The most important information within the cryptoverse for Nov. 4 contains Bitcoin’s outperformance of Nasdaq after the Fed raised rates of interest, Do Kwon’s invitation to all regulation enforcement on the planet to hitch an internet convention, and DOGE’s 9% fall amid Twitter’s class-action lawsuit.

CryptoSlate Prime Tales

Bitcoin outperformed NASDAQ after Fed raised charges by 0.75%

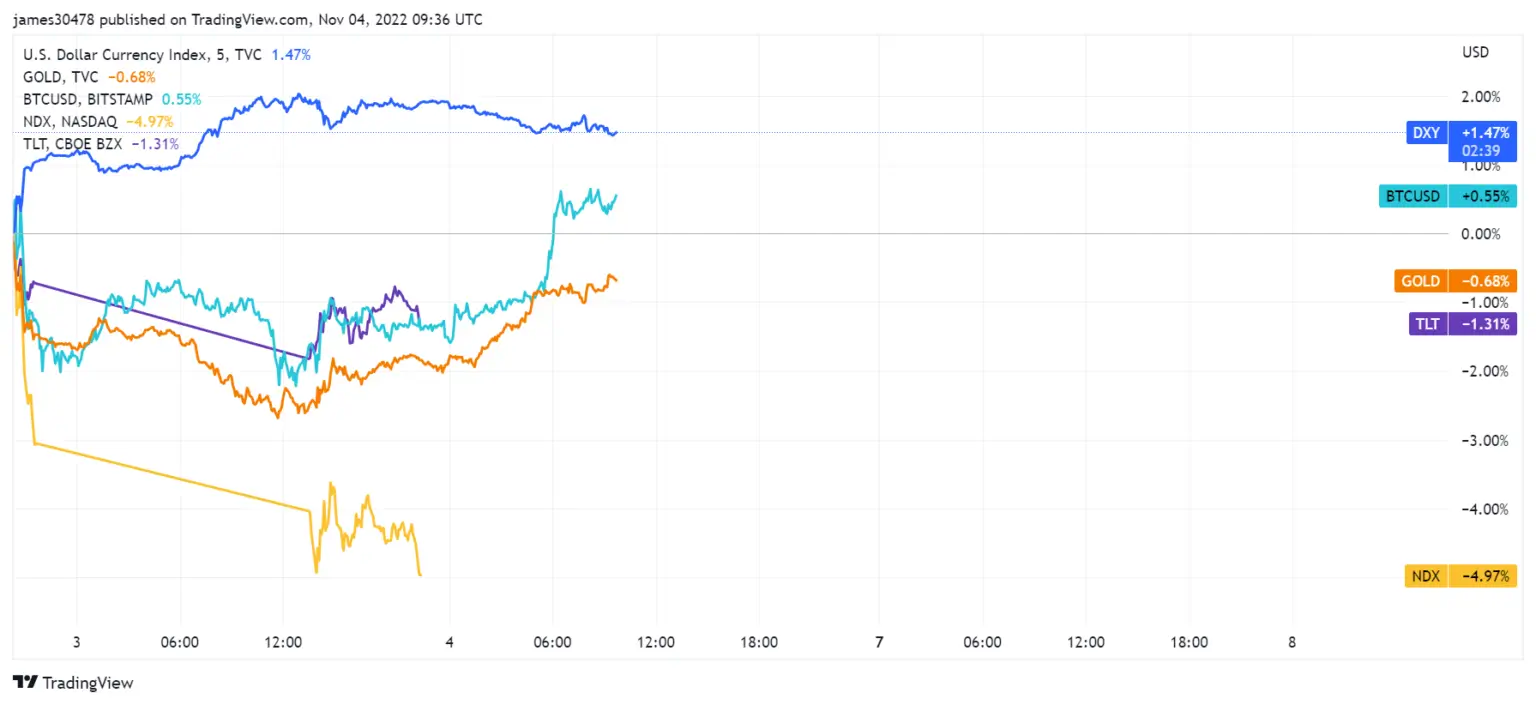

NASDAQ and Gold costs reacted to the Fed’s newest 0.75% rate of interest hike by sinking, whereas Bitcoin (BTC) carried out higher than each and recorded a spike.

