Cryptos noticed $1B in liqudations as each BTC and ETH misplaced main help ranges we are able to see extra as we speak in our newest altcoin information as we speak.

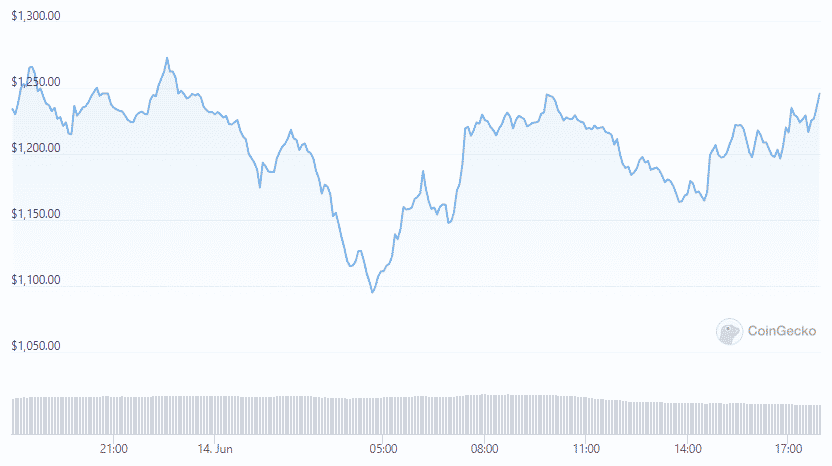

Bitcoin misplaced the $25,000 stage whereas ETH slid to $1200. The crypto-tracked futures misplaced over $1 billion previously day and had been weighed down by a weak sentiment for BTC and different cash amid the weak world financial outlook. The liqudations check with when the alternate forcefully closes a dealer’s leveraged place due to a partial or whole lack of the dealer’s preliminary margin and it occurs when a dealer is unable to fulfill the margin necessities of the leveraged positions.

The losses got here as BTC misplaced main help of $25,000 with the crypto market cap reaching ranges seen in January 2021 and most cryptocurrencies dropped by 15%. Bitcoin accounted for $532 million of all of the liqudations proper after Ether at $317 million and SOL tokens at $20 million. The Futures monitoring Cardano ADA, GMT, and Binance ecosystem tokens noticed over $6 million in losses with 213,000 particular person buying and selling accounts seeing liquidation previously day.

Longs or merchants that guess on the upper costs, noticed $510 million in liqudations and the shorts or the bets on decrease costs noticed $554 million in losses which suggests futures merchants are including to the market volatility and affected merchants equally in both path. FTX recorded over $417 million in liqudations which is probably the most amongst its counterparts adopted by OKX at $251 million and Binance at $198 million. The open curiosity dropped by 7% previously day to $23 billion which recommended an enormous quantity of merchants closed the positions anticipating additional market volatility.

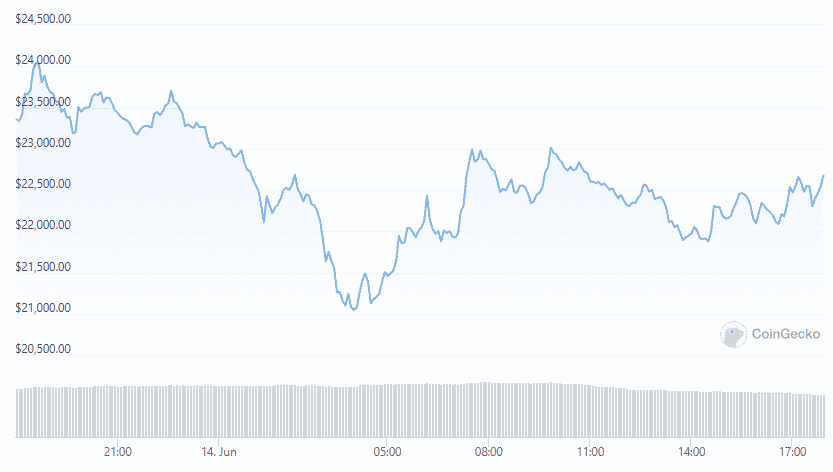

BTC traded at over $22,000 within the EU with a 12-week slide persevering with. The asset misplaced 66% of its worth from a excessive of $69,000 in November. A lot of the decline got here after the US FED deliberate to hike the charges within the upcoming months and battle the results of file inflation which is a transfer that induced a spike in world shares and cryptocurrencies with buyers taking cash off property seemingly dangerous. The sentiment amongst market observers remained bearish with some warning of main losses forward.

DC Forecasts is a frontrunner in lots of crypto information classes, striving for the best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be at liberty to contact us at [email protected]