In a lately printed video titled “Finest Altcoins To Purchase Now,” crypto influencer Lark Davis shared his newest insights on promising altcoins together with his 546,000 YouTube subscribers. Recognized for his candid and simple method, Davis emphasised the speculative nature of his suggestions and the inherent dangers of crypto investments.

Davis started by acknowledging Bitcoin’s position because the premier digital retailer of worth, noting that whereas it stays probably the most safe asset within the crypto house, it’s unlikely to ship the excessive returns that some altcoins can supply. “In the event you’re after life-changing beneficial properties, then it’s important to threat life and limb within the altcoin jungle,” Davis remarked, underscoring the potential of altcoins to yield substantial returns, albeit with vital dangers. He identified that Bitcoin, whereas being a strong alternative for wealth preservation, most likely gained’t ship 100x and even 10x returns within the close to future.

The approval of spot Ethereum ETFs is a major improvement that Davis believes will carry consideration to different altcoin initiatives, setting the stage for a broader “altcoin season.” He acknowledged that whereas memecoins typically achieve probably the most consideration throughout these occasions, different initiatives with actual utility deserve nearer scrutiny. Davis expressed his intent to focus on cash with precise use circumstances, as these have higher probabilities of surviving market cycles and doubtlessly attaining long-term success.

Finest Altcoins To Purchase Now

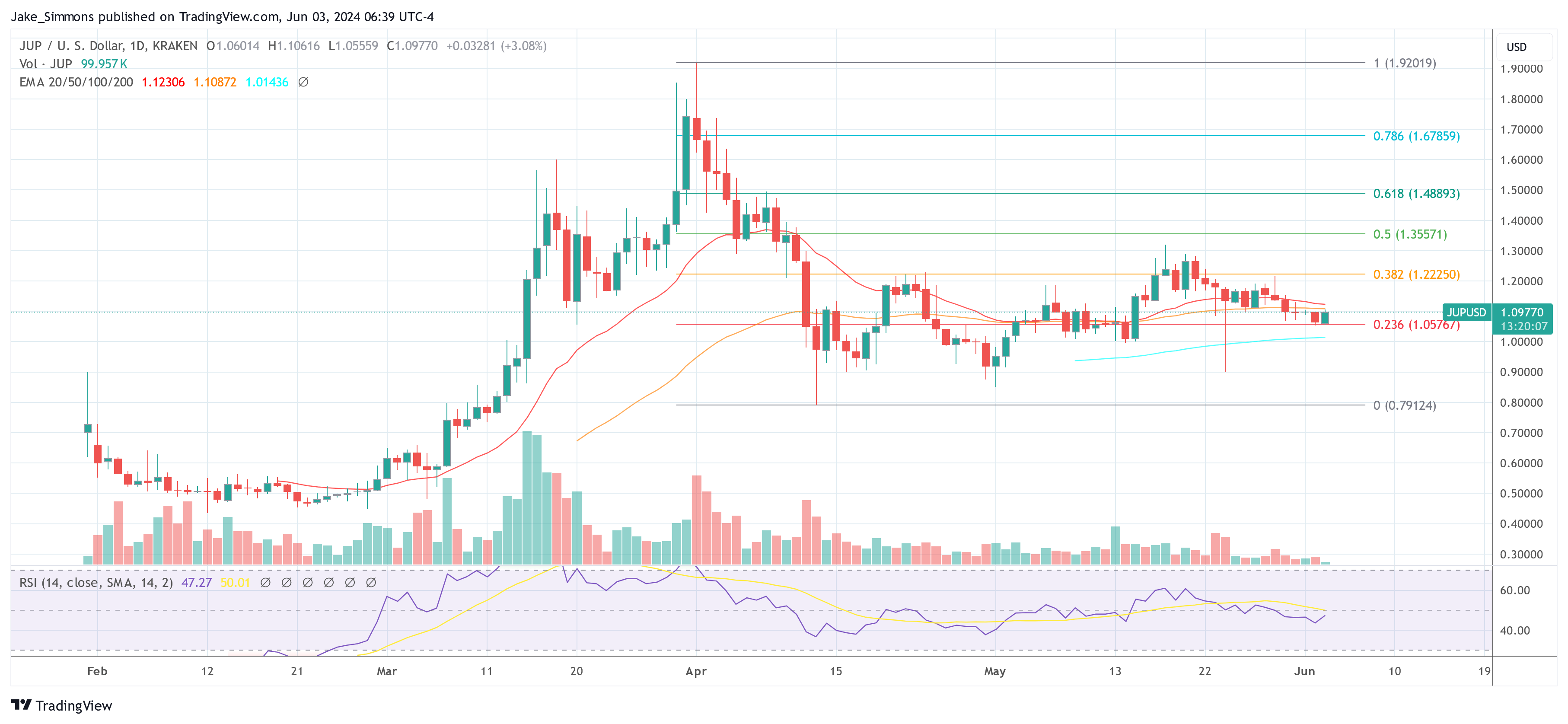

The primary altcoin Davis highlighted is Jupiter (JUP), a decentralized change (DEX) aggregator constructed on the Solana blockchain. Jupiter stands out because of its capacity to persistently supply the most effective token costs by aggregating information from a number of exchanges. Davis emphasised the significance of Jupiter’s user-friendly interface, which simplifies the onboarding course of for brand new customers getting into the DeFi house. This ease of use, mixed with Solana’s current recognition pushed by memecoins, positions Jupiter as a key gateway for merchants trying to capitalize on rising traits.

