“It can get higher. Simply grasp in there.”

Deconstructor of Enjoyable’s Eric Kress kicked off immediately’sThink Video games Istanbul occasion by stating that, regardless of the present challenges, the trade will recuperate.

Kress stated many individuals in cell might not have seen a downturn earlier than, however he harassed it has occurred earlier than within the wider video games sector. “That is what occurs … growth and bust,” he stated.

Amid such a difficult time and many potential adjustments forward for the video games and wider tech sector, Kress, together with Deconstructor of Enjoyable founder Michail Katkoff, provided their predictions for what 2024 might seem like.

TL;DR

- Digital Market Act will make Apple bleed

- AI begins to rework methods of working

- UA recovers

- Apps overtake video games in IAPs

- Funding crunch continues

- The lean occasions drag on

Digital Markets Act bites

This week the Digital Markets Act formally comes into drive, making a framework designed to maintain giant on-line platforms – or ‘gatekeepers’ – from abusing their dominant market positions and to create a “fairer enterprise atmosphere” for all firms.

Apple has made non-compulsory adjustments to its App Retailer guidelines in response. If publishers opt-in, Apple will scale back its income share to 17% – or 10% for some builders – in the event that they use an alternate market or cost possibility. However Apple can also be introducing a core expertise price, which prices €0.50 for every first annual set up per yr over a million downloads for installs from the App retailer and/or an alternate market.

Kress shared frank views on Apple’s new guidelines, stating they’re “clearly not acceptable”.

“That is Apple at its best proper… heads you lose, tails I win,” he stated.

He predicted most publishers is not going to opt-in to the brand new phrases – sustaining the established order – and that the DMA “goes to go medieval on this”.

He stated it was his understanding the DMA is to not be trifled with, and believes Apple will really feel the warmth from regulators, forcing them again to the negotiation desk.

You’ll be able to see what analysts, publishers and cost suppliers consider Apple’s EU adjustments in our article right here.

The lean occasions will keep it up

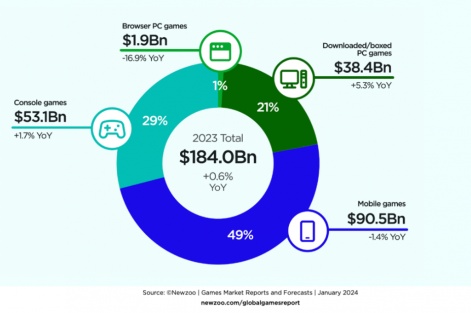

Katkoff stated he expects the lean occasions for the trade to hold on. Newzoo information reveals that the trade grew by simply 0.6% year-over-year in 2023 to $184 billion, with cell down 1.4% Y/Y to $90.5 billion.

In the meantime, console, which Katkoff stated had most likely the most effective years ever for high quality video games, barely noticed any development at 1.7% Y/Y – a determine that doesn’t take into consideration inflation.

He stated this was doubtless right down to various components – too many customers, too many video games, too many enterprise fashions, whereas the necessity for {hardware}, pricing and a restricted viewers means income didn’t develop as anticipated.

Katkoff cited 5 key post-lockdown tendencies to clarify the sport trade’s challenges proper now:

- Folks rekindled with out of doors actions

- Structural shifts in privateness which have shaken the sector

- Competitors for media consumption has intensified (e.g. social media, streaming, podcasts, and many others.)

- Geopolitical atmosphere deteriorated income outlook

- Financial challenges impacted spending patterns

Lastly, Katkoff defined how inflation, which results in excessive rates of interest, will have an effect on video games trade development. He highlighted the oil disaster within the Nineteen Seventies as proof that, when inflation rises and rates of interest do the identical to fight it, charges will keep excessive as banks are afraid inflation will bounce again.

For video games firms, the rise in rates of interest proper now means the price of servicing debt has gone up, impacting specifically firms which have spent considerably on M&A for development.

To round-up, Katkoff famous: Excessive rates of interest > Lean occasions for video games.

- Restricted shopper demand for video games

- Fewer new video games in growth (firms avoiding riskier bets)

- Fewer investments into new tasks

- Fewer exists by way of mergers and acquisitions

- Concentrate on profitability as a substitute of development.

