On the week of June 13, the crypto market took a serious hit after Bitcoin’s worth fell. The market cap began the week at $867 billion and ended at $955 billion. This occurred at a time when buyers began pulling their Bitcoins from exchanges, and analysts argue that Bitcoin will proceed its fall.

Bitcoin

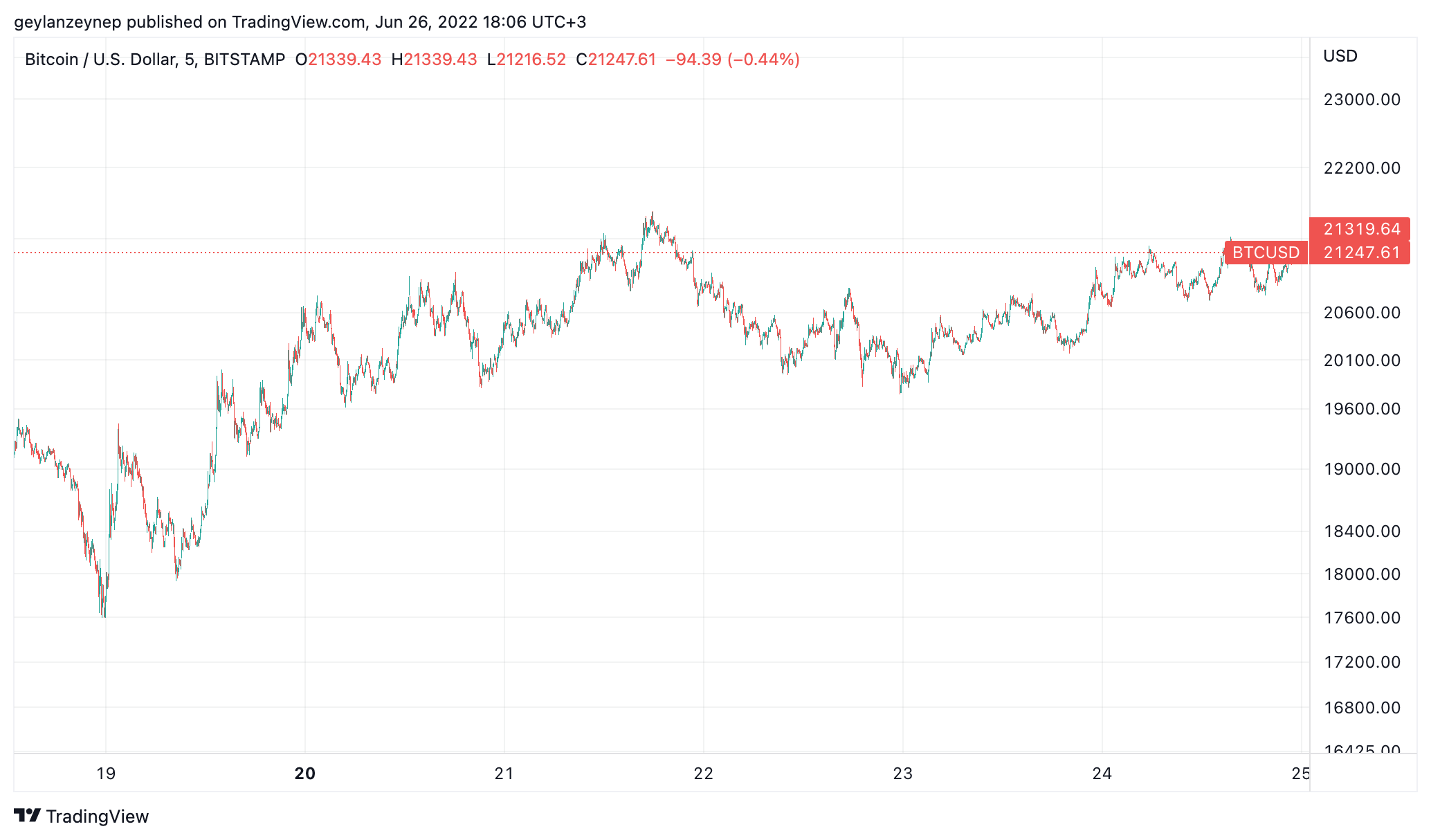

Bitcoin additionally ended the week in inexperienced by displaying parallelism to the general market cap. The value was lingering round $17,616 initially of the week and elevated to $21,247 on the time of writing, recording a %20 % improve.

Sentiments on the bear market

Despite the fact that buyers pull their Bitcoins out of exchanges and miners select to promote, crypto hedge funds are nonetheless bullish on Bitcoin.

Regardless of the market crash, distinguished analysts and executives by no means doubted Bitcoin. Whereas agreeing that the bear market will perish hundreds of cash and blockchains, main crypto executives say that those that supply actual worth will survive and improve greater than their earlier ranges.

Web3 Basis CEO, Bertrand Perez, stated:

“We’re in a bear market. And I feel that’s good. It’s good, as a result of it’s going to clear the individuals who have been there for the unhealthy causes,”

Alternatively, Bloomberg’s Senior Commodity Strategist Mike McGlone thinks Bitcoin will see $100K by 2025. Commenting on the adoption and halving charges of Bitcoin, McGlone says:

“For now, I count on Bitcoin to commerce decrease -I don’t know by how a lot.[…] it may get down to twenty,000, I doubt it does. However no matter occurs, I totally count on it to get to 100,000 {dollars} in two years.”

Distinguished information supply Forbes additionally takes Bitcoin as a long-term actuality and argues that it could actually clear up the growing earnings inequality by offering possession and correct pricing.