A current evaluation by Deribit, a number one derivatives trade, suggests a bullish sentiment for Bitcoin as we method early 2024. This optimism is rooted within the present Bitcoin put-call choices ratio, a crucial possibility market metric.

Deribit’s Perception: Bitcoin Calls Outpace Places Signaling Market Confidence

Notably, choices are monetary devices that give merchants the correct, however not the duty, to purchase (name choices) or promote (put choices) an underlying asset at a specified worth inside a set timeframe. The put-call ratio is utilized in choices buying and selling to measure market sentiment.

A put possibility signifies a guess on the value of an asset falling, whereas a name possibility represents a wager on its rise. A decrease put-call ratio signifies that extra merchants are betting on the asset’s worth rising relatively than reducing.

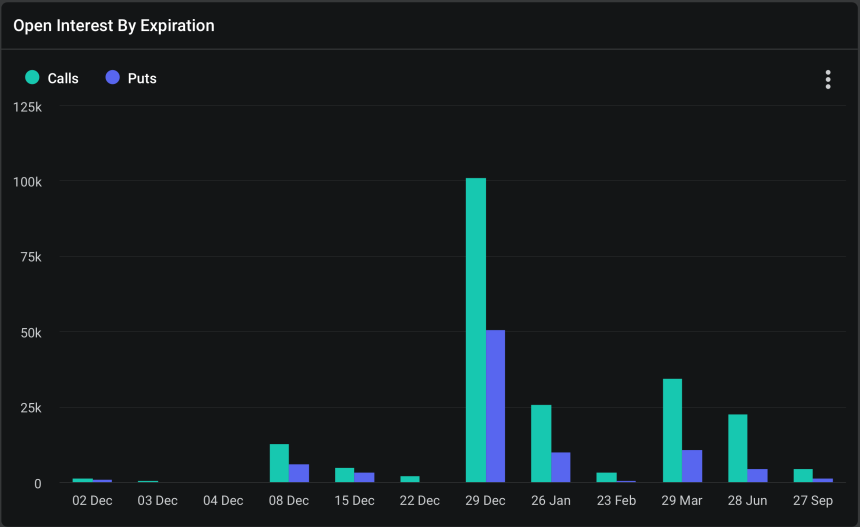

Deribit’s evaluation exhibits an rising pattern within the variety of name choices outstripping put choices in Bitcoin’s choices market. Luuk Strijers, Chief Business Officer at Deribit, highlighted that the put-call ratio for Bitcoin has persistently hovered “between 0.4 and 0.5” all year long.

This pattern is especially noticeable for choices expiring in March and June 2024, suggesting that buyers are more and more utilizing name choices to place for a possible appreciation in Bitcoin’s worth throughout this era.

The put-call choices ratio falling beneath one is a bullish market indicator, because it exhibits that decision quantity, or bets on the value improve, surpasses the put quantity, that are bets on the value lower. In response to Deribt, Bitcoin’s put-call ratio at the moment stands at 0.42, as of in the present day.

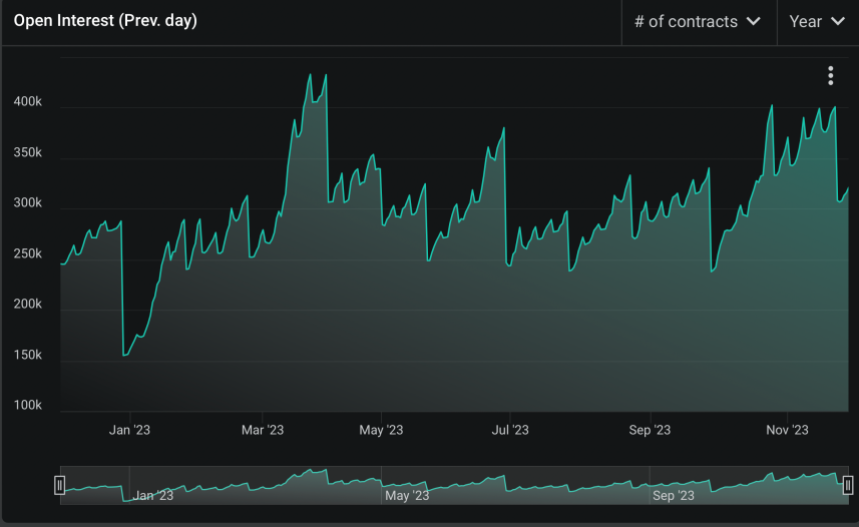

A Surge In Crypto Derivatives Exercise

In the meantime, November has seen vital exercise within the crypto derivatives market, as famous by Strijers. The Deribit govt attributes this elevated market exercise to increased ranges of “implied volatility (DVOL),” which have spurred “alternatives and general market volumes.”

The expiration dates of the upcoming choices, particularly the numerous one on December 29, are anticipated to take care of the heightened curiosity and exercise out there. With $5.7 billion in Bitcoin choices and $2.7 billion in Ethereum choices set to run out on the finish of December, the market is poised for notable actions.

Bitcoin maintains its upward momentum, advancing by 1.8% over the previous 24 hours. With Bitcoin at the moment buying and selling at $38,344, the asset has sustained the beneficial properties achieved on the shut of the earlier month.

Bitcoin’s buying and selling quantity considerably displays heightened market exercise, suggesting ongoing shopping for strain. In simply the final day, buying and selling volumes have surged from round $11 billion earlier within the week to over $21 billion, a noteworthy indication of accelerating investor engagement.

Featured picture from Unsplash, Chart from TradingView