In accordance with CryptoSlate information, the whole crypto market cap fell under $1 trillion, marking a three-week low. Equally, market chief Bitcoin misplaced $22,000 as bears took management.

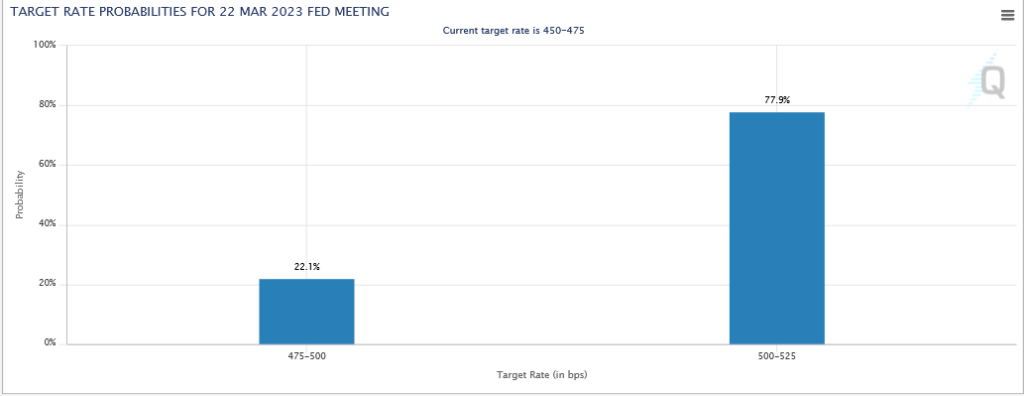

Latest days have seen the build-up of notable headwinds, together with Silvergate going into voluntary liquidation and mounting hypothesis that the Fed will train a 50 foundation level hike after the upcoming FOMC assembly scheduled for March 22.

The crypto market has misplaced its 2023 momentum

The overall market cap sunk to $994.6 billion on the time of press – a stage not seen since Feb. 13 because the Paxos/Binance USD state of affairs blew up, triggering market panic.

New York regulators ordered Paxos to stop issuance of BUSD over allegations the stablecoin shouldn’t be 1:1 backed with USD.

A bullish begin to 2023 noticed the whole market cap rise from $795.2 billion to peak at $1.134 trillion on Feb. 21. The trough-to-peak transfer represented a 42% improve in valuation.

Nonetheless, because the fallout from the spate of crypto bankruptcies catches up, not forgetting persevering with macro uncertainty, crypto consumers have moved to exit their positions.

The Relative Energy Index (RSI,) a measure of market momentum, reveals a present studying of 38, having peaked as excessive as 85 on Jan. 15.

The earlier studying of 38 was on Dec. 31, which means the crypto market has misplaced all of 2023’s market momentum.

Headwinds

On March 8, Silvergate introduced it supposed to wind down all operations and go into voluntary liquidation. Solvency rumors circulated after the crypto financial institution stated it will miss its March 16 10-Okay submitting deadline.

In response, a number of crypto platforms distanced themselves from the beleaguered financial institution. Most lately, KuCoin CEO Johnny Lyu sought to reassure customers that his trade “has no enterprise relationship” with Silvergate and that “all customers’ funds are secure with us.”

Lyu signed off, saying he hoped this was the final piece of “unhappy information” this cycle.

Talking earlier than the Senate banking Committee on Tuesday, Fed Chair Jerome Powell stated the central financial institution is ready to speed up fee hikes if want be.

“If the totality of the information have been to point that quicker tightening is warranted, we’d be ready to extend the tempo of fee hikes.”

Powell’s renewed hawkishness had goal fee chances flip to 78% in favor of a 50 foundation level hike following March 22’s FOMC assembly, placing extra strain on risk-on markets.