Este artículo también está disponible en español.

Knowledge exhibits the cryptocurrency market has witnessed huge liquidations in the course of the previous day following the restoration Bitcoin and the altcoins have made.

Bitcoin & Altcoins Have Jumped Again Following Trump’s Announcement

Bitcoin and the remainder of the cryptocurrency sector ended February on a really bearish word, because the market went by means of a deep drawdown that took BTC to as little as $78,000. In a flash, nonetheless, the digital property have seen their fates flip in the course of the previous day.

Associated Studying

The impetus behind the restoration transfer has been Donald Trump’s announcement of a Crypto Strategic Reserve that features Bitcoin, Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA).

The announcement got here by means of the president’s official Reality Social deal with. Within the preliminary submit, Trump solely talked about the altcoins XRP, SOL, and ADA, however in a follow-up submit, he additionally confirmed BTC and ETH, saying they are going to be “the center of the Reserve.”

For the reason that US elections, the Crypto Reserve has been one thing much-anticipated in cryptocurrency circles, so it’s not stunning that the information has been in a position to have a drastic impact on dealer temper.

From the graph, it’s seen that Bitcoin approached the $95,000 stage in the course of the surge, however its value has since witnessed a small pullback to $92,800. Ethereum has displayed an analogous sample, though its retrace from $2,550 to $2,360 has been notably bigger than BTC’s.

Total, the highest two cryptocurrencies are up 8% and 6% over the last 24 hours, respectively. Apparently, XRP, SOL, and ADA, the three cash initially introduced, have proven a lot stronger rallies of 17%, 13%, and 48%, respectively.

The bullish momentum hasn’t been restricted to only these 5 included within the Reserve, as cash throughout the house have noticed a point of rise. A consequence of all this volatility has been that liquidations have piled up on derivatives platforms.

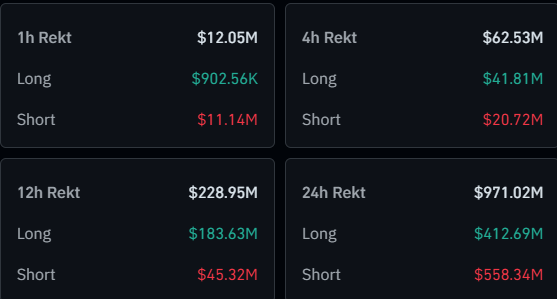

Crypto Derivatives Market Has Simply Seen $971 Million In Liquidations

In keeping with knowledge from CoinGlass, a complete of $971 million in cryptocurrency derivatives contracts have discovered liquidation prior to now day. “Liquidation” right here refers back to the forceful closure any open contract undergoes after it has amassed losses of a sure diploma.

Beneath is a desk that breaks down the related numbers associated to the newest mass liquidation occasion.

As is seen above, round $558 million of those liquidations concerned the brief buyers, representing over 57% of the whole. These merchants making up for almost all of the occasion is of course anticipated, because the market has gone up inside this window. Although, regardless of the bullish motion, round $412 million in lengthy holders nonetheless bought liquidated because of the pullback.

Associated Studying

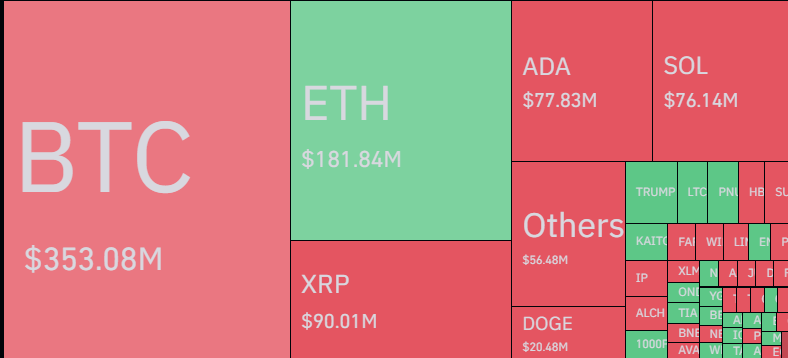

When it comes to the person symbols, Bitcoin and Ethereum have predictably come out on high with $353 million and $182 million in liquidations, respectively.

Featured picture from Dall-E, CoinGlass.com, chart from TradingView.com