In response to a latest report printed by crypto analytics agency Chainalysis, cash laundering involving crypto belongings has skilled a notable decline in comparison with the earlier 12 months. Nonetheless, the report highlights that illicit actors have began adapting their techniques to evade detection and additional obscure the motion of illicit funds.

Evolving Techniques In Crypto Cash Laundering

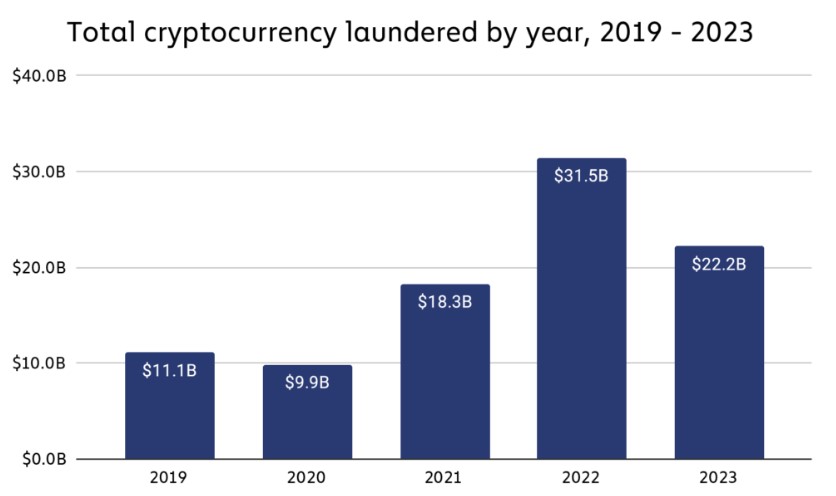

In response to the report, illicit addresses despatched roughly $22.2 billion price of cryptocurrency to varied providers in 2023, a big lower from the $31.5 billion despatched in 2022.

Whereas a part of this decline may be attributed to an general lower in authentic and illicit crypto transaction quantity, the report reveals that cash laundering exercise witnessed a steeper drop of 29.5%, in comparison with the 14.9% lower in whole transaction quantity.

Centralized exchanges stay the first vacation spot for funds originating from illicit addresses, with this pattern remaining comparatively secure over the previous 5 years. Nonetheless, the report signifies a shift within the distribution of illicit funds, with a rising share being directed in direction of decentralized finance (DeFi) protocols.

Chainalysis means that this may be attributed to DeFi’s general enlargement throughout the identical interval, though the clear nature of DeFi platforms makes them much less favorable for obfuscating fund actions.

Whereas the breakdown of service varieties used for cash laundering in 2023 resembled that of the earlier 12 months, there have been noticeable adjustments in particular sorts of crypto criminals’ cash laundering practices.

The report highlights a big enhance within the quantity of funds despatched to cross-chain bridges from addresses related to stolen funds, indicating a shift in direction of using bridge protocols for cash laundering functions. Moreover, there was a considerable rise in funds despatched from ransomware assaults to playing platforms and bridges, showcasing the “adaptability and resourcefulness” of cybercriminals.

North Korean Hackers And Cross-Chain Bridges

The focus of cash laundering at fiat off-ramps, the place criminals convert their crypto into money, stays a big concern. Whereas 1000’s of off-ramping providers function, most cash laundering exercise is concentrated in a number of providers.

In 2023, 71.7% of illicit funds despatched to off-ramping providers went to simply 5 providers, a slight enhance from 68.7% in 2022. The report additionally reveals a rise in deposit addresses receiving massive sums of illicit cryptocurrency, indicating a extra diversified strategy by criminals to evade detection and mitigate the affect of frozen accounts.

Moreover, the report highlights the altering techniques of “refined” crypto criminals, significantly within the case of North Korean-affiliated hacking teams like Lazarus Group.

In response to Chainalysis, these actors have demonstrated a capability to adapt their cash laundering methods in response to regulation enforcement actions. The report cites the shutdown of mixer providers, corresponding to Sinbad, and the next rise of replacements like YoMix, which has grow to be a most well-liked mixer for North Korea-affiliated hackers.

Furthermore, cross-chain bridges have seen substantial development in cash laundering actions, with illicit actors leveraging these protocols to maneuver funds between blockchains. North Korean hackers, specifically, have been outstanding customers of bridge protocols for cash laundering functions.

Finally, the report emphasizes the necessity for elevated diligence and understanding of “interconnectedness” in combating crypto crime by concentrating on cash laundering infrastructure.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site solely at your individual danger.