A gentle enhance within the circulating provide of stablecoins reveals an rising demand for these belongings. It means that extra merchants and buyers are making ready to enter the market or facilitating extra buying and selling exercise.

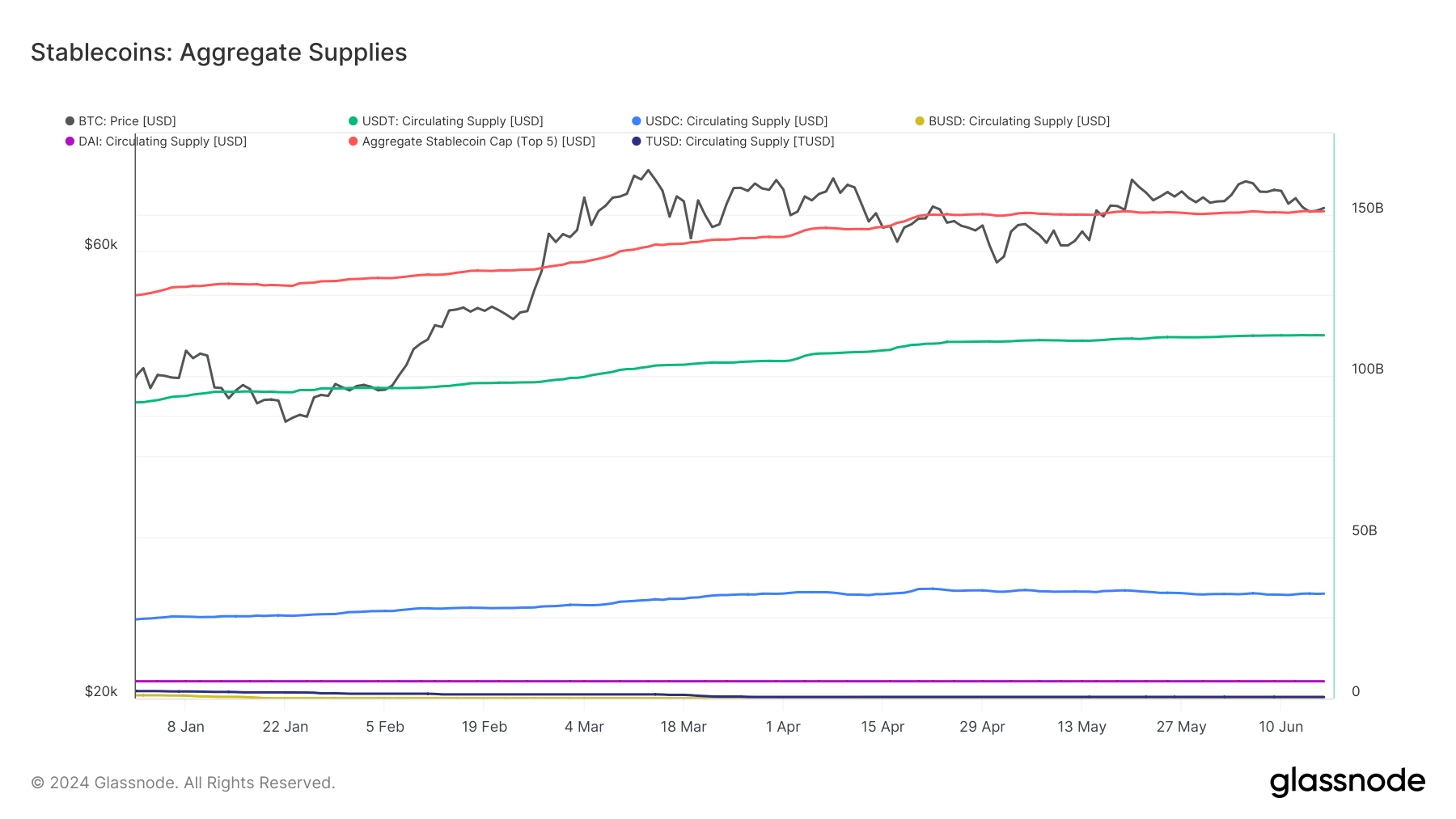

The rise within the mixture circulating provide of stablecoins during the last six months represents a big growth. The combination provide of the 5 largest cash peaked at over $150.874 billion on June 16 — representing a considerable enhance from the $124.890 billion recorded at the start of the 12 months.

Stablecoins present a haven during times of market uncertainty and liquidity during times of upward value actions. The rise of their circulating provide reveals a shift in direction of stability and threat administration amongst buyers and an general maturity available in the market, which chooses to deploy its capital by means of stablecoins as a substitute of fiat currencies.

The particular adjustments within the circulating provides of particular person stablecoins present how market preferences shifted all year long.

Tether stays a dominant power within the stablecoin market, with USDT provide rising from $91.71 billion to $112.48 billion. Equally, USDC’s progress from $24.5 billion to $32.4 billion signifies robust demand for Circle’s stablecoin.

In distinction, the dramatic lower in BUSD’s provide from $1.011 billion to $70.421 million and TUSD’s drop from $2.310 billion to $495.710 million displays their important regulatory challenges and reducing investor curiosity.

