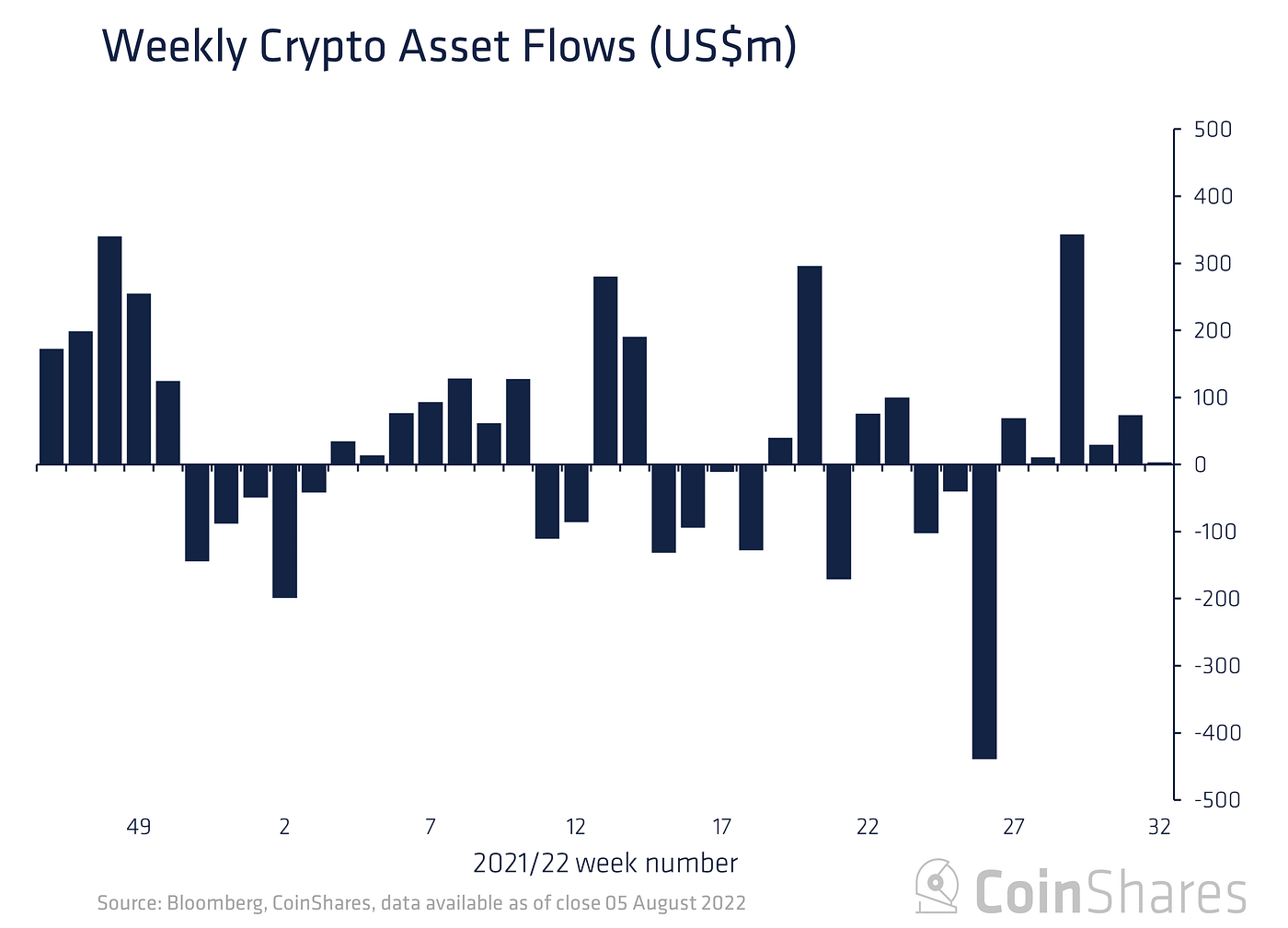

Inflows into crypto funding merchandise have been experiencing an uptick for six consecutive weeks, topping $500 million, in accordance to a report by market perception supplier CoinShares.

The research dubbed “Quantity 92: Digital Asset Fund Flows Weekly Report” highlighted:

“Digital asset funding merchandise noticed inflows totalling US$3m final week marking the sixth consecutive week of inflows that whole US$529m, representing 1.7% of whole belongings below administration (AuM).”

Supply:CoinShares

CoinShares famous that fixed inflows are occurring regardless of the crash within the crypto market witnessed within the second quarter of 2022.

Because the much-anticipated merge within the Ethereum community edges nearer, extra inflows have been trickling into the second-largest cryptocurrency. The report identified:

“Ethereum noticed inflows totalling US$16m and is having fun with a close to 7 consecutive week run of inflows totalling US$159m. We imagine this turn-around in investor sentiment is because of higher readability on the timing of The Merge.”

The merge, which is anticipated to occur on September 19, will change the present proof-of-work (PoW) framework to a proof-of-stake (PoS) consensus mechanism. Furthermore, it’s purported to be the most important software program improve within the Ethereum ecosystem.

American multinational funding financial institution Citi lately famous that the merge would make Ethereum a “yield-bearing asset,” Blockchain.Information reported.

Alternatively, CoinShares famous that regardless of sentiment within the crypto market bettering, buying and selling volumes remained low the previous week at $1.1 billion in comparison with the year-to-date weekly common of $2.4 billion.

“Bitcoin noticed very minor outflows totalling US$8.5m whereas short-Bitcoin funding merchandise noticed a report outflow totalling US$7.5m, and for the second consecutive week suggesting traders imagine Bitcoin costs have troughed,” CoinShares added.

Picture supply: Shutterstock