Fast Take

As of 2023, Bitcoin has demonstrated a sturdy rise of over 120% YTD, doubtlessly signaling the onset of a brand new bull run. Nonetheless, in step with historic precedents, this incline shouldn’t be anticipated to proceed unabated with none market corrections. It is very important notice that market corrections are a traditional a part of any monetary cycle, contributing to the general well being of the market.

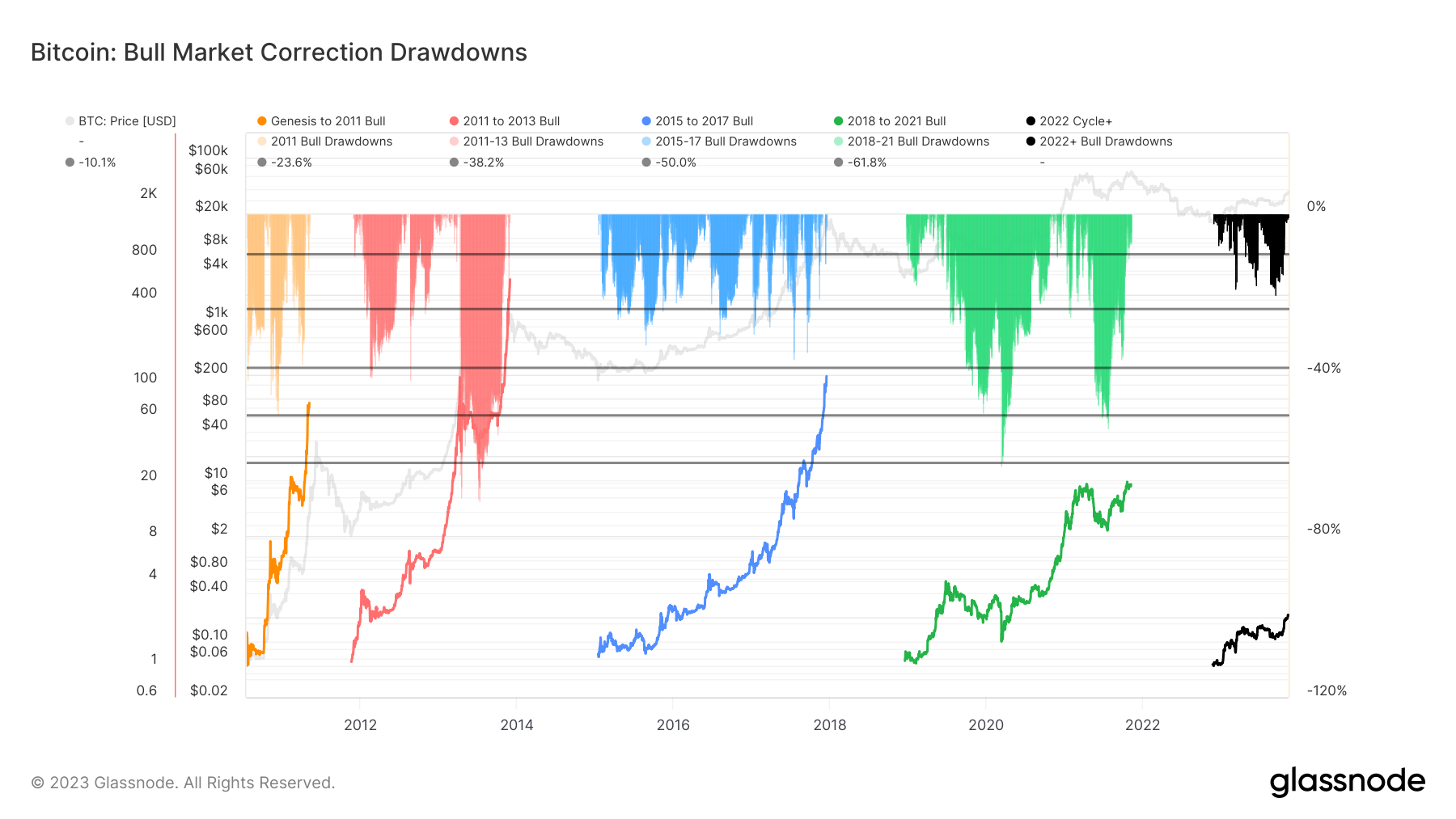

In 2023 alone, probably the most important correction was a 20% decline in July, when Bitcoin’s worth retreated from $31,000 to $25,000. Delving into historic knowledge, in the course of the China mining ban in 2021, a sharper correction of fifty% was witnessed, although this was from an all-time excessive in early 2021. The 2020 Covid-induced market turmoil is seen as an outlier on account of its ‘black swan’ nature.

Historic developments from 2015-17 and 2011-13 cycles additional present a number of corrections of over 30%. These corrections are sometimes linked to elements like profit-taking, as seen in current weeks, and the liquidation of leveraged positions, which might set off cascading results available in the market.

The publish Regardless of 120% YTD progress, Bitcoin’s path could comply with historic market corrections appeared first on CryptoSlate.