Davis detailed Jupiter’s vital buying and selling volumes, noting that it often surpasses Uniswap. In March and April, Jupiter achieved $47 billion and $35 billion in buying and selling quantity, respectively. He highlighted Jupiter’s perpetual change function, which provides as much as 100x leverage, as a major attraction for merchants in search of substantial beneficial properties. Furthermore, Jupiter’s staking rewards mannequin incentivizes participation in venture governance, offering stakeholders with extra advantages comparable to incentivized tokens, launchpad charges, and airdrops. Davis talked about Jupiter’s plans to increase into the foreign exchange and inventory markets, which may additional improve its utility and market place.

Associated Studying

Subsequent on Davis’s checklist is Aerodrome (AERO), a DEX working on Coinbase’s Base ecosystem. Davis underscored the strategic benefit of getting Coinbase, with its in depth person base of over 120 million, backing the Base ecosystem. This assist, mixed with the upcoming introduction of good wallets to simplify person onboarding, provides Aerodrome a major edge. Though there isn’t any native token for the Base ecosystem but, Davis believes Aerodrome’s token may function a viable different, benefiting from its position as a significant DeFi platform throughout the ecosystem.

Davis identified Aerodrome’s spectacular whole worth locked (TVL) of round $700 million and a market cap of roughly $500 million. He advised that as extra Coinbase customers interact with the Base ecosystem, the Aero token may see substantial appreciation. Davis revealed that he has elevated his holdings in Aerodrome, assured that the platform’s development potential aligns together with his funding technique.

Davis additionally mentioned SubSquid (SQD), describing it because the “Google of blockchains.” SubSquid is a complete blockchain indexing resolution designed to facilitate fast and cost-effective entry to on-chain information. Davis defined that SubSquid acts like a decentralized submitting cupboard, organizing information from a number of blockchains to allow builders to construct decentralized functions (dApps) with out the burden of sluggish queries. Supporting over 100 networks and utilized by greater than 5,000 dApps, SubSquid provides a strong infrastructure for blockchain improvement.

With a complete token provide of 1.34 billion and a market cap of round $21 million, SubSquid presents a compelling funding alternative, based on Davis. He in contrast SubSquid’s market place to that of The Graph (GRT), which boasts a market cap of $3 billion, suggesting that SubSquid has vital room for development. Davis talked about his participation in SubSquid’s personal sale and his present holding technique, anticipating the venture’s improvement and market efficiency.

Associated Studying

The Oasis Community (ROSE), a layer-1 blockchain targeted on privateness and scalability, was one other suggestion. Davis highlighted its distinctive two-layer structure, which separates consensus and good contract execution to reinforce privateness and scalability. This construction makes Oasis appropriate for functions in finance, synthetic intelligence (AI), and the metaverse. Davis emphasised the significance of privateness in blockchain functions, particularly for attracting institutional customers. He likened Oasis’s method to Polkadot’s unbiased parachains and Avalanche’s subnet infrastructure.

Davis identified Oasis’s strong ecosystem fund, supported by distinguished buyers comparable to Binance Labs, Pantera Capital, and Bounce Capital. The community’s ongoing rebrand goals to emphasise its give attention to decentralized AI, aligning with present market narratives. Collaborations with initiatives just like the Ocean Protocol and the involvement of notable figures in AI additional bolster Oasis’s credibility and potential. The native token, ROSE, has a market cap of round $600 million and a most provide of 10 billion cash. Davis disclosed that he acquired a major quantity of ROSE throughout the bear market and continues to watch the venture’s progress.

Lastly, Davis mentioned Fantom (FTM), a layer-1 blockchain designed to problem Ethereum’s dominance. He highlighted the upcoming Sonic improve, which is able to rework Fantom into a brand new blockchain, changing the unique. This rebrand, accompanied by technical enhancements, may drive vital curiosity and funding in Fantom. Davis praised Sonic’s spectacular transaction velocity of two,000 transactions per second and sub-second finality, noting that these options place Fantom as a robust contender within the blockchain house.

Davis revealed that he secured a considerable place in Fantom by means of an OTC deal and later doubled his holdings by buying extra on Binance. He emphasised the potential of the Sonic improve to draw consideration and funding, pushed by the involvement of well-liked developer Andre Cronje. With on-chain statistics enhancing and renewed curiosity within the Fantom ecosystem, Davis stays optimistic about its prospects.

In closing, Davis reminded viewers of the speculative nature of crypto investments and the significance of conducting thorough analysis. “Simply because I like these cash doesn’t imply they’re assured to succeed,” he cautioned. Davis’s insights replicate the dynamic and high-risk surroundings of the cryptocurrency market, the place knowledgeable decision-making is essential.

At press time, JUP traded at $1.0977.

Featured picture created with DALL·E, chart from TradingView.com