The crypto market has not but been capable of finding the appropriate footing primarily based on tightened macroeconomic components and Russia’s invasion of Ukraine.

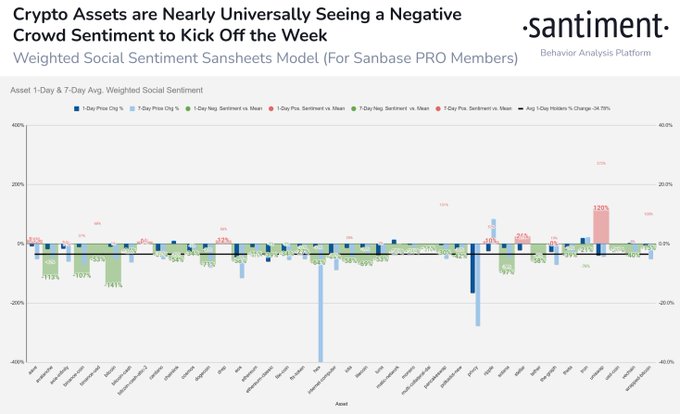

Because of this, crowd sentiment towards cryptocurrencies has turned unfavourable. Market perception supplier Santiment explained:

“With Bitcoin, Ethereum, and most altcoins ticking down barely Monday, the gang’s bearish outlook continues to be evident. Inexperienced bars point out extra FUD than standard towards an asset, and pink bars point out extra FOMO.”

Supply: Santiment

Based mostly on Santiment’s knowledge, concern, uncertainty & doubt (FUD) proceed to rock the crypto market, prompting a bearish outlook. Bitcoin (BTC) and Ethereum had been down by 1.89% and a pair of.95% to hit $19,067 and $1,278, respectively, throughout intraday buying and selling, based on CoinMarketCap.

This development is being witnessed forward of the discharge of the U.S. inflation knowledge scheduled for October 13.

Riyad Carey, a analysis analyst at Kaiko, identified:

“There appears to be some jitters and derisking throughout all markets as we method Thursday’s CPI launch.”

Carey added:

“Bitcoin is transferring intently with equities and I’d anticipate that to proceed as there haven’t been many crypto-specific catalysts in latest weeks. I additionally anticipate vital volatility on Thursday, with a transfer up or down relying on the inflation determine.”

The Bureau of Labor Statistics is about to unveil the patron worth index (CPI) for September, with some economists anticipating a 0.3% month-to-month improve and the annual achieve to leap to eight.1%.

The federal reserve (Fed) has been on a curler coaster experience of accelerating rates of interest to tame runaway inflation, however this has been detrimental to the crypto market.

This development has prompted concern from numerous gamers. As an illustration, James Butterfill, the top of analysis at CoinShares, acknowledged:

“We imagine there’s a constructing narrative that central banks are starting to make coverage errors. A number of of our purchasers have made the purpose that they don’t wish to purchase Bitcoin proper now, however as quickly because the Fed pivots, they are going to add to positions.”

The UNCTAD lately identified that the Fed ought to ease rate of interest hikes as a result of this might set off a worldwide recession, Blockchain.Information reported.

Picture supply: Shutterstock