Sam Bankman-Fried’s failed crypto buying and selling agency Alameda Analysis seems to be consolidating crypto property right into a single pockets.

The agency has steadily accrued $93,353,985 value of Ethereum-based altcoins into only one handle in current days, in accordance with the on-chain analytics firm Nansen.

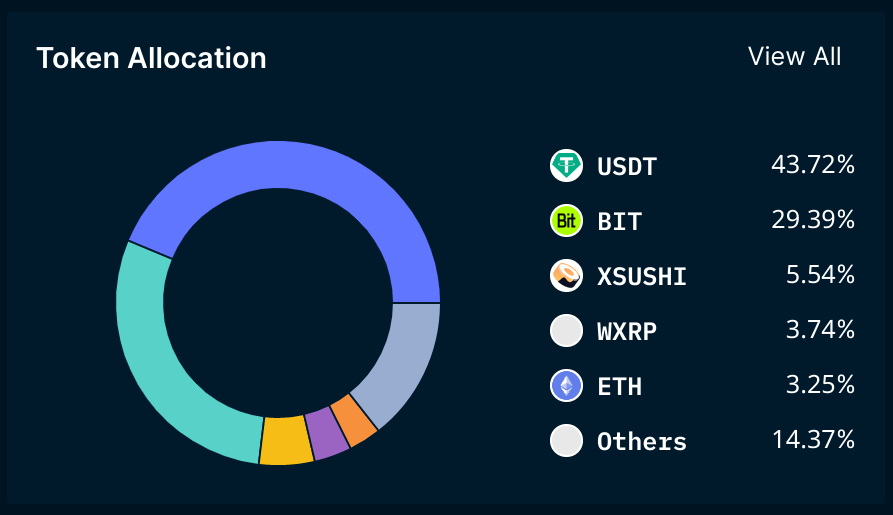

The majority of the altcoins are denominated within the US dollar-pegged stablecoin Tether (USDT), which quantities to 43% of the portfolio.

The second-largest altcoin allocation is BitDAO (BIT). The decentralized autonomous group (DAO), which is backed by Bybit, Pantera and billionaire Peter Thiel, represents a 29% chunk of the pockets in query.

The pockets additionally contains a number of extra property in smaller quantities, together with Ethereum (ETH) itself, which is 3% of the pockets.

Analysts at Nansen say the cash are possible being consolidated as chapter procedures for Bankman-Fried’s defunct crypto empire FTX start.

Bankman-Fried, who’s accused of mishandling and spending buyer funds, declared chapter at FTX, FTX.US, Alameda Analysis and different FTX associates ten days in the past.

John J. Ray III, who oversaw the liquidation of the scandalous American power firm Enron, is now managing the fallout from FTX as the corporate’s new CEO.

In his preliminary submitting on the corporate’s affairs, Ray stated he has by no means seen a company enterprise as mismanaged as FTX.

“By no means in my profession have I seen such an entire failure of company controls and such an entire absence of reliable monetary info as occurred right here.”

The quantity of buyer cash misplaced by FTX, Alameda Analysis and its subsidiaries varies wildly, and no less than $1 billion value of investor’s funds is believed to have vanished.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/robertedit949/Natalia Siiatovskaia