- Concentrate on effectivity and productiveness that results in layoffs

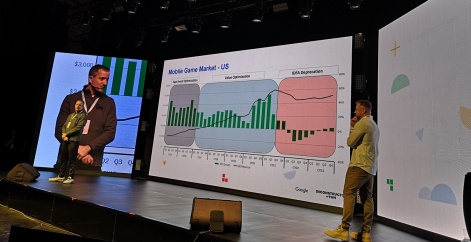

Person acquisition market stabilises

After app monitoring transparency led to very large challenges in person acquisition, Kress stated that we’re now seeing stablisation within the UA market, which could be put right down to changes by the likes of Fb, Apple and Google within the advertisements house to adapt to privateness adjustments.

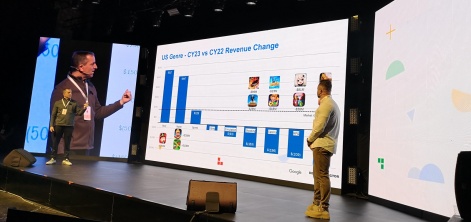

He famous that titles like Monopoly Go and the informal style had been rising within the U.S., although extra core titles had been nonetheless on the decline.

Apps will overtake video games on spending

Katkoff predicted that apps will overtake video games on spending.

He stated that customers are spending increasingly more time on totally different platforms, and questioned whether or not video games are extra sociable and addictive than apps like TikTok.

Katkoff defined that for the video games trade to take the street again to development, it wants to alter from a development market mindset to working in a mature one. It must ditch the lean startup mentality for a deliberate strategy, he stated.

- Compelling technique > Fast experimentation – Builders want a compelling technique for what they’re constructing, and wish to grasp the competitors, the market and their funding scenario to grasp it.

- Changes > Fail quick and pivot – Katkoff stated builders want to grasp what’s taking place available in the market and their funding scenario, and know the way they’ll modify their technique inside that. He used the instance of Scopely’s Monopoly Go, which took seven years to make and went by way of changes.

- Don’t overfocus on testing – Whereas testing is vital as you progress by way of the event cycle, there should not be an excessive amount of deal with this.

- For those who construct if, they gained’t simply come – Katkoff stated publishers want to consider development from the beginning of a recreation, not simply when the KPIs are good.

The state of M&A

Discussing the state of the M&An area, Kress stated he didn’t count on any mega mergers within the close to future.

He famous one of many basic issues for M&A is the dearth of acquirers proper now. Zynga is off the board, EA is licking its wounds from the Glu deal, and Scopely is taking a break. In the meantime, the likes of Embracer and Stillfront “have collapsed”. Kress stated there could also be smaller M&A offers, nonetheless.

On the subject of the VC market: “it’s going to be a slog”, stated Kress, stating that buyers might chase the rainbow of AI and even spend money on crypto once more.

As for public markets, Kress stated quite a lot of large gamers have been taken off the board – like Activision and Zynga – however he expects Epic to go for an IPO within the subsequent 18 to 24 months. General, the general public markets can be “fairly energetic” over the following few years, he stated.

AI remodeling the trade

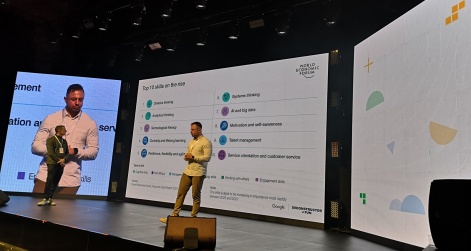

Concluding the speak, Katkoff delved into the methods AI is remodeling the best way builders make video games.

- Compact groups’ creativity is just not held again by an absence of assets – With further instruments, small groups can doubtlessly now increase video games or begin working them as a service

- Giant groups will create immersive worlds

- Skilled professionals who embrace AI can change into invaluable

- Much less skilled professionals might change into replaceable.

He highlighted prime expertise folks within the trade can work on to adapt to this development (additionally outlined by the World Financial Discussion board), which included: creativity, analytical considering, technological literacy, lifelong studying and resilience.