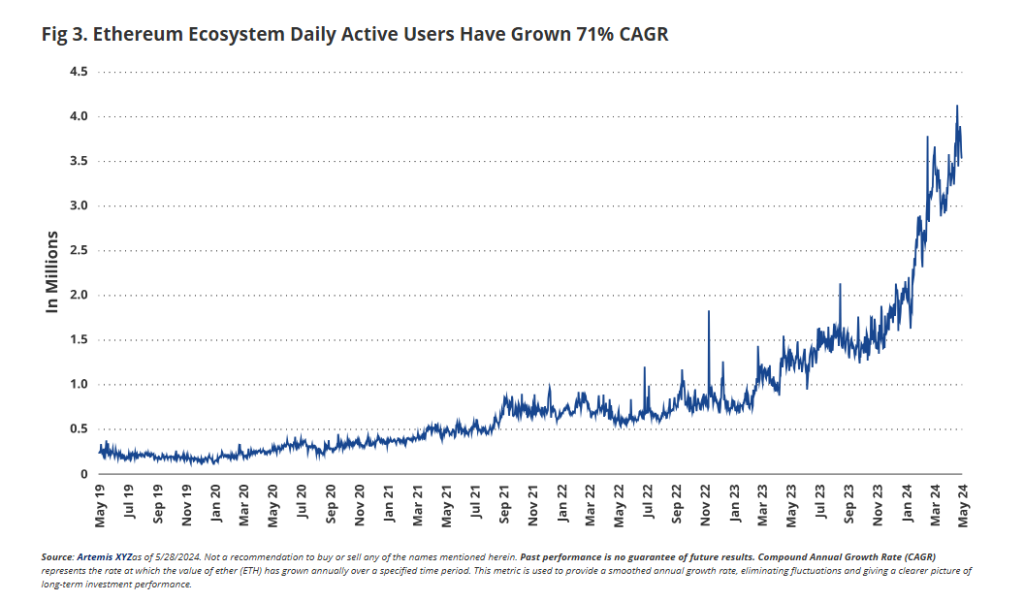

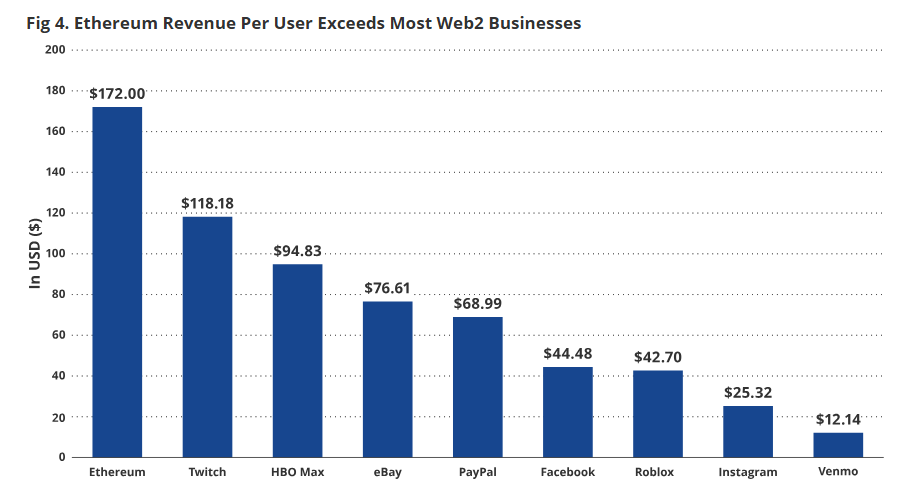

The Ethereum community boasts a sturdy consumer base, processing round $4 trillion price of transactions and facilitating $5.5 trillion in stablecoin transfers over the previous yr. This spectacular exercise highlights Ethereum’s place as a significant cog within the decentralized finance (DeFi) machine.

VanEck’s evaluation components in Ethereum’s ongoing evolution, together with the rising adoption of purposes constructed on its platform, the rising shortage of ETH tokens as a consequence of burning mechanisms, and its potential to seize a bigger share of the burgeoning blockchain market. The report estimates the entire addressable market (TAM) for blockchain purposes to be a staggering $15 trillion, indicating huge room for Ethereum’s development.

Will Ethereum Turn into The Silicon Valley Of Blockchain?

VanEck’s evaluation paints an image of Ethereum as a possible “Silicon Valley of Blockchain,” a platform that fosters innovation and disrupts conventional industries. The power to construct and deploy sensible contracts on Ethereum empowers builders to create new purposes and monetary devices that would revolutionize sectors like provide chain administration, identification verification, and even voting techniques. As Ethereum’s ecosystem thrives, the worth proposition of holding ETH tokens strengthens, probably fueling the expected worth surge.

Associated Studying

Ether Worth Prediction

In the meantime, in accordance with the newest forecast, Ether is anticipated to rise by 2.13%, reaching $3,861 by July 6, 2024. This projection is supported by a set of technical indicators that at the moment sign a bullish sentiment. The general market sentiment for Ethereum is optimistic, with a Concern & Greed Index studying of 78, indicating “Excessive Greed.” This index measures market feelings and sentiment from varied sources, and a excessive degree like this usually alerts that buyers have gotten overly assured, which might typically precede a market correction.

When it comes to current efficiency, Ethereum has skilled 17 inexperienced days out of the final 30, translating to a 57% fee of optimistic every day efficiency. This means a usually upward pattern with constant features. Nonetheless, over the previous 30 days, Ethereum has proven an 11.30% volatility fee. This degree of volatility is comparatively excessive, implying that whereas the worth is anticipated to rise, it may expertise vital fluctuations.

Featured picture from InvestorsObserver, chart from TradingView