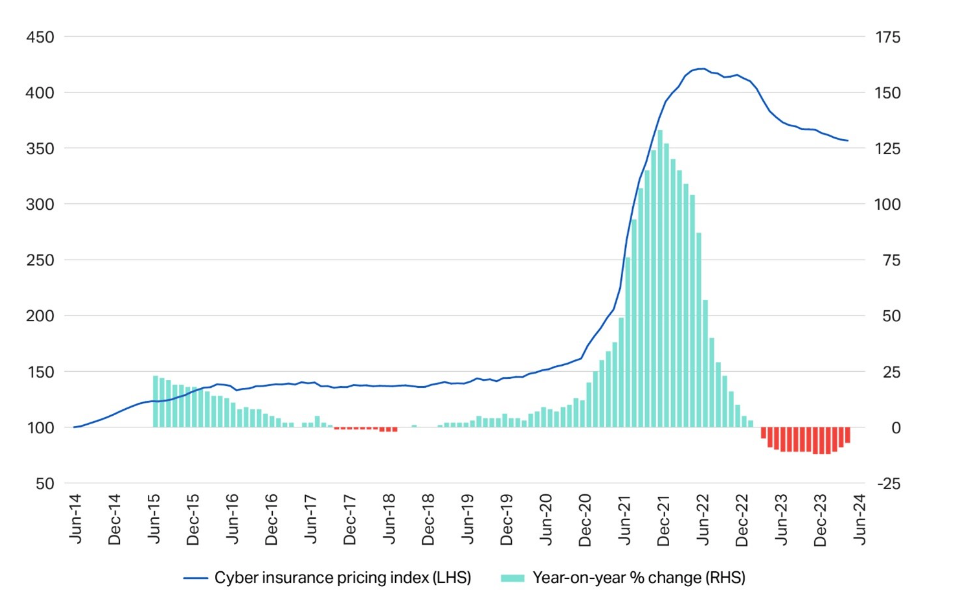

Improved cyber hygiene amongst companies has led to a discount in cyber insurance coverage premiums by 15% worldwide during the last two years, a brand new report from Howden Insurance coverage Brokers has discovered. That is even if cyberthreats, significantly ransomware assaults, have gotten extra prevalent.

Consciousness of cyber hygiene practices, like multifactor authentication, EDR and cloud backups, has grown considerably since 2022.

Ransomware assaults have elevated by 18% this 12 months, based on Howden and NCC Group, however efficient threat controls have lowered the necessity for firms to pay ransoms. Nonetheless, restoration prices at the moment are on the rise once more after a quick decline in 2022.

Insurance coverage premiums skyrocketed in 2021 and 2022 because the COVID-19 pandemic compelled firms to hurry their transitions to distant work. Menace actors actively exploited new community vulnerabilities that resulted from using private gadgets, elevated entry factors and lack of centralised information controls, resulting in extra claims.

Sarah Neild, head of cyber retail U.Ok. at Howden, defined why the price of cyber insurance coverage has declined. She informed TechRepublic in an e mail, “Elevated threat consciousness off the again of persistent and high-profile assaults is one cause.

“Insurers mandating minimal hygiene ranges for companies in an effort to entry capability has additionally had a significant impression.” Fewer claims are being made because of this, so insurance policies are getting cheaper.

Neild added, “The appreciable funding burden on firms however, it has helped to instil a lot wanted resilience for policyholders. That is now paying dividends as they navigate a quickly shifting menace surroundings.”

The Howden information additionally confirmed that the variety of oblique claims from third events not deliberately focused in a cyber incident has been decrease than direct claims on common, additional indicating that firms are successfully managing their dangers and mitigating losses.

Competitors between insurers is growing, too, as increasingly more provide cyber insurance coverage insurance policies, serving to to drive costs down for purchasers, the report said.

“Beneficial dynamics have persevered into 2024, with the price of cyber insurance coverage persevering with to fall regardless of ongoing assaults, heightened geopolitical instability and the proliferation of Gen AI,” Neild mentioned in a press launch.

“At no different level has the market skilled the present mixture of circumstances: a heightened menace panorama mixed with a secure insurance coverage market underpinned by sturdy threat controls.”

The Howden report additionally discovered that demand for cyber insurance coverage in Europe is more likely to develop within the subsequent few years. Penetration ranges within the area are at present low, however consciousness of cyber dangers and strategic safety investments are rising. Small and medium organisations are additionally an underserved market.