The truth that DAI’s provide has remained fixed at $5.347 billion suggests a secure demand for this decentralized stablecoin, which might replicate a desire for decentralized monetary merchandise available in the market. The steadiness amid fluctuations in different stablecoins’ provides reveals a balanced demand for centralized and decentralized cash, every serving completely different wants and threat appetites inside the market.

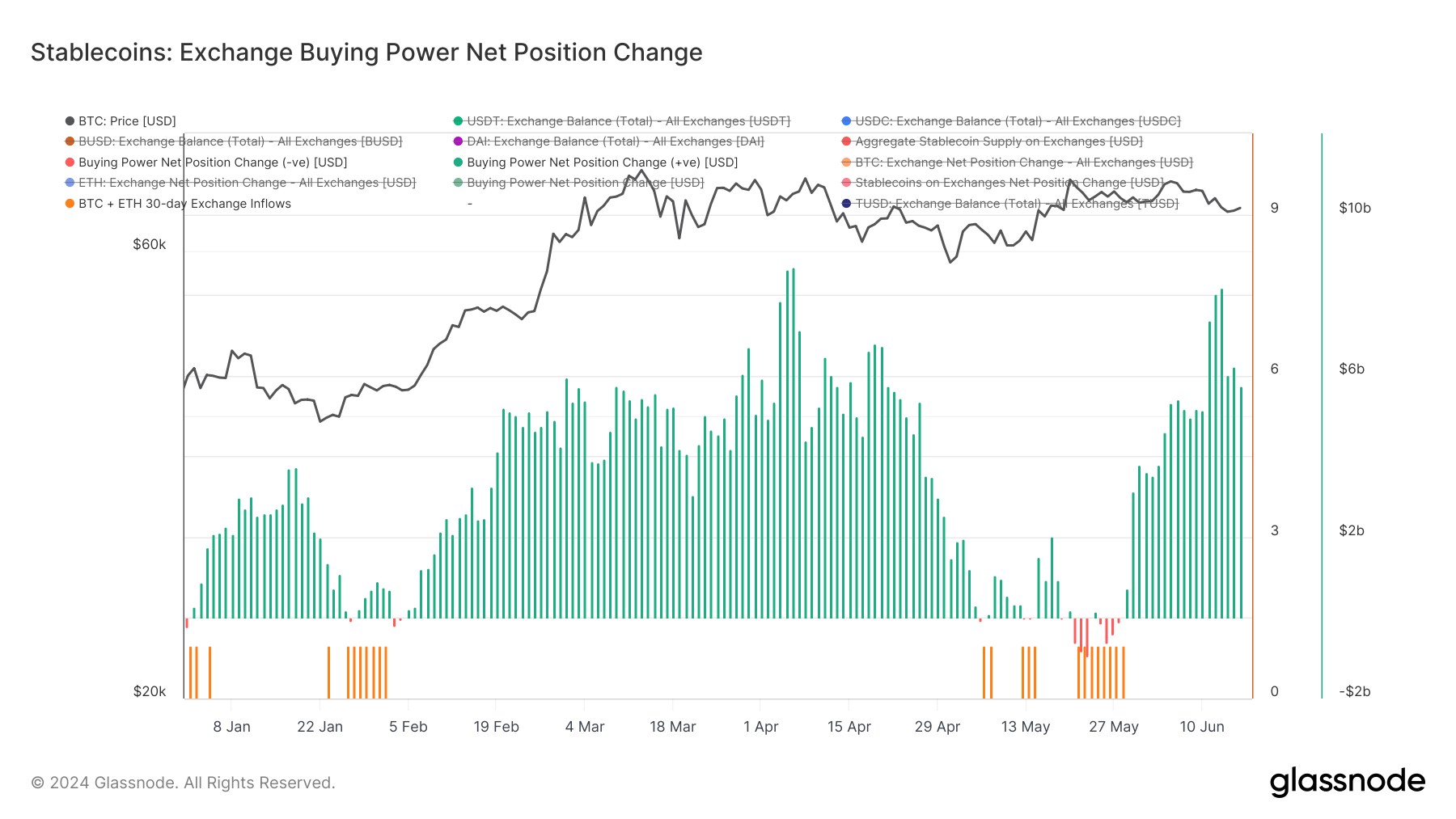

The 30-day change in stablecoin shopping for energy on exchanges, which has elevated previously week with out corresponding inflows of BTC and ETH, signifies a big accumulation of those stablecoins on exchanges.

This accumulation means that merchants are making ready for potential market strikes and hedging in opposition to volatility. This habits signifies the market is in a state of readiness, the place individuals are ready to deploy capital swiftly in response to market actions.

