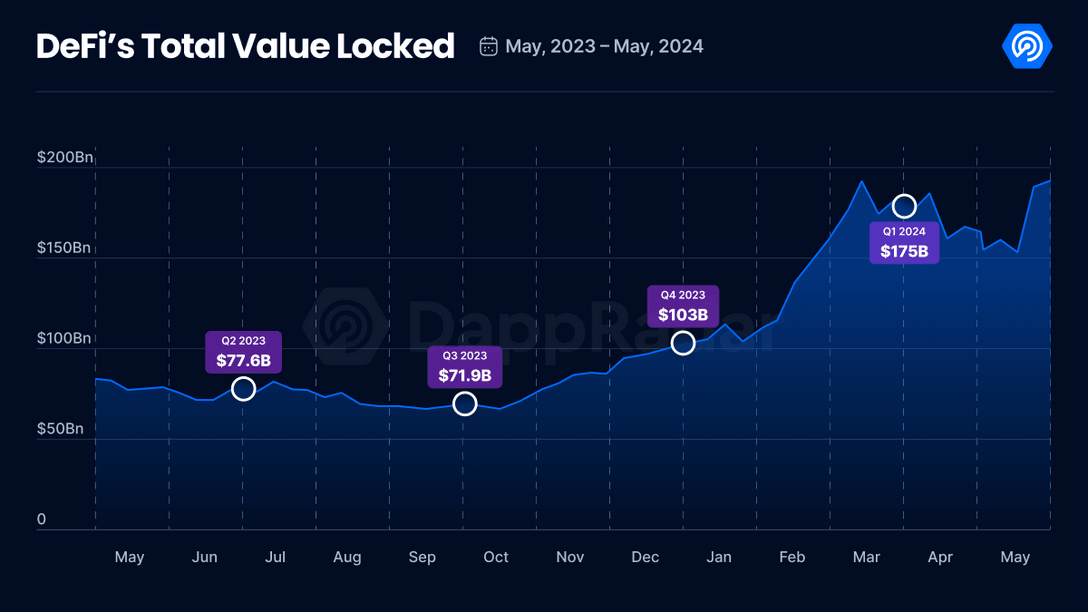

New knowledge from market intelligence agency DappRadar reveals that the full worth locked (TVL) inside the decentralized finance (DeFi) sector has skyrocketed to the very best degree in 15 months.

In a brand new weblog publish, DappRadar notes that DeFi’s TVL has reached $192 billion, a 17% rise from the earlier month and one of the best it has registered since February 2022.

TVL refers back to the quantity of capital deposited inside a protocol’s sensible contracts and is usually used to gauge the well being of a crypto ecosystem.

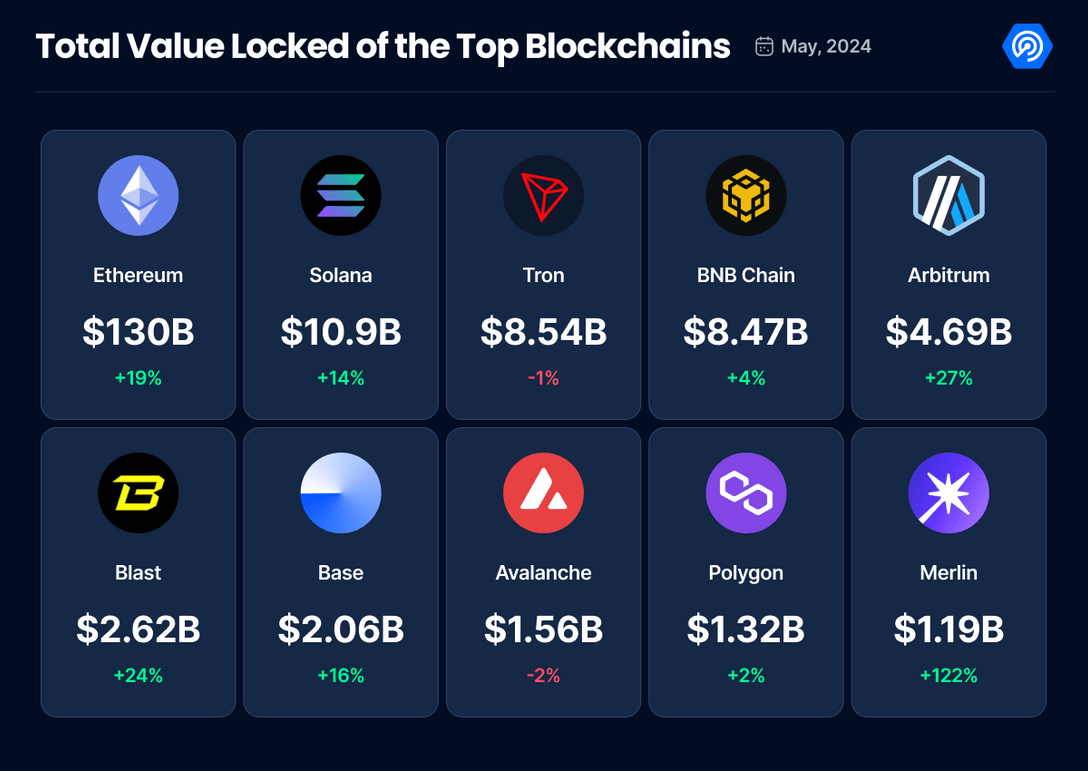

In response to the crypto analytics agency, the vast majority of the expansion was pushed by a rise in token costs, notably these of sensible contract platforms Ethereum (ETH) and Solana (SOL).

“Ethereum holds the larger portion of the entire DeFi’s TVL, and this month its dominance is at 68%. Adopted by Solana, which previously months has been propelled by memecoin buying and selling and DeFi exercise on its community. Furthermore, the native SOL token has surged by 11% previously 30 days.”

ETH is buying and selling for $3,692 at time of writing whereas SOL is price $158.94.

DappRadar goes on to notice that Bitcoin’s (BTC) layer-2 answer Merlin Chain (MERL) additionally significantly contributed in Could, turning into the crypto king’s largest sidechain, dwarfing the Lightning Community.

“The narrative across the Layer-2 networks continues to be robust, however the actual prime performer this month has been Merlin. It has change into the biggest Bitcoin sidechain and greater than thrice as massive because the payments-focused Lightning Community.

Greater than half of Merlin’s $1 billion is held in Solv Finance, a protocol that enables customers to deposit Wrapped Bitcoin and obtain ‘Solv Factors’ in return.”

MERL is buying and selling for $0.441 at time of writing, an 10.10% lower over the past 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you might incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney