In his latest report, Charles Edward, a outstanding crypto market analyst, launched an replace on the state of the Bitcoin (BTC) market. The report highlights the continuation of the downtrend for Bitcoin, which has been dropping its key assist, the 50-day Transferring Common (MA).

The bearish development has been confirmed by technical indicators and the pure elementary Bitcoin Macro Index algorithm, which has seen an rising fee of contraction during the last week.

Is Bitcoin Headed For $25,000?

The report supplies insights into each excessive and low timeframe technicals, with the subsequent assist ranges for Bitcoin at $28,000, $24,000, and low-$20,000, every providing higher relative alternatives.

The low timeframe technicals point out a breakdown in assist at $30,000 and the emergence of a brand new bearish development, with a goal of circa $25,000.

The Capriole Bitcoin Macro Index, which mixes over 40 of probably the most highly effective Bitcoin on-chain, macro market, and equities metrics right into a single machine studying mannequin, suggests an honest long-term worth for multi-year horizon buyers, however with reducing fundamentals during the last week.

However, the Three Issue Mannequin, a brand new open-source algorithm, values the S&P500 utilizing three elementary knowledge factors solely, indicating that the markets are pretty valued immediately, with room for extra upside, regardless of latest bearish indicators.

Regardless of the bearish outlook, the report means that the macroeconomic backdrop stays favorable for Bitcoin over the approaching years.

The Federal Reserve has paused fee hikes, and the S&P500 has had its longest successful streak in years. Nonetheless, the technicals and fundamentals are at the moment exhibiting a “not but” sign, indicating that the market might have to attend for a optimistic set off such because the approval of the Blackrock ETF.

Total, the report suggests a long-term bullish outlook for Bitcoin, however with warning within the quick time period till technicals or fundamentals show in any other case.

In response to Edwards, the closest factors of technical alternative are $28,000, $25,000, and $21,000, or a day by day shut again into the $30,000 vary.

Low Volatility, Excessive Potential

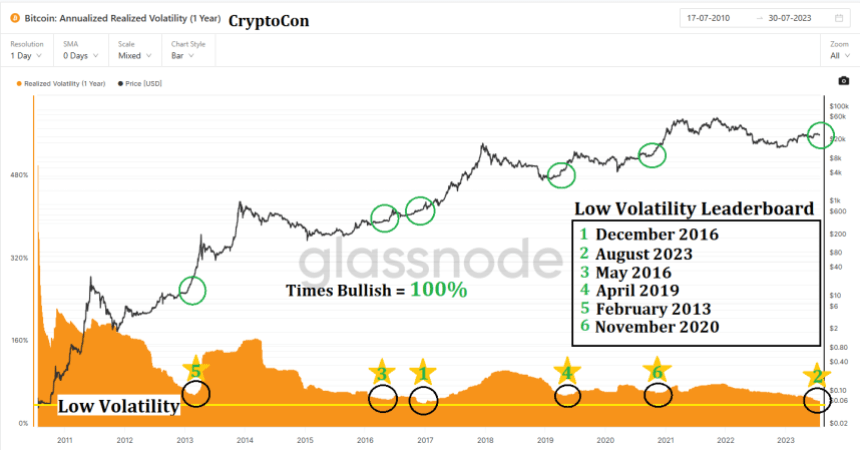

Bitcoin’s value volatility has been at historic lows, with the cryptocurrency experiencing its second-lowest degree of yearly volatility ever. This truth has been famous by many within the crypto neighborhood, together with Crypto Con, who points out that traditionally, low volatility has been a bullish signal for Bitcoin.

Low volatility will be seen as an indication of stability and maturity for a cryptocurrency. It means that the market is turning into extra environment friendly and that there’s much less hypothesis driving costs up and down. This could be a optimistic signal for long-term buyers, because it means that cryptocurrency is turning into extra dependable as a retailer of worth.

Furthermore, Bitcoin has traditionally carried out nicely after intervals of low volatility. Each time Bitcoin’s volatility has dropped to comparable ranges prior to now, it has been adopted by a major value improve.

This implies that, whereas the present low volatility could also be irritating for merchants on the lookout for fast income, it might be a optimistic signal for long-term buyers.

In conclusion, whereas the present low volatility in Bitcoin’s value is probably not thrilling for merchants, it might be a optimistic signal for long-term buyers. Traditionally, low volatility has been a bullish signal for Bitcoin, and the cryptocurrency’s present stability comes at a time when a number of optimistic macroeconomic components may drive its value up sooner or later.

As of the time of writing, Bitcoin has misplaced its essential assist line of $29,000 and is at the moment buying and selling at $28,900, representing a decline of over 1% within the final 24 hours.

Featured picture from Unsplash, chart from TradingView.com