Because the US economic system has tightened, the enterprise capital and acquisition panorama has shortly shifted to grow to be a consumers’ market, with startups failing to command the excessive valuations that had been widespread in previous years.

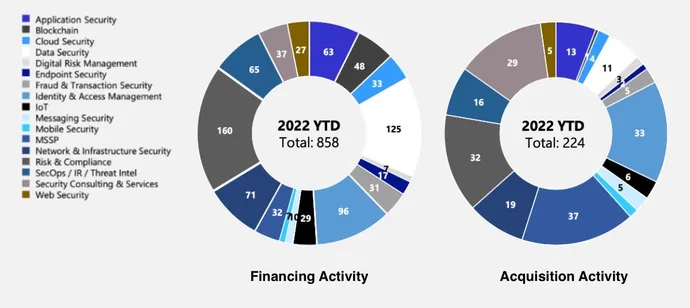

Whereas the sheer variety of financing offers is on observe to match the greater than 1,000 cybersecurity-related investments introduced in 2021, the worth of these offers has dropped by greater than 1 / 4, in accordance with knowledge from cybersecurity-focused advisory agency Momentum Cyber. The worth of bought firms can be on observe to drop by 1 / 4 in 2022, though absolutely the variety of acquisitions will solely drop by about 8%.

The leaner instances for startups and their venture-capital backers come because the personal sector is chopping prices and refocusing on essentially the most worthwhile strains of enterprise to prepared themselves for a doable recession, says Eric McAlpine, a managing associate at Momentum Cyber.

“We’ve already seen bigger venture-backed firms consolidate considerably to chop prices and refocus on profitability,” he says. “Strategic acquirers typically have a troublesome time justifying new acquisitions to their board and taking over firms with new workers in a time the place they’re already chopping sources and headcount internally.”

The fear of a downturn has unfold throughout industries. Nearly all of firms — 83% — are involved a few recession coming in 2023, with half of organizations taking concrete steps to arrange for an financial decelerate, in accordance with Spiceworks Ziff Davis’s “2023 State of IT” report. Three-quarters of companies are planning to scale back the variety of safety distributors they use, a big transfer towards consolidation from two years in the past when 29% aimed to cut back their vendor depend.

Because the enterprise panorama modifications, so, too, are firms altering the way in which they function. The overwhelming majority of corporations — 83% — are putting a larger give attention to digital capabilities and operations, in accordance with a survey of CEOs carried out by enterprise intelligence agency Gartner. The analyst agency confused in a March 2022 advisory that such efforts require cybersecurity groups to adapt and take an built-in position in defending and enabling the enterprise.

Firms’ safety groups ought to “rework the safety perform into a real business-enabling functionality by shifting away from risk-averse, control-driven safety working fashions towards a extra agile, advisory-centric method of delivering safety providers,” Gartner said.

Smaller Firms, Smaller Investments, Fewer Layoffs

Enterprise cash is at present following these developments. Total, the period of huge valuations for newcomers has come to “a standstill,” says Momentum Cyber’s McAlpine, who sees founders not receiving the identical excessive valuations in contrast with the current previous, leaving many to carry off on being acquired within the present market.

There are some exceptions, equivalent to Broadcom’s huge deal to accumulate VMware — a deal valued at $69 billion. And October noticed a surge in deal-making, with two giant acquisitions — KnowBe4 and ForgeRock — by personal fairness corporations. However these had been outliers, with the variety of offers reaching a low level in September, in accordance with McAlpine. Total, smaller and extra specialised corporations will make up the overwhelming majority of acquisition targets within the close to future, he says.

To this point, in 2022, the common (imply) financing deal amounted to $21 million, down from $28 million in 2021. , and the common acquisition worth was $21 million (after dropping the deal for VMware), additionally down from $28 million.

The excellent news? Worker layoffs is not going to essentially be a part of the post-merger panorama, McAlpine says. Usually, normal enterprise and administration departments signify a lot of the duplication between merged firms, resulting in cuts in workers in these departments, whereas the engineering and improvement groups at startups are wanted for his or her experience, he says.

“Worker cuts aren’t quite common after a merger, even in a down market,” McAlpine says. “Many smaller corporations and startups are lean to start with, and their workers are sometimes seen as a precious a part of the acquisition.”

No Recession in cybersecurity?

The excellent news for cybersecurity firms is that the enterprise demand for services isn’t going away anytime quickly, and there are indicators that the sector will proceed to develop — albeit far more slowly than prior years.

Barely greater than half of firms (51%), for instance, anticipate to extend their IT budgets, and solely about 40% of these attribute the will increase to inflation, in accordance with Spiceworks Ziff Davis’s “2023 State of IT” report. The Bureau of Labor Statistics at present pegs inflation for end-user costs at roughly 9% year-over-year, however the common IT spending is anticipated to develop by 13% in 2023 in contrast with the prior 12 months, says Peter Tsai, head of know-how insights at Spiceworks Ziff Davis.

Firms are updating outdated infrastructure, rising their give attention to IT tasks like digital transformation, and including workers to essential areas — all of which represents cybersecurity threat, which requires elevated spending on defenses.

“Each the scale of the general tech spending pie was anticipated to extend, along with the safety slice of the pie getting a bit bigger,” Tsai says. “Inflation will definitely be an element influencing many 2023 finances will increase, but it surely will not be the highest purpose driving finances development.”