Neild mentioned she expects the low costs to proceed. Nonetheless, they’re unlikely to drop any additional. She informed TechRepublic, “Present dynamics — provide vs demand, robust competitors and so on. — counsel consumers will proceed to learn from beneficial circumstances. Capability is up and the latest robust efficiency of the market factors to the price of cowl being commensurate with loss prices.

“That mentioned, we’re already seeing worth decreases reasonable following high-profile assaults within the first half of 2024, within the healthcare sector specifically. We subsequently count on market circumstances to stabilise from right here and are available to a touchdown level that provides a sexy long-term proposition for each consumers and carriers.”

Why cyber insurance coverage is changing into extra vital to companies

Cyber insurance coverage may help companies face up to the prices related to a profitable cyberattack or penalties for breaching more and more rigorous compliance rules. Knowledge breach prices rose to $4.45 million per incident in 2023, based on IBM, partly attributable to the truth that it was taking longer to analyze breaches.

A report from Splunk printed final month discovered the primary explanation for unplanned downtime throughout the world’s largest firms was cybersecurity-related human errors, resembling clicking a phishing hyperlink. Downtime total prices them $400 billion a 12 months, or roughly 9% of their earnings.

Downtime from a cybersecurity incident straight leads to monetary losses via misplaced income, regulatory fines and time beyond regulation wages for workers rectifying the difficulty. The report additionally unveiled hidden prices that take longer to have an effect, like diminished shareholder worth, stagnant developer productiveness and reputational harm.

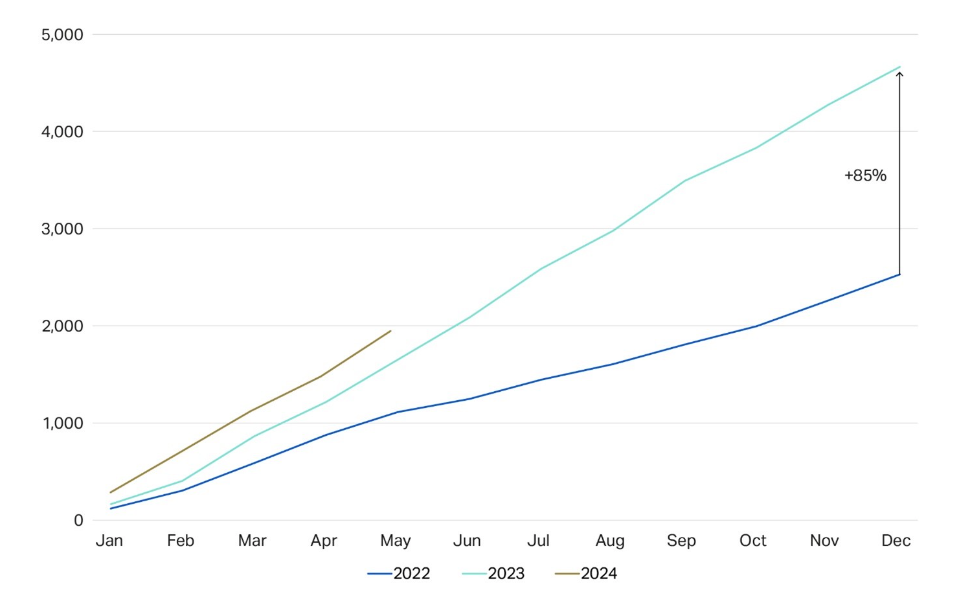

Along with the rising related prices, cyberattacks are additionally changing into more and more profitable. In April, a research by Kaspersky discovered the variety of gadgets contaminated with data-stealing malware elevated by seven occasions between 2020 and 2023. Final month, insurance coverage dealer Marsh revealed that they had obtained greater than 1,800 cyber claims from North American purchasers in 2023, a report excessive, attributable to firms being struck by ransomware.

SEE: 87% of UK Companies Are Unprepared for Cyberattacks

Regardless of this, there’s proof that firms are enhancing their defences towards cyberattacks. In keeping with a 2024 report from Mandiant, the median dwell time — the period of time attackers stay undetected inside a goal surroundings — of world organisations decreased from 16 days in 2022 to 10 days in 2023 and is now at its lowest level in additional than a decade.