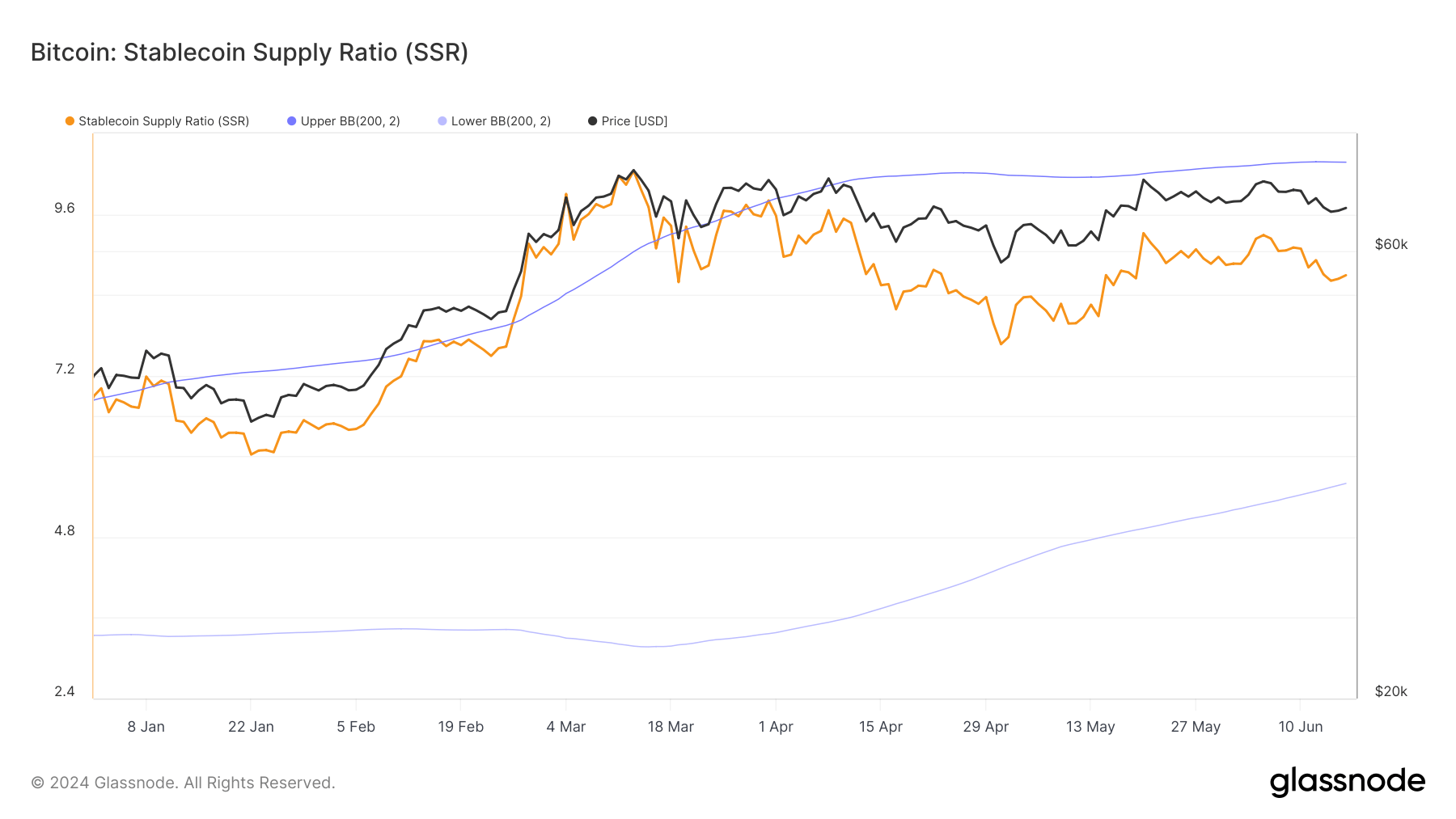

Analyzing the Stablecoin Provide Ratio (SSR) alongside adjustments within the stablecoin circulating provide is smart as a result of it supplies a deeper understanding of how stablecoin liquidity impacts Bitcoin’s value.

The SSR measures the ratio of Bitcoin’s provide to the mixture stablecoin provide, highlighting the potential shopping for energy of stablecoins relative to Bitcoin. Vital adjustments in stablecoin provides can alter the SSR, indicating potential shifts in market sentiment and the readiness of capital to maneuver into or out of BTC.

The present SSR stands at 8.6919. The SSR’s higher and decrease Bollinger Bands, 10.3718 and 5.5973, point out that it’s inside a secure vary. Traditionally, Bitcoin peaked when the SSR broke above the higher Bolinger Band, and sharp drops had been seen when it fell under the decrease band.

This sample reveals that important actions within the SSR can function an indicator for Bitcoin’s value motion, additional cementing Bitcoin’s ties to the liquidity coming from the stablecoin market.

General, the rising stablecoin provide, the numerous 30-day change in stablecoin shopping for energy on exchanges, and the secure SSR point out a cautious however ready market. Traders appear to be positioning themselves for potential volatility, counting on stablecoins as a buffer whereas intently monitoring Bitcoin’s value actions by means of the SSR.

This setting suggests a interval of consolidation the place market individuals are ready for clearer alerts earlier than making substantial strikes.

The put up Demand for stablecoins grows as market prepares for volatility appeared first on CryptoSlate.