NASDAQ and Gold fell by 4.79% and 0.68%, respectively. Within the meantime, Bitcoin elevated by 0.55%.

Terra Do Kwon needs to ask the police for a convention

On Nov.3, Korean prosecutors claimed that they obtained a non-public dialog between Do Kwon and one in every of his staff, proving that Kwon purposely manipulated the Terra (LUNA) value. The prosecutor’s workplace additionally stated that the dialog proved Kwon was an unlawful immigrant in Europe.

On Nov.4, Kwon Tweeted to say that he’d maintain a digital convention to finish all talks of him being in hiding.

Alright in poor health throw a meetup/convention quickly to recover from this in hiding bs

Cops from world over welcome to attend

— Do Kwon 🌕 (@stablekwon) November 3, 2022

Kwon didn’t disclose a date for the digital convention however invited all regulation enforcement worldwide to hitch.

Twitter going through lawsuit over employees layoffs, Dogecoin sinks 9%

After Elon Musk took over Twitter, he introduced that he was planning to chop 50% of its workforce, which suggests that he’ll fireplace 3,700 individuals. Twitter is now going through a class-action lawsuit over this, because the employers took authorized motion on Nov. 4.

Musk’s favourite Dogecoin (DOGE) reacted to this information by falling 9% within the final 24 hours.

Bitcoin mining issue anticipated to spike Nov. 6, enhance stress on miners

Bitcoin mining issue will regulate on Sunday, Nov. 6. and it’s anticipated to extend to file a brand new all-time-high third time in a row.

CryptoSlate analysts examined the mining issue and hash fee knowledge and realized that bitcoin issue recorded a slight lower on Nov. 4 whereas the hash fee stored growing.

This means that the stress on miners hasn’t been relieved and that the mining issue will probably enhance this Sunday.

Extra entities again Ripple as SEC seeks extension

Ripple (XRP) and the Securities and Trade Fee (SEC) have been concerned in a lawsuit since 2019.

Since then, a complete of 12 firms have filed amicus briefs to help Ripple’s standing. Ripple’s basic counsel, Stuart Alderoty, stated:

“A dozen unbiased voices – firms, builders, exchanges, public curiosity and commerce assoc.’s, retail holders – all submitting in SEC v Ripple to clarify how dangerously flawed the SEC is. The SEC’s response? We want extra time, to not hear or have interaction, however to blindly bulldoze on.”

Canada launches consultations on crypto, stablecoins, CBDCs

The Canadian authorities introduced launching a session service on all crypto-related subjects, together with stablecoins and Central Financial institution Digital Currencies (CBDC).

The consultations will deal with illicit crypto actions and supply a legislative evaluate of the digitalization of cash.

Mempool Studio launch presale for web3 yearbook, almanac

Mempol Studio is gathering milestone occasions of the web3 house in a 300-page restricted version hardcover yearbook. The yearbook is known as “Web3 Yearbook 2022” and can be launched subsequent yr.

Analysis Spotlight

Analysis: US inflation breaking boundaries within the 2020s; began quicker than 70s, 80s development

