The publish Crypto Liquidations Hit $495 Million Amid Iran’s Assault on Israel appeared first on Coinpedia Fintech Information

Following Iran’s strike on Israel, the crypto market witnessed almost half a billion in liquidations and turned the general market sentiment bearish. On October 1, 2024, in response to native information media, Iran fires tons of of ballistic missiles over Israeli cities, leading to a massacre within the crypto market.

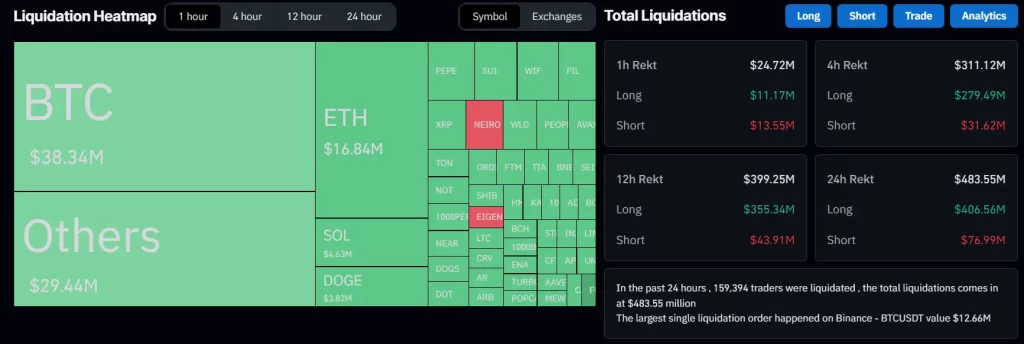

Crypto Market Bleed $495 Million

Amid the strike, over 160K crypto merchants liquidated a major $495 million in each lengthy and quick positions. Nevertheless, the one largest liquidation, amounting to $12.66 million, occurred on Binance within the BTCUSDT pair.

Out of the $495 million in liquidations, bulls liquidated almost $416 million in lengthy positions, whereas quick sellers confronted $78 million briefly place liquidations. This huge liquidation hints at concern and an additional worth decline as bears start to dominate the market.

Main Cryptocurrencies Hit

Based on CoinMarketCap knowledge, main cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Binance Coin (BNB) have skilled a worth decline of over 1.85%, 3.2%, 4.5%, and three.4%, respectively, during the last 24 hours. Nevertheless, main worth declines appeared following the Iran strike.

Ethereum Whale Income Amid Decline

Amid the bearish market sentiment, the on-chain analytics agency Lookonchain just lately made a publish on X (beforehand Twitter) that an Ethereum whale bought 29,480 ETH price $76.8 million at a mean worth of $2,605, making a revenue of $2.34 million. This means that the whale could have been conscious of the approaching worth decline earlier than the market really dipped.

Present Value Momentum

At press time, ETH is buying and selling close to the $2,480 degree and has skilled a worth decline of over 3.5% prior to now 24 hours. Throughout the identical interval, its buying and selling quantity jumped by 45%, indicating greater participation from merchants and buyers.

Moreover, ETH’s future open curiosity has declined by 4.5% prior to now 24 hours, indicating the liquidation of merchants’ positions, and there was hesitation to construct new ones because of concern out there.