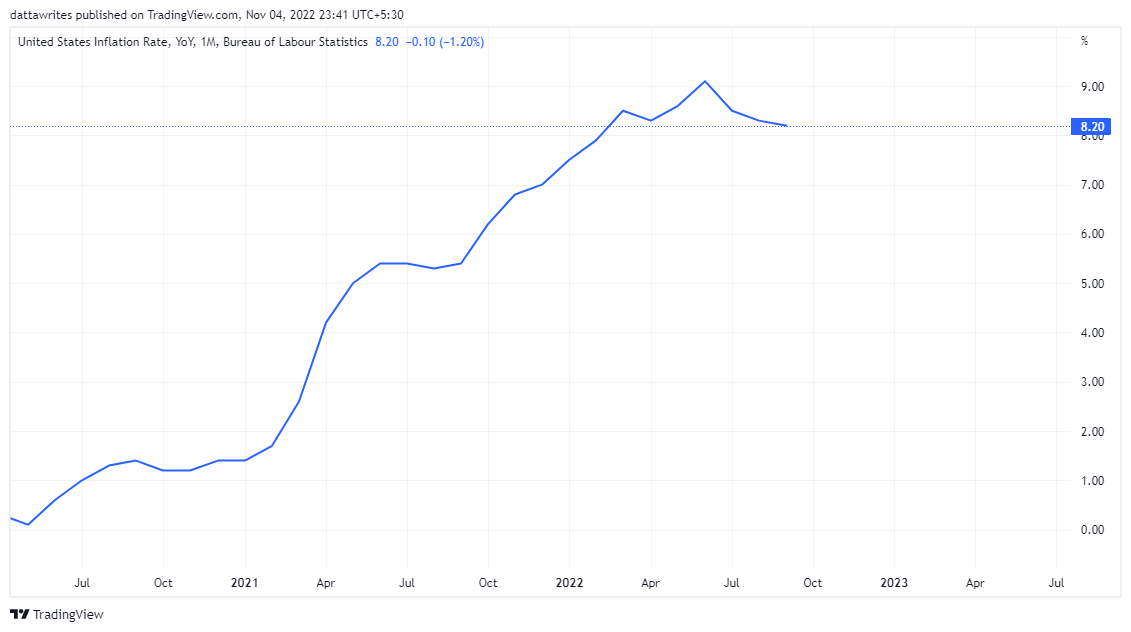

Inflation in developed economies like Europe and the U.S. is growing alarmingly, primarily because of the growing costs of vitality, gasoline oil, and gasoline.

Within the U.S., inflation was 7.5% at first of 2022, reaching 9% by June. That is a lot larger than the 5.4% recorded in June 2021 and 0.6% recorded in June 2020.

However, Bitcoin has been up by 184.28% for the reason that begin of 2020. In the identical timeframe, gold solely elevated by 5.38%, which indicated that Bitcoin was a greater hedge for inflation for the previous two years.

CryptoSlate Unique

Is now a superb time to maneuver greenback price common (DCA) into crypto?

Tokenist’s Chief Editor, Shane Neagle, wrote an unique article for CryptoSlate, discussing if that is the suitable time to dollar-cost common (DCA) in crypto.

DCA is a buying and selling technique involving shopping for and promoting the identical quantity of the identical asset at common intervals. It’s primarily based on the premise of ignoring short-term value modifications and behaving as a hedge in opposition to excessive market volatility. That’s why it’s most popular by crypto traders usually.

Nonetheless, Neagle attracts consideration to the truth that Bitcoin costs are extremely uncovered to the general macroeconomic circumstances. Due to this fact, he advises traders ought to suppose twice earlier than committing to DCA.

Neagle wrote:

“In an atmosphere the place Bitcoin costs stay extremely uncovered to the general macroeconomic circumstances, traders ought to critically take into account committing to the dollar-cost averaging strategy as a method of investing in digital property – ought to sturdy convictions be prevalent.”

Information from across the Cryptoverse

What if Michael Saylor purchased Ethereum?

blockchaincenter.internet exhibits what would occur if MicroStategy founder Michael Saylor had purchased Ethereum (ETH) as a substitute of Bitcoin.

In accordance with the information on the time of writing, Saylor would revenue $1.76 billion if he purchased Ethereum as a substitute of shedding $1.27 billion.

U.S. millionaire obtained arrested for facilitating drug exchanges through crypto

A U.S. nacro-millionaire was detained in Canada for utilizing crypto to distribute medication, in line with Montreal Gazette. On the time of his arrest, he possessed round 200,000 Bitcoins, $2 million in an offshore checking account, and $4 million in Canadian {Dollars}.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by +4.05% to succeed in $21,064, whereas Ethereum (ETH) additionally spiked by +6.61% to commerce